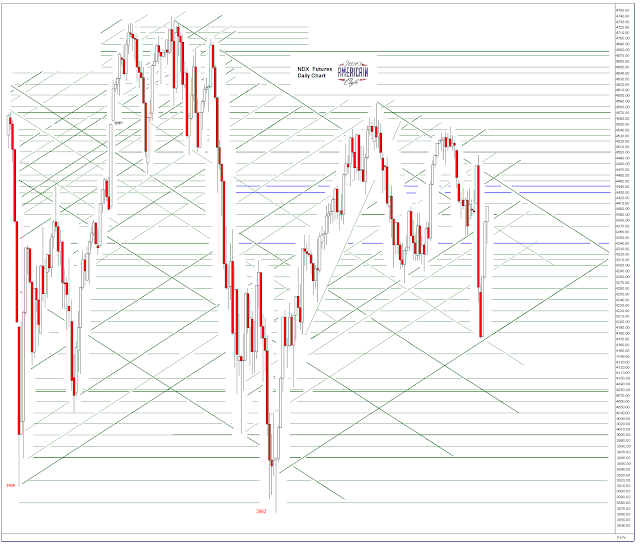

I know some of you have been projecting these nested 'cup and handle' formations on your own, because several readers have sent their examples to me and have asked for comments.

My first comment is the most important and I wish you to take it to heart.

Projections such as this are not forecasts, because the chart formations in these examples for the most part have not been 'activated' and are therefore merely potential things, possibilities, lines on a page subject to a great many exogenous forces and variables, including human and institutional decisions.

Only the cup and handle

'a' on the chart below has been activated and achieved fairly quickly I might add. We are now working on

'b' and it will not be activated unless the price of silver takes out 21.50 or so.

And then and only then if the price of silver in dollars holds that level with the kinds of retracements and pricing action one would expect to see as a confirmation of it can we say that the chart formation is active and 'working.' And even then it could fail.

And then after that we would be watching and considering scenarios

c and

d.

Again, this is

not a forecast because it cannot be since it is not an active chart formation. It is a set of possibilities based on the mechanics of supply and demand and price. And as we all know too well, these various aspects of the market can be led down a dark alley of leverage and willfulness and strangled.

Let us bear in mind that at this time the central banks, too often in concert with their associated multinational banks and camp follower hedge funds are openly engaging in market actions to move prices for the short term where they will, and that these actions are not limited to interest rates. I hope we have moved well past this debate.

The question is how long can the financial engineers keep doing this type of 'pooling,' as the have done in the past, with assets that have ties to physical reality that tends to trump debate? And what happens when the pool dissipates and the markets revert to longer term relationships as they always seem to do.

I will not be posting this chart on a regular basis. But as long term readers know I keep several of these scenario charts going in the background for my own pathfinding purposes. And that is all it is. It is a sketch of realms still unknown. But it is nice to keep sketching out a map of where one has been and where one might be heading.

So let us consider this a diverting look into what might be possible on a slow Friday afternoon rolling into a three day weekend on which we celebrate the sacrifices for freedom of those who have come before us.