01 December 2018

30 November 2018

Stocks and Precious Metals Charts - Lawlessness and Hearts Grown Cold - Non-Farm Payrolls Next Week

“Oh where is the noble face of modesty, or the strength of virtue, now that blasphemy is in power and men have put justice behind them, and there is no law but lawlessness, and none abide in fearful respect for the gods?”

Euripides, Iphigenia in Aulis

“In an ever-changing, incomprehensible world the masses had reached the point where they would, at the same time, believe everything and nothing, think that everything was possible and that nothing was true. ... Mass propaganda discovered that its audience was ready at all times to believe the worst, no matter how absurd, and did not particularly object to being deceived because it held every statement to be a lie anyhow.

The totalitarian mass leaders based their propaganda on the correct psychological assumption that, under such conditions, one could make people believe the most fantastic statements one day, and trust that if the next day they were given irrefutable proof of their falsehood, they would take refuge in cynicism; instead of deserting the leaders who had lied to them, they would protest that they had known all along that the statement was a lie and would admire the leaders for their superior tactical cleverness.”

Hannah Arendt, The Origins of Totalitarianism

Apparently the Fed is investigating the manner in which Goldman was able to utterly evade their wonderful compliance oversight in executing a multi-billion dollar scam in Malaysia. The Fed is now concerned because the Malaysians are demanding their money back!

And on another front, Deutsche Bank has been caught with their hand in the cookie jar (again) for major money laundering activity, over a long period of time, purposefully and systematically it would appear.

As a bad forecaster the Fed tries to make up for it by being a bad regulator as well.

One cannot blame those who think that the Banks, already established as serial felons, are like global crime cartels who seem to constantly evade justice, except for fines which they view as just a cost of doing very profitable and illicit business.

They are the real 'Teflon Cons.'

Traders cast aside their fears of higher interest rates and of an escalating trade dispute between the US and China today.

And so the major stock indices in the US went out at the highs.

Gold and silver were a bit weaker as the Dollar strengthened against most major currencies.

There will be a meeting between Xi of China and Trump of the US at the G20 meeting tomorrow. The markets are expecting some sort of 'breakthrough', or even words that can hint at or be interpreted as indicating a breakthrough, in the trade tensions between the US and China.

On the gold front we had the uncommon report of deliveries of paper claims on gold at the NY Comex, which is remarkable given that not much has been happening there for quite some time now.

HSBC was a major supplier of contracts, with the biggest taker being the house account at Goldman. I have included the clearing report below.

On the related inventory report you can see that HSBC moved a chunk of gold from the 'eligible' to 'deliverable' category to cover this transaction.

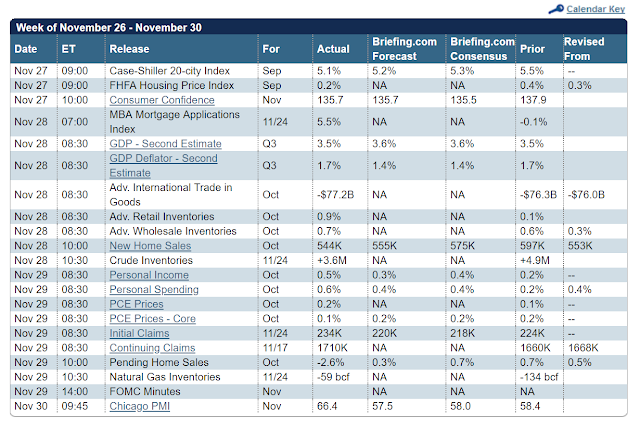

There will be a Non-Farm Payrolls report for November next week. I have included the economic calendars below.

Dolly was very spiffy in her freshly cleaned snowflake sweater today. She watched me put up the Christmas lights outside. Hard to believe that Christmas is only a few weeks away.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.

29 November 2018

Stocks and Precious Metals Charts - Winter Is Coming

The markets paused today to consolidate their gains.

The economic news is not all that good if you look at it closely. But since most mainstream media talking heads just parrot talking points everything is just great.

I adjusted and synched up the two equity charts with respect to levels and terminology.

Both have hit their 2nd level of retracements after the recent sell off. What the means is that the 'bounce' that often comes after a big drop is over, and the shorts are squeezed, and the hot money has poured back in for the short term trade.

Now we will see what the markets are made of, as we see how traders position themselves into the close into a weekend.

Geopolitical risks are still rather imposing, even if most of the domestic concerns are being swept under a rug of optimism and happy talk from the gated community types.

Deutsche Bank is in trouble again with regulators. Since the big banks often tend to resemble serial felons, this is no surprise. One way to get rid of crime is to deregulate so much and prosecute and investigate so little that nothing is a crime anymore. Innovation!

The 'economic donkeys', as Simon Johnson calls them, are setting us up for another whopper of a financial crisis. It is important to remember that they do not care, as long as they are able to avoid any blame for it.

The latest long range weather forecasts seem to be arriving at a colder and snowier outlook for the northeastern US. Something about a 'weak el nino' and a jet stream that barrels down from the arctic. Great.

I took Dolly to the groomers yesterday for a hair cut and a wash, and she spent the rest of the day pouting. But she did like it when I put her little snowflake sweater on this afternoon and took her for a walk. I washed all of her blankets, sweaters, pillowcases and so forth, and so they all smell very good and are nice and clean.

Today was, I hope, the last day for clearing leaves with the JD lawn tractor. I gave it a thorough cleaning and parked it for the winter. I'll probably give it an end of year tune up this weekend. I already changed the cutting blades and had the old ones sharpened. I keep two pairs and just keep rotating them.

I was a little surprised at how few birds and squirrels and chipmunks were around the bird feeder after the very early morning. When I took Dolly for her walk I saw that one of the big red-tailed hawks is back in the neighborhood.

The Raptor Trust is nearby. They released three big hawks which they had rehabilitated a couple years ago. When one of those silent predators start cruising the skies overhead, most of the wildlife takes cover. The blue jays always start sounding an alarm as they do for snakes and other predators.

We live near the Great Swamp Wildlife Refuge. There is a large assortment of wildlife that forages out from there, especially during the winter. They tend to come up the waterways and wooded areas. There are black bears to bobcats and everything in between.

The bird population variety is impressive up in these foothills. We even have the orange plumed tweeter, which is often seen on weekends at the nearby Trump National Golf Club in Bedminster.

Have a pleasant evening.

28 November 2018

Stocks and Precious Metals Charts - Economic Donkeys - Market Cheers the 'Powell Put'

"The real problem with our financial system is that our economic and political system work together to encourage excessive risk, and this risk in turn leads to cycles of prosperity and collapse. In 1998, a much smaller Lehman Brothers was placed in financial peril by the aftermath of the Asian financial crisis and failure of Long Term Capital Management, a major hedge fund. The Federal Reserve responded by lowering interest rates and other central banks followed suit. This reduced the cost of obtaining funds, effectively bailing out Lehman and other institutions in trouble.

As markets have grown to recognize how quick the Federal Reserve is to bail out institutions (and executives) in trouble, they naturally respond. In the 1990s, people talked about the “Greenspan Put” a term which derisively suggests that it is always safe to invest in risky assets, because the Federal Reserve is ready to bail out investors (a put is effectively a promise to buy an asset at a fixed price if you are unable to sell it to someone else at a higher price – this is a way to lock-in profits or limit losses on investments). However, in months following the collapse of Lehman, we learned that the “Bernanke Put” is even more valuable since Chairman Bernanke, alongside the Bank of England, the European Central Bank, and central banks in much of the rest of the world, is prepared to take drastic measures to prevent asset prices from falling when there are risks of global collapse."

Simon Johnson and Peter Boone, Economic Donkeys

"I have marked my estimates of the quality of the bounce by levels it achieves. Given that this market is running on hot money and adrenaline, I would not tend to underestimate it."

Jesse, yesterday

Fed Chair Jay Powell gave the markets a fresh whiff of hot money in his statement today, which was widely interpreted as a dovish 'walking back' of the statement from October 3.

And the markets huffed up that blast of fresh bubble brew and took off to the upside.

Stocks were up sharply, bond yields fell, gold got a big reversal the day after option expiry, and the Dollar took a dive.

Not that the real world matters but it was interesting that a huge chunk of the physical gold inventory in the Comex Hong Kong warehouses took a hike last night. 296,000 troy ounces is about twice the gold that is ready for delivery at these prices in New York.

As you can see from the charts below, the stock futures went through the first two retracement levels pretty handily.

It should be noted that they were stalling around the first retracement target until Chairman Jay spoke around noon.

I found it to be interesting that despite the massive and relentless bear market squeeze, which took off and never once seemed to hesitate, the VIX did not drop by a commensurate amount.

Was this a 'set piece', a contrivance of some sort? A systemic entitlement for the insiders and financiers, another easy score for the informed among so many? No way to tell.

We'll just have to sit in the shadow of these dark markets, and see where it all goes next.

I did notice that the spokesmodels on bubblevision used the terms 'Fed Put' and 'Powell Put' about eighty times this afternoon.

I got a chuckle when one said 'Why not buy APPL if the Fed is protecting it?'

You just can't make this stuff up. We have learned nothing, absolutely nothing, over the past twenty years. And it just gets worse, each time that we allow this, and forget.

And why should things change, when the current scheme of things pays off so well for a few?

Let's see where we go next.

Have a pleasant evening.

Category:

bernanke put,

greenspan put,

mispricing of risk,

moral hazard,

powell put

Subscribe to:

Comments (Atom)