Gresham's law is an economic principle that states that when an official market or cartel overvalues one type of money or asset and undervalues another with respect to its fair market value and risks, the undervalued money or asset will leave the country as best it can, or will disappear from circulation into hoards, while the overvalued money or assets will flood into circulation.

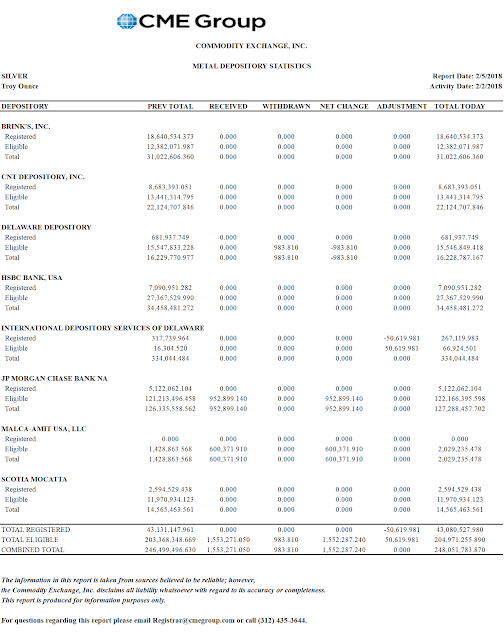

Let me stipulate up front that when it comes to the global gold market, the Comex has actual gold flows that are so meager compared to the amount of trading which occurs on paper that I have said it is starting to look like The Bucket Shop.

And in recognition to the disclaimer statement that appears on all of their documents, the exchange makes no claims and accept no liability that any of these numbers are accurate. They are taking the originators of these numbers at their word, some of which are Banks which have recently been shown to be serial offenders when it comes to their financial dealings, pricing, and representations.

As of Wednesday, only 171,613 ounces (5.13 tonnes) were 'up for delivery.' In a global market where the daily deliveries are measured in metric tonnes, that is a very small amount.

In terms of overall active Comex contracts, that represents a paper to physical leverage of roughly 263 to 1, compared to a historic trend of about 24:1.

And as I looked things over, I was struck by the fact that of those meager ounces available, 101,312 (3.2 tonnes) were from the vaults of Nova Scotia, or roughly 60% of the total.

That struck a chord in my memory, so I looked over the list of deliveries for the month of October.

Of the pathetically small amount of 240 contracts, or 24,000 ounces (.75 tonnes) delivered in the entire month, 17,600 have come from the 'house account' at Nova Scotia.

And the 'takers' of those few ounces have been the 'house accounts' at JP Morgan and HSBC.

So what I am trying to prove with all this? Nothing. I am merely showing an interesting trend change that has gone largely overlooked, except in some notable exceptions of the 'smart money.'

And I am documenting some facts for those who have a mind to see them, and to establish a record that people can refer to when these jokers blow up yet another market through their reckless obsession with gambling large.

It shows that in a world of global gold flows, very little is moving in the Comex warehouses, and the little that is changing hands seems to be moving between the houses of three of the big bullion banks.

And it tend to support a hypothesis that the gold trading in London and New York has taken on the character of currency crosses, and lost their ties to the physical commodity nature of the product. This divergence may be convenient for the management of the price, and for easy profits for those managing the game.

But it has longer term consequences which will eventually come back to shock the markets. Where have we seen these types of divergences among risk, valuation, and the underlying realities before? In just about every financial fraud and following crisis in the modern era at least.

So remember this when the next crisis comes, and the distraction, dissimulation, and duplicities are put forward, and the search for non-consequential scapegoats is underway. And you are expected to bail out these jokers once again 'to save the system.'

I am fairly confident that all of this will come to pass if things do not change, and serious reform and enforcement of the rules of the markets are not undertaken. So far the changes we have are largely cosmetic. In a plutocracy big money manages the government and the media; they have bought and paid for it. And eliminating government only serves to eliminate the middleman. Transparency and reform are the only sustainable answer.

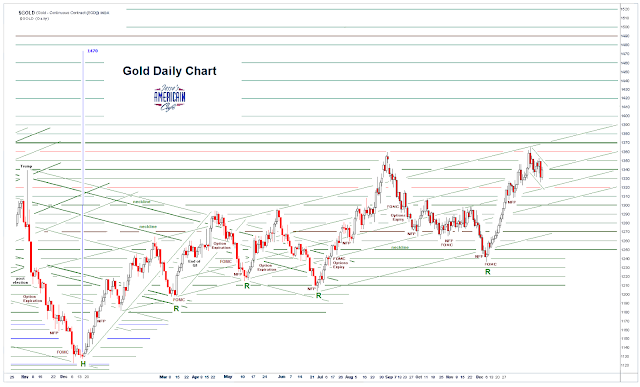

The big action in the precious metal bullion markets is in Asia.

And gold and silver bullion are steadily flowing from West to East

because of a mispricing of valuation and risks. And the reason for the stunning drop in physical trading activity in the West is because in a manifestation of Gresham's Law,

the hypothecated paper metals are driving out the bullion out of the market.

This is a trend, and it has significance to those who are willing to see it.