“Happy, happy Christmas, that can win us back to the delusions of our childish days; that can recall to the old man the pleasures of his youth; that can transport the sailor and the traveler, thousands of miles away, back to his own fire-side and his quiet home!

I will honor Christmas in my heart, and try to keep it all the year.”

Charles Dickens

"Let the children have their night of fun and laughter. Let the gifts of Father Christmas delight their play. Let us grown-ups share to the full in their unstinted pleasures before we turn again to the stern task and the formidable years that lie before us, resolved that, by our sacrifice and daring, these same children shall not be robbed of their inheritance or denied their right to live in a free and decent world. And so, in God’s mercy, a happy Christmas to you all."

Winston Churchill, December 1941

Stocks attempted to rally today, and once again flopped into the close, although they managed to finish off their lows and nearly unchanged.

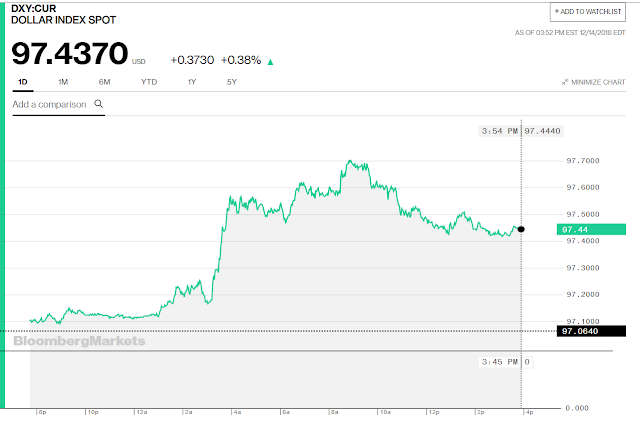

Gold caught a bid in a clear flight to safety, if but a bit subdued. Silver and the Dollar moved sideways.

The FOMC meeting tomorrow may be pivotal for the markets, at least for a little while.

The Fed is almost universally expected to raise rates a last 25 bp for the year. And I fully believe that they will, or otherwise shock the markets.

It is what they say and indicate about next year that is important. They are strong whispers that they will signal a more cautious, data-focused approached towards raising rates, with dovish overtones.

They might have done so more strongly, but the Big Tweet had to threaten them, which makes their task all the more complicated, as they cannot be seen to be giving in to bullying, or lose what little credibility they have remains.

There will be a stock option expiration on Friday.

If the wiseguys want to rig a Santa rally, the end of this week is as likely a time as we will see all things considered. It would help to know in detail the short interest and amount of puts held, and volumes in the bearish ETFs. That provides fodder for a proper jam-job.

Here is an article about Emergency Room Bills. The US healthcare systems is disgraceful, blinded by greed to the point of insanity, emboldened by corruption and the abuses of big money. It shames and sickens the decent And yet we are proud of it, cling to it proudly, as we do our financial system.

But regardless, there will continue to be abuses, until we make them stop. They will not stop of themselves. And there will be consequences.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.