Sandy: You saw a lot in one night. It's a strange world.

Jeffrey: Why are there people like Frank? Why is there so much trouble in this world?

Sandy: I don't know. I had a dream. In fact, it was the night I met you. In the dream, there was our world and the world was dark because there weren't any robins, and the robins represented love. And for the longest time, there was just this darkness. And all of a sudden, thousands of robins were set free, and they flew down and brought this Blinding Light of Love. And it seemed like that love would be the only thing that would make any difference. And it did. So I guess it means there is trouble 'til the robins come.

David Lynch, Blue Velvet

Stocks were attempting to rally this morning, again.

The expectations in the market were broadly held that while the Fed would no doubt raise their benchmark interest rate by 25 basis points, they would at least acknowledge that the economy is faltering a bit, inflation is subdued and fading, and that the equity and risk loans markets are dancing on the edge of an abyss.

But alas, that was not meant to be. The Fed put on their big boy pants, and decided that a hard lesson needed to be served up to the President, and the rest of the non-banking public as well.

After all, Jamie Dimon did say that a recession is no big deal, and might even do some good for JPM. Let them eat rate hikes. And there you have it.

Most were a bit surprised that the Fed took such a stone cold shot on this one. I was wondering if they were going to send a message to tweet central about their prerogatives as the true money masters of the universe.

As I noted at the beginning of all this, the Fed will be raising rates not to fight inflation, not to defend the dollar, but to get their benchmark rate high enough off the zero bound so they have the ability to engage in interest rate policy after their latest financial asset bubble implodes. And so far it looks like a close race.

As the afternoon unfolded I had this really marvelous image in my head of Trumpolini popping a gasket in the Oval Office, as he watched the stock markets selling off. This bubble rally is, after all, one of his few demonstrable accomplishments.

What reaction will we see from our apoplectic leader next: John Wick, from the movie of the same name, or Frank Booth, from cult classic Blue Velvet.

I can almost hear the sounds of amyl nitrate being huffed from the Oval Office now.

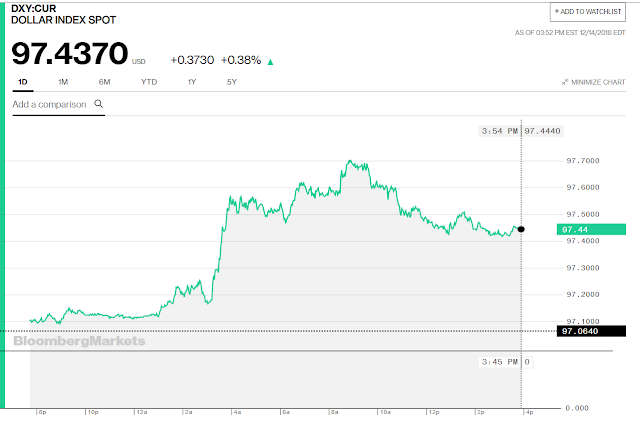

Gold and silver took a hit as the Dollar spiked higher.

Let's see how the rest of the world deals with the antics of our merry pranksters.

It looks like Santa won't be coming to Wall Street anytime soon.

Stock option expiration will be on Friday.

Have a pleasant evening.