I wanted to call your attention to this story about brazen manipulation in the forex exchange markets by the Banks for three reasons:

1. The markets are too large to be manipulated. When accusations of market manipulation are made, spokesmodels and apologists will dismiss them by saying 'the market is too big to be manipulated' and then cite some gross total of the market trade. This is utter baloney and they know it. Prices are set at the margins, not on the whole, and there is no market that is too big to be manipulated in some manner by big enough players.

2. The government is the problem. If there was a free market you would not see any manipulation. Get rid of all government involvement. This is such a howler that I won't even waste many words on it, except to say that this sophistry implies that if we eliminated the law, then there would not be any crime. This is utopian nonsense, repeated as slogans by those who have stopped thinking for themselves.

3. The Banks are too well regulated to manipulate markets. It is the same big banks that are involved in these market manipulation schemes, again and again. They are serial felons who always blame each instance of the felony crime to some 'rogue element' or isolated trader, which is also nonsense. And in each case the fine, while nominally large by individual standards, is really just a cost of doing business.

These market manipulation schemes will end when people reject the narratives put forward by the Bankers and their enablers and think tanks, and choose to elect people who are serious about financial and political reform.

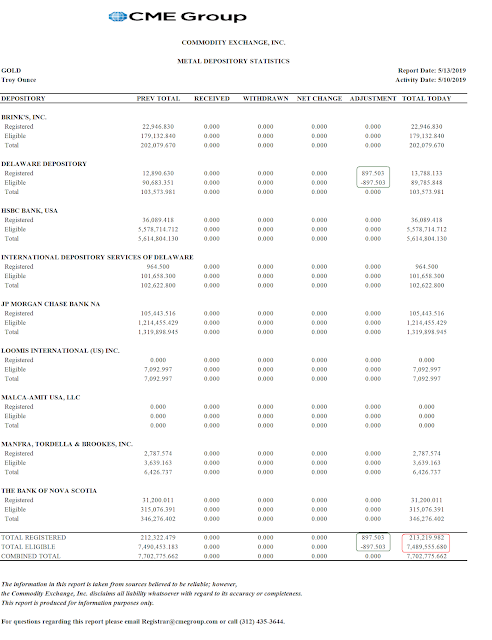

At some point the long term price/physical manipulation in the gold market is going to blow up, and no one in authority could have seen it coming. Because their eyes are firmly closed and gaze averted.

And Trump is no different from his predecessors, and in some ways may be worse.

"Citigroup Inc.[aka Dr. Evil], Royal Bank of Scotland Group Plc and JPMorgan Chase & Co. are among five banks that agreed to pay European Union fines totaling 1.07 billion euros ($1.2 billion) for colluding on foreign-exchange trading strategies.

Citigroup was hit hardest with a 310.8 million-euro penalty, followed by fines of 249.2 million euros and 228.8 million euros for RBS and JPMorgan, the European Commission said in a statement on Thursday. Barclays Plc was fined 210.3 million euros and Mitsubishi UFJ Financial Group Inc. must pay nearly 70 million euros as part of the settlement with the EU’s antitrust regulator.

Traders ran two cartels on online chatrooms, swapping sensitive information and trading plans that allowed them to make informed decisions to buy or sell currencies, the regulator said. Many of them knew each other, calling one chatroom on the Bloomberg terminal the "Essex Express n’ the Jimmy" because all of the traders but one met on a commuter train from Essex to London. Other names for rooms were the "Three Way Banana Split" and "Semi Grumpy Old Men."

"Foreign exchange spot trading activities are one of the largest markets in the world, worth billions of euros every day," EU Competition Commissioner Margrethe Vestager said. "These cartel decisions send a clear message that the commission will not tolerate collusive behavior in any sector of the financial markets."

...The effects of the EU decision on banks will be “relatively mild, because the fines aren’t huge,” said Aitor Ortiz, an analyst at Bloomberg Intelligence. Referring to the third probe involving Credit Suisse, he said “we may still have to wait another year” to see the decision, because the bank has refused to join a settlement that would grant lower fines.

Traders exchanged information about outstanding customers’ orders, bid-ask spreads, their open-risk positions and details of current or planned trading activities. They would sometimes agree to "stand down" or stop a trading activity to avoid interfering with another trader in the group. They traded 11 currencies, including the euro, the U.S. dollar, the British pound and the Japanese yen...

Read the entire story here.