"Shanghai Gold will change the current gold market with its 'consumed in the East but priced in the West' arrangement. When China has the right to speak in the international gold market, the true price of gold will be revealed."

Xu Luode, Chairman, Shanghai Gold Exchange, 15 May 2014

“Imaginary evil is romantic and varied; real evil is gloomy, monotonous, barren, boring. Imaginary good is boring; real good is always new, marvelous, intoxicating. Everything beautiful has a mark of eternity.”

Simone Weil

"Nature is never spent;

There lives the dearest freshness deep down things;

And though the last lights off the black West went

Oh, morning, at the brown brink eastward, springs —

Because the Holy Ghost over the bent

World broods with warm breast and with ah! bright wings."

Gerard Manley Hopkins, God's Grandeur

Stocks dropped significantly after Trump initiated a 'shock tariff' on all Mexican goods effective June 10.

The Dollar declined.

Gold rallied significantly in a flight to safety. Silver tagged along, weighed down a bit by its industrial component.

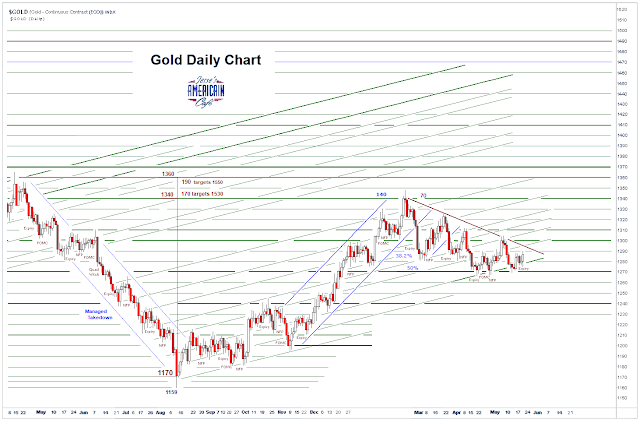

On the chart gold has broken up and out from a large descending triangle. Let's see if it can stick this breakout and expand it through the Non-Farm Payrolls report next week.

If so, this may activate the much larger cup and handle pattern that has been lingering on the chart for some time.

The US Treasury yield curve is now more inverted than at any time since 2007 and the inception of the last financial crisis.

Treasuries are apparently pricing in two rate cuts for this year.

At the same time junk bonds are signficantly diverged from this outlook on risk.

Something is going to break, and badly.

There will be a Non-Farm Payrolls report next Friday.

There is an economy of the lord of this world, that rewards the attentions of its adherents, temporarily if not fleetingly. And there is the economy of God, that embraces all of us in the next, forever.

For some, that the economy of this passing world deems foolish, it is simply a matter of investment assumptions and horizons. Their hearts are invested in what is to come— and what will endure.

Need little, want less, and love more. For those who abide in love abide in God, and God in them.

Have a pleasant weekend.