The rest of this week and some of the next should be rather exciting, and volatile in the markets.

Tomorrow we have the much anticipated FOMC decision.

I tend to doubt that they will actually give the markets a rate cut tomorrow.

It is possible but not probable. And an actual cut might spook the markets.

Rather it is more likely we will see some sort of verbage like the ECB's Draghi gave the markets about being willing to feed them the rate cut sugar they crave.

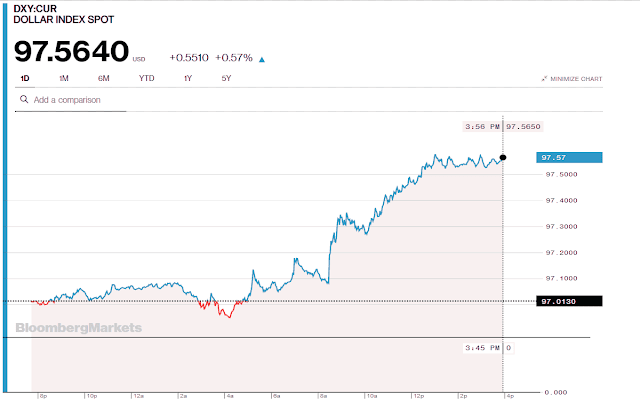

This was enough to ignite the US risk markets today.

In addition there were seom 'encouraging' words about the G20 meeting and China trade talks. That really put a spark under bully.

The actual G20 meeting in Osaka is not until late next week, so there will be little more than speculative leaks until then perhaps.

The scenarios for the resolution of these big macro events is in a nice little chart right below.

Today was a taste of number 2.

As a reminder, there is also a stock option expiration on Friday.

I have been thinking of various ways of playing this, other than having a gold long trading position I have had for some time since the price of gold in dollars turned up and broke out of the descending triangle.

The bond and equity markets, along with several important indicators, are suggesting that there is a significant mismatch in the pricing of risks.

My money is on the bond markets. The equity market has become dominated by carnies, con men, and snake oil peddlers.

I have been watching youtube videos today, by a guy named Andrew Camarata, who is a 'property maintenance manager' in upstate NY near some places where we used to go, for used and antiquarian books in Woodstock, and a garlic festival in Saugerties.

He has an amazing array of equipment which he maintains himself. He has skills, and I find his whole approach to things very similar to my own. He would be a great friend and neighbor.

Need little, want less, love more.

Have a pleasant evening.