“There are two ways to be fooled. One is to believe what isn't true; the other is to refuse to believe what is true.”

Søren Kierkegaard

"Beware the leaven of the Pharisees, which is a pious, hollow hypocrisy. For there is nothing covered that shall not be revealed, or hidden, that shall not be made known. Whatever has been said in the darkness shall be heard in the light: and what has been whispered behind closed doors shall be shouted from the roof tops."

Luke 12:1-3

"A sentiment of trust in the legal money of the State is so deeply implanted in the citizens of all countries that they cannot but believe that some day this money must recover a part at least of its former value.

To their minds it appears that value is inherent in money as such, and they do not apprehend that the real wealth, which this money might have stood for, has been dissipated once and for all.

This sentiment is supported by the various legal regulations with which the Governments endeavor to control internal prices, and so to preserve some purchasing power for their legal tender.

Thus the force of law preserves a measure of immediate purchasing power over some commodities and the force of sentiment and custom maintains, especially amongst peasants, a willingness to hoard paper which is really worthless."

John Maynard Keynes, Economic Consequences of the War

That last quote by Keynes is one of my favorite quotes about fiat money. Modern Money is a mix of force and fraud. As the fraud grows thin, the force must increase.

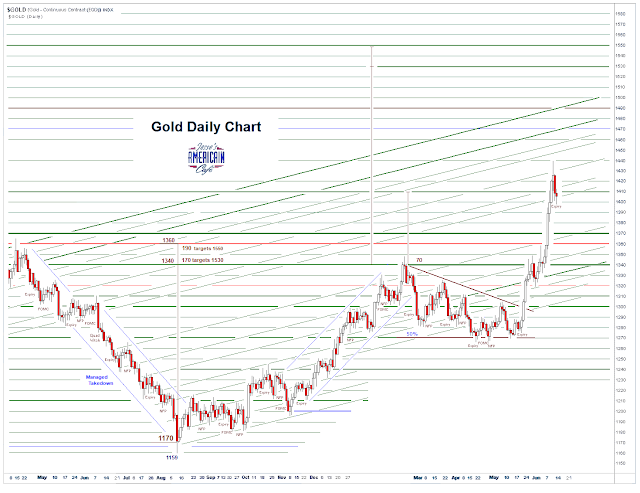

Gold rocketed $30 higher today, gaining back everything it lost on Monday, and then some.

This violent snapback rally lends itself to the theory that the smackdown of the past few days was designed to reduce the open interest in the August futures contracts.

It may also be significant that gold was pummeled down to its 50% Fibonacci retracement on the latest leg higher, but they could not make that stick— and got it stuffed back in their faces.

If gold can hold 1400 through the Non-Farm Payrolls nonsense, and make a higher high, this is very bullish action.

The spokesmodels were chortling when gold was smacked lower yesterday, and forecasting even lower prices down to $1350. But they were silent about its vicious snapback rally today. How unusual.

I find it a bit odd that with these price fluctuations there is zero activity being shown out of the Hong Kong comex gold warehouses. This is a dog that is failing to bark.

Rumors of a bullion bank being caught with its pants down have been making the rounds. I wonder if it involves a physical delivery.

Oil dumped today. This was particularly odd given the recent strong statements from the latest OPEC meeting. Well, they can reduce supply, but they cannot create demand.

Stocks caught a strong bid into the close. It looks like another blow off top is in the making. I am getting my bear claws ready.

They'll never learn. Why should they, when their paydays from this have been so personally fulfilling.

Someone is in trouble somewhare behind the scenes. Who or what it is, we do not yet know,

But it may very well involve a difficultly in meeting one's obligations.

Have a pleasant evening.

P.S. Gold exploded even higher after hours, rising $17 to 1436. It is hovering below 1430 now. Odd.