"As everything in what used to be called creation becomes a commodity, human beings begin to look at one another, and at themselves, in a funny way, and they see price tags. There was a time when people spoke, at least occasionally, of 'inherent worth'— if not of things, then at least of persons."

Harvey Cox, The Market as God

"Those who are at present so eager to be reconciled with the world at any price must take care not to be reconciled with it under this particular aspect: as the nest of The Unspeakable. This is what too few are willing to see."

Thomas Merton

"He had a history of screwing anyone who relied on him, whether we’re talking about the investors in his Atlantic City casinos or a bevy of small business types and others who worked for him — plumbers, waiters, painters, cabinet makers — and were later stiffed. In other words, Americans elected a bankruptcy king as their president and character will tell.

There really are no secrets here. In the end, Donald Trump clearly cares about nothing but himself (and perhaps his family as an extension of that self). Whether in his first or second term (should he win again in 2020), if things start to head south economically, count on this: he’ll repeat his well-documented history and jump ship, leaving the American people, including that beloved base of his, holding the bag."

Tom Engelhardt, Donald Trump Will Bankrupt America

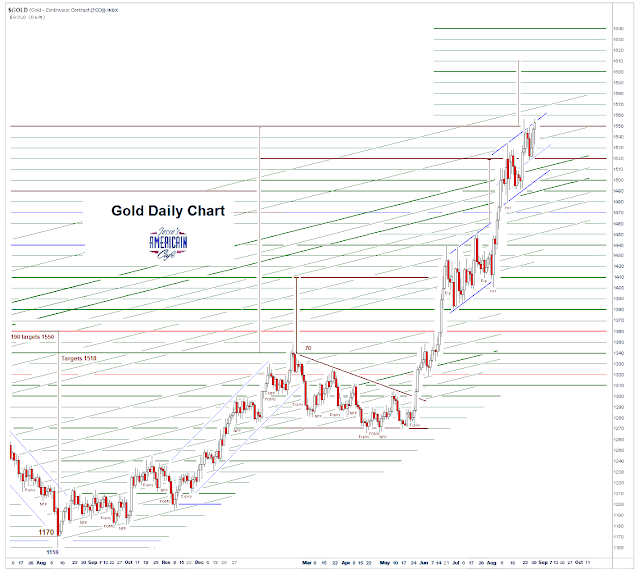

News of scheduled talks between China and the US in October, a better than expected ISM Service Index number, and a stronger than expected ADP Private Payrolls report combined for a massive reversal of the risk off trades into safe havens.

Bonds and gold and silver were sold, stocks were bought en masse, and short stops were run with aggressive abandon.

Something had for the banks who were holding bleeding short positions, to help get them off the hook. And this is just the group of crony capitalists and lowlifes to do it.

And so it is, and not one thing has changed.

But we were overextended in some of the safer assets, technically speaking. The recent run up in silver had me concerned, especially when the usual suspects came out this week with their gleeful calls of silver to $50 and gold to $10,000.

And the wiseguys love this environment where the SEC and CFTC are asleep at the switch, and the pigmen are private labeling and branding the swamp.

Do as you will, believe as you wish, but own the consequences. And you most certainly will own them in the long run, whether you realize it or want to or not.

I had been laying back in cash for my short term trading, and filled up some of the empty position slots during the day.

Better for most to take a unleveraged position, to get right and sit tight, and to stop reading the clickbait sites that seek to stir up your emotions, your fear and hate and envy. Life is too short.

Have a pleasant evening.