Load up on guns, bring your friends

It's fun to lose and to pretend

With the lights out, it's less dangerous

Here we are now, entertain us.

Nirvana, Smells Like Teen Spirit

"For the hearts of these people are hardened,

and their ears cannot hear,

and they have closed their eyes,

so their eyes cannot see,

and their ears cannot hear,

and their hearts cannot understand,

and they cannot turn to me

and let me heal them."

Matthew 13:15

"They do not see the image of Almighty God before them, and ask themselves what He wishes: if once they did this they would begin to see how much He requires, and they would earnestly come to Him, both to be pardoned for what they do wrong, and for the power to do better. And, for the same reason that they do not please Him, they succeed in pleasing themselves.

Surely, there is at this day a confederacy of evil, marshalling its hosts from all parts of the world, organizing itself, taking its measures, enclosing the Church of Christ as in a net, and preparing the way for a general Apostasy from it. Whether this very Apostasy is to give birth to Antichrist, or whether he is still to be delayed, as he has already been delayed so long, we cannot know; but at any rate this Apostasy, and all its tokens and instruments, are of the Evil One, and savour of death."

John Henry Newman

Another round of economic data intruded on the illusions of exceptionalism and prosperity this morning. The pigmen and their servants are restless.

Well, tomorrow is another day, and a good ISM Services number, if such a thing is on deck, will provide a renewed enthusiasm for the games that we play.

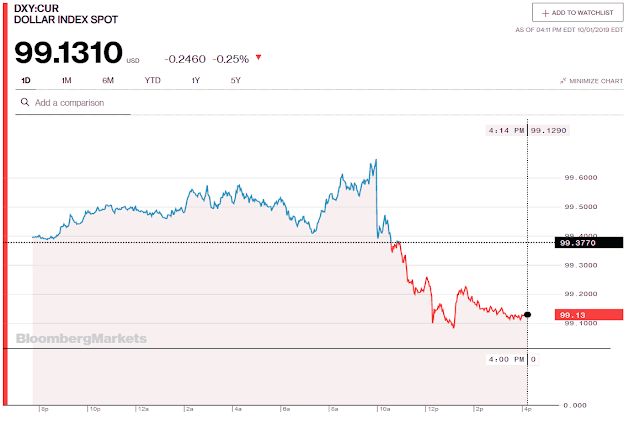

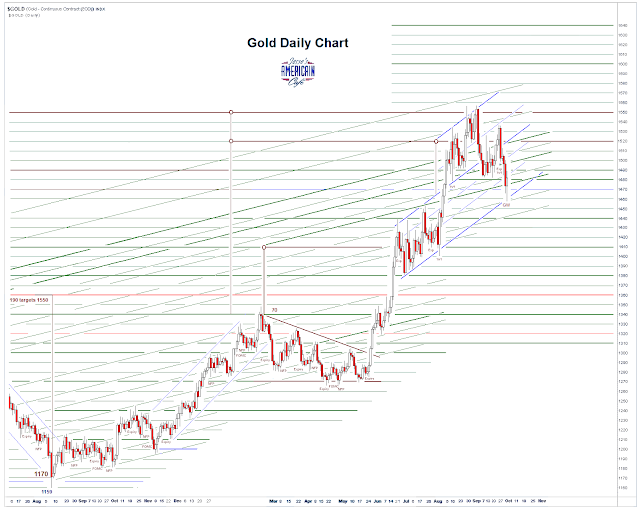

The Dollar was lower and gold and silver rose sharply. Funny, that the metals went down BEFORE Golden Week, a seven day national holiday in China.

The theory there is, of course, that during Golden Week with their markets closed, the Chinese will not be active in the physical markets, thereby cramping the style of the paper leverage games in New York and London. But the stiff decline in the metals happened before Golden Week even began.

By the way, have you noticed that the Chinese have stopped the big offtakes in physical gold from the Hong Kong Comex warehouses some months ago? Do you know why?

The big hit on the metals last month was driven largely, if not almost exclusively, by market antics on the Comex, and the four or five houses who were sucking on the wrong end of a big metals short, with an intense desire to drive the price down and cover. And so they did.

Not one thing has changed. The markets may rally madly on a different set of economic data into the weekend. But this is not reform or recovery.

Need little, want less, and love more. For blessed are those who called to the supper of the Lamb.

Have a pleasant evening.