“In a sense, blowback is simply another way of saying that a nation reaps what it sows. Although people usually know what they have sown, our national experience of blowback is seldom imagined in such terms because so much of what the managers of the American empire have sown has been kept secret.

Even an empire cannot control the long-term effects of its policies. That is the essence of blowback.”

Chalmers Johnson, Blowback

"...we but teach

Bloody instructions, which, being taught, return

To plague the inventor: this even-handed justice

Commends the ingredients of our poisoned chalice

To our own lips."

Shakespeare, Macbeth

"And one day, too late, your principles, if you were ever sensible of them, all rush in upon you. The burden of self-deception has grown too heavy...

Now you live in a world of hate and fear, and the people who hate and fear do not even know it themselves; when everyone is transformed, no one is transformed. Now you live in a system which rules without responsibility even to God. The system itself could not have intended this in the beginning, but in order to sustain itself it was compelled to go all the way.”

Milton Mayer, They Thought They Were Free

Stocks were a bit wobbly today, and the expectation of another push higher dissipated fairly early on.

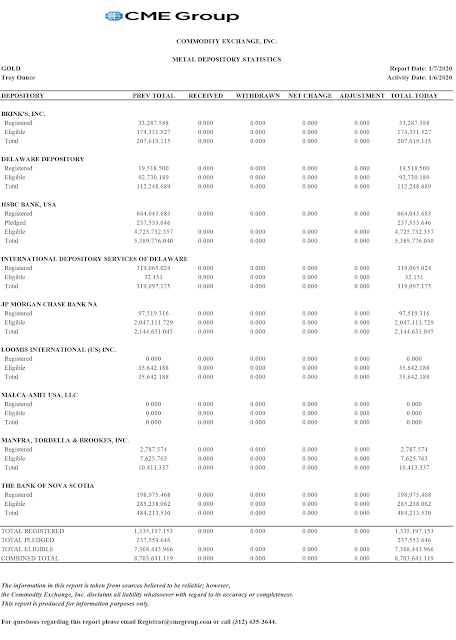

Gold and the Dollar and silver all moved higher today in what appeared to be a 'risk off' move to safer waters.

The spokesmodels on financial TV had their pom poms out and were leading the cheers, but the crowd seemed as listless as the cheerleaders seemed to be desperate.

We may have reached that phase in the market rally where the insider money is looking to complete the hand off of the inflated assets to the public.

Don't worry though. There is an Internet of carnies and con-men who will gladly tell you whatever you wish to hear, and especially whatever message that their handlers and self-interests wish them to deliver. Until their true believers get knee-capped by reality.

If you have profits lingering from the stock market rally from last year, now might be the time to trim your sails, and put profits aside in some safer places.

The Fed was enormously generous, even to a fault, in opening the floodgates and smothering the Wall Street Banks in piles of newly 'printed' money, sparking a late stage blowoff top in financial assets late last year.

But for all the obvious reasons this cannot last. And the consequences of this may be inbound, along with those from other follies of our elite.

I continue to believe that many things will be revealed and made clear by July of this year. The cards seem to be falling that way.

But for now, let's just be watchful and waitful.

Get right and sit tight. And keep your eyes and ears open.

Have a pleasant evening.