"Reality is that which when you stop believing in it, it doesn't go away."

Philip K. Dick

"I'm not crazy about reality, but it's still the only place to get a decent meal."

Groucho Marx

Stocks were utterly hammered today in the US, as the realization that the coronavirus is a serious exogenous effect on the global ecnomy has finally penetrated the exceptionalism of the Wall Street elite and their handmaidens in the media.

What a surprise. Who could have seen this coming? Especially when they had their eyes squeezed shut.

The coronavirus is highly contagious and partiicularly tough to contain. Thank God that so far it seems to have a low mortality rate, as pandemic viruses go.

I think the fragility of the system as it is may be magnifying its effects. And the general nuttiness of the corporate media, clickbait sites, and a sizable minority of the public for whom reality is just an optional viewpoint.

The safe havens caught an obvious bid, with gold rising to $1690 before *someone* decided to dump a billion or so in contracts on the market.

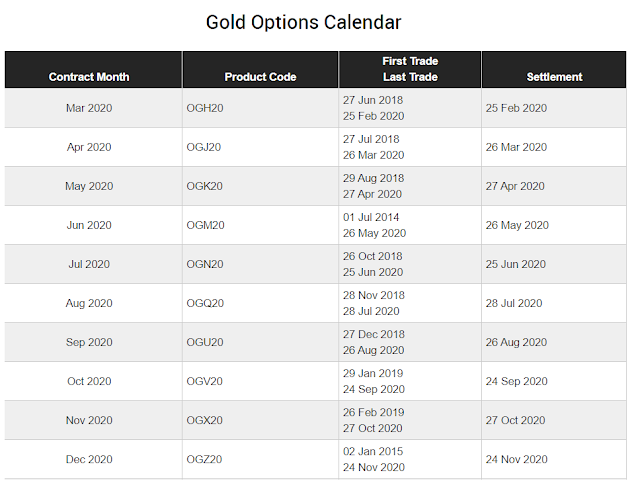

Oh yeah, there will be a Comex Option expiration for March tomorrow.

For gold March is a relatively light contract, compared with April which is a much bigger month this time of year.

Not so for silver, with March being a much more significant expiration.

Still, any excuse for a solid market manipulation. One thing you can say for our financial class— they are almost never too lazy to steal.

I suspect we will be seeing a rather volatile market over the next month or two, or more.

The spokesmodels kept asking today if the decline was 'orderly' and when would the Fed intervene.

Orderly means much more downside in the weeks ahead, if they don't know it. It is going to take a panic to set a bottom in this latest manifestation of the bubble economy created by and for the financial class.

Trumpolini has taken his show on the road, and is conducting his latest rally in a stadium in India.

Why not?

Year-to-date assets chart below.

The world and its servants do not love you.

They lie to you, and cheat you, to enslave you, first by hate, and then by fear.

Remember who you are, the light you follow, and to whom it is that you belong, always.

Have a pleasant evening.