"Thou shalt not sacrifice any of your children to the fires of Moloch, and thereby profane the name of your Lord, who is God."

Leviticus 18:21

"The perpetrators were scholars, doctors, nurses, justice officials, the police and the health and workers’ administration.

The victims were poor, desperate, rebellious or in need of help. They came from psychiatric clinics and childrens hospitals, from old age homes and welfare institutions, from military hospitals and internment camps.

The number of victims is huge, the number of offenders who were sentenced, small."

Aktion T4 Commemorative Tablet, Tiergartenstraße 4, Berlin

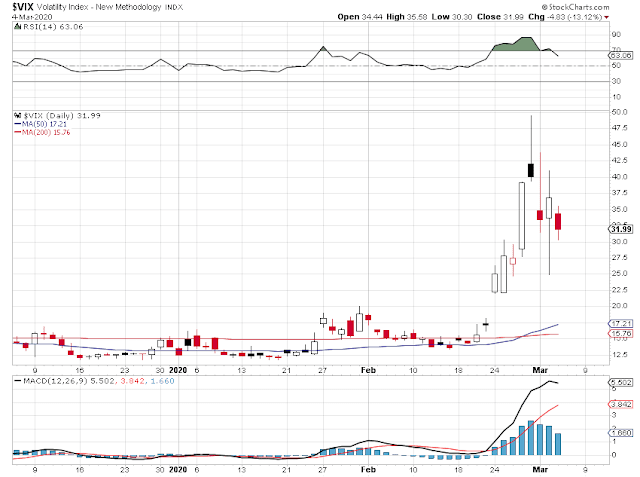

Up 1000 points one day, down 1000 points the next.

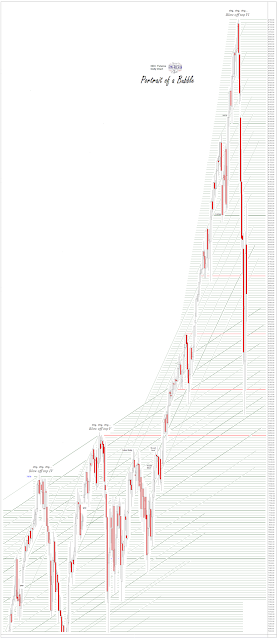

This may be the kind of violent action that precedes a serious break in the market, similar to what was seen in early 1929. It made people dizzy. Until they became crazy.

The crash is on my mind because Season 3 of Babylon Berlin just ended with scenes from the Berlin stock exchange in October 1929. It was fairly graphic.

Today we were down on coronavirus fears. Some think that they are just a hoax, a plot to make leaders like Trump and Boris Johnson look bad.

Gold and silver were up sharply. The Dollar continued its slide.

Tomorrow there will be a non-farm payrolls report. It will be 'backward-looking' in the sense that it wil likely not caprure any of th eeconomic imact of the coronavirus quarantines.

On the NY Comex warehouses report it shows the amount of 'pledged' gold is now over 500,000 ounces.

The NY Fed is creating a place on the web for resources to study economic inequality.

This is like the British East India company initiating a study on the negative effects of mercantile colonialism.

The New York Fed is pleased to announce the launch of a hub on Economic Inequality and Equitable Growth. Through this initiative, the New York Fed conducts research to better understand what contributes to economic inequality in its many forms. With a better understanding of the problem, we look to convene key stakeholders like you to discuss best practices and new strategies to support equitable growth in the region and the nation. This new web page will house current New York Fed research and analysis, resources from the Federal Reserve System, content from trusted external organizations, and highlight events and forums that promote solutions to make communities more prosperous.People will do what they will do, and believe what they wish to believe. Generally that which is convenient for them, and flatters them.

We hope you find the resources on this page beneficial.

Men go mad in herds it is well said, but come back to their senses one at a time.

But until then, they flock to their favorite liars desperately, like addicts in need of a fix of confirming and flattering lies, as a way of avoiding reality.

Have a pleasant evening.