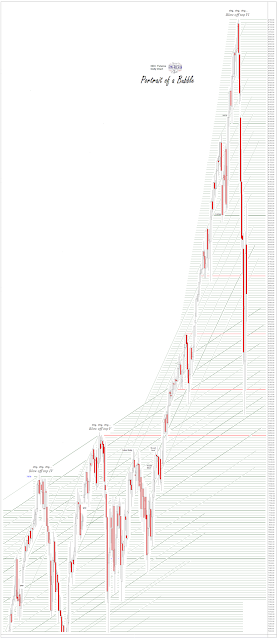

Stocks were plummeting on the overnight. Same old same old.

They plunged much further during the day, with the SP futures down over 100 points. But as is now often the case they managed to take back a chunk of their losses into the close.

Gold rocketed during the early trade to 1690, in an obvious a flight to safety.

And then the Non-Farm Payrolls Party Crowd just wantonly smashed gold down to 1242, by pretty much dumping contracts into the market to 'run the stops.'

And then, having achieved their objective or more likely run out of energy, the market for gold went back up again to retest the 1690 level. Wheee!!

If the US markets were not so serious to pension funds, corporations, and investors this would almost be funny, in the manner of the Three Stooges of trading, full of obvious nonsense and shenanigans..

I think that those who still say that there is no manipulation in these markets must have issues of one sort or another.

If the precious metals are not manipulated then they would seem to be the only market that is not, given all the scandals and serial felonies, albeit addressed by wristslaps, over that past fifteen years.

This is not a good way to support a major global industry and serve legitimate companies and customers. But it does pay off very well for the well connected white collar criminal types, and their enablers.

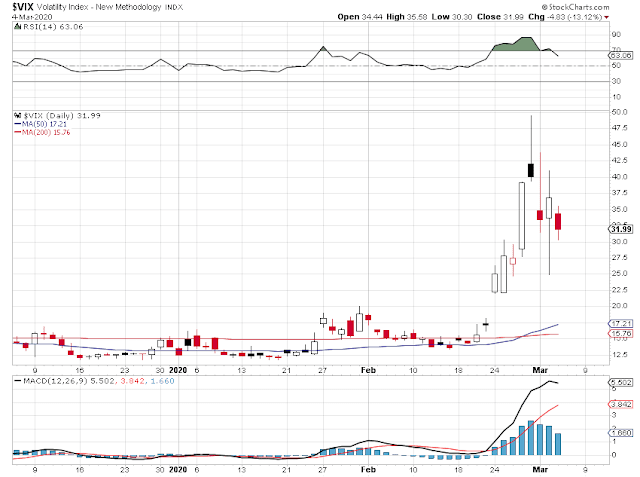

Next week is next week, but most likely more of the same. I suspect we will keep seeing extreme volatility ahead, as the US financial system continues to come to terms with its own obvious mortality.

Have a pleasant weekend.