“People with advantages are loathe to believe that they just happen to be people with advantages. They come readily to define themselves as inherently worthy of what they possess; they come to believe themselves 'naturally' elite; and, in fact, to imagine their possessions and their privileges as natural extensions of their own elite selves.”

C. Wright Mills, The Power Elite

"The acceptance of near-indigency of the mass of the citizens as the price to be paid for the highest stage of prosperity was accompanied by very different human attitudes. Townsend righted his emotional balance by indulging in prejudice and sentimentalism. The improvidence of the poor was a law of nature, for servile, sordid, and ignoble work would otherwise not be done. Also, what would become of the fatherland unless we could rely on the poor? "For what is it but distress and poverty which can prevail upon the lower classes of the people to encounter all the horrors which await them on the tempestuous ocean or on the field of battle?"

Karl Polanyi, The Great Transformation, 1944

"And the brute was given a mouth for uttering haughty and blasphemous words, and was allowed to exercise authority for forty-two months."

Revelation 13:5

“Each day we are becoming a creature of splendid glory, or one of unthinkable horror.”

C. S. Lewis

"And because of the increase in lawlessness, the love of most will grow cold."

Matthew 24:12

These are certainly confusing and volatile times.

I have a recurring feeling that some revelation will unfold for us before or around Sunday, August 2.

Usually these sorts of things in the market reach their critical points in September and October. But given this is an election year, perhaps it will be a bit earlier.

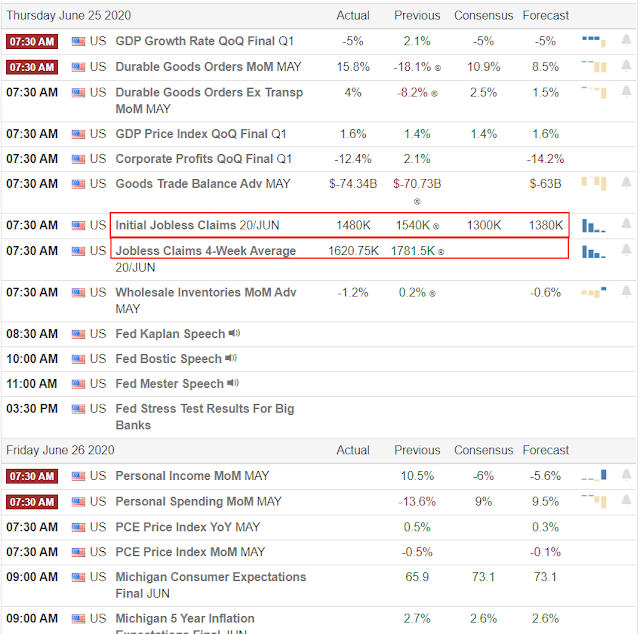

Stocks failed at any rally attempts and gave it up in a big way in recognition that the coronavirus is not going to obey our wishes or listen to our commands.

Gold and silver gained back ground, with gold putting in one of those yo-yo days that so often follow a Comex expiration.

Personally I am inclined to just sit tight and hang on here, hedging around the core positions perhaps.

Be careful of the lies you ingest; they may give you indigestion.

It is hard enough for us to stand fast and maintain ourselves in this time of the beast.

Let us be even more careful of the lies and hateful things that we may be tempted to repeat to others, especially those for whom we have some responsibilities, who listen to us out of love and respect, for those actions will not be easily forgiven.

Have a pleasant weekend.