"The only function of economic forecasting is to make astrology look respectable.”John Kenneth Galbraith

Just another day in the hood with the hoods.

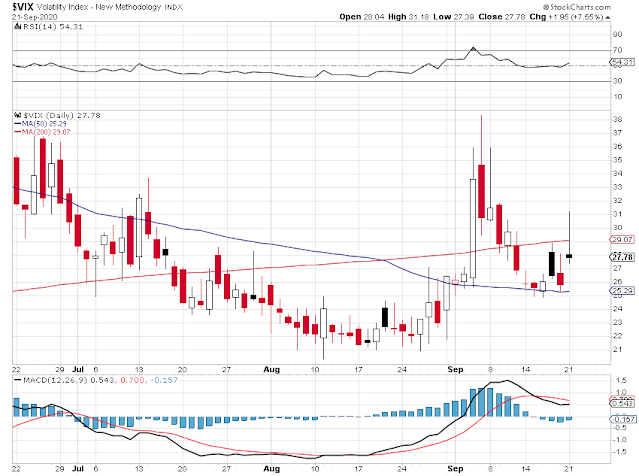

Stocks and precious metals bounced off support today.

I managed to buy the metals with leverage and play the bounce for a day.

This lends some credence to the thought that this might just be a correction in a short term overbought condition.

Along with some of the usual insider shenanigans, as they seek to clip the speculators and average investors.

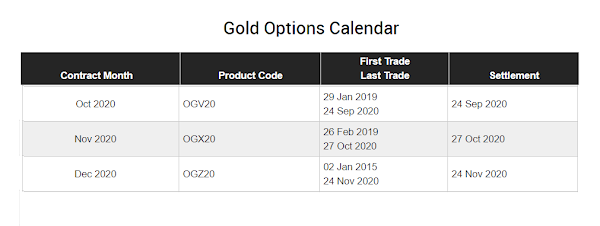

However, we *might* see another gut check tomorrow, especially in gold as the in the money call options are converted to active futures contracts.

So let's see what happens, and let the market tell us which of several scenarios may be correct.

Have a pleasant evening.