"Human beings are so made that the ones who do the crushing feel nothing; it is the person crushed who feels what is happening. Unless one has placed oneself on the side of the oppressed, to feel with them, one cannot understand. Power is as pitiless to the man who possesses it, or thinks he does, as it is to its victims; the latter it crushes, the former it intoxicates. The truth is, no one really possesses it."

Simone Weil

"Education without values, as useful as it is, seems rather to make a man a more clever devil."

C. S. Lewis

"You do not know the working class. But you are not to be blamed for this. How can you know anything about the working class? You do not live in the same locality with the working class. You herd with the capitalist class in another locality. And why not? It is the capitalist class that pays you, that feeds you, that puts the very clothes on your backs that you are wearing to-night.

And in return you preach to your employers the brands of metaphysics that are especially acceptable to them; and the especially acceptable brands are acceptable because they do not menace the established order of society. Each of you dwells in a cosmos of his own making, created out of his own fancies and desires. You do not know the real world in which you live, and your thinking has no place in the real world except in so far as it is phenomena of mental aberration."

Jack London, The Iron Heel

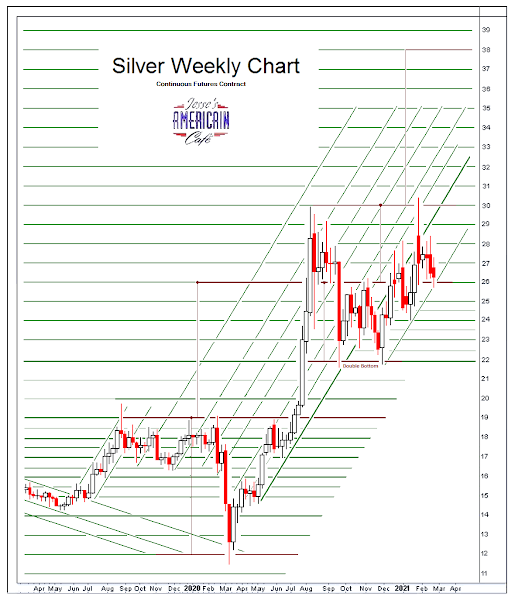

Gold and silver both held their price at the 61.8% retracement level.

Next week will tell us if this is a major correction or the start of a new formation.

But the amount of physical bullion being added in Hong Kong suggests 'mission accomplished' in cleaning out the precious metal ETFs.

As I said, look for this type of action to continue while the gold pool falls apart.

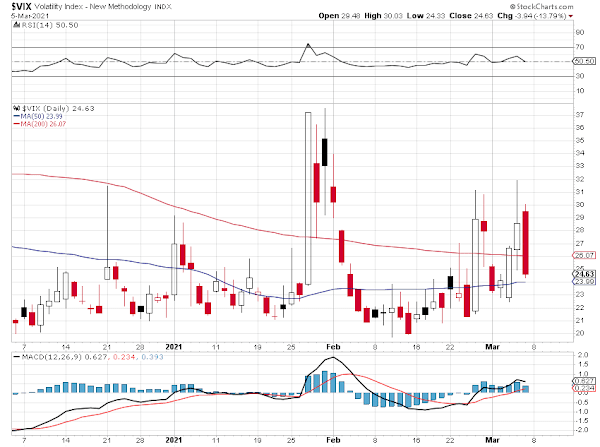

Stocks took a plunge today, but then held their own levels as needed on their charts and managed to stage a major relief rally.

Let's see if bully can keep that going as a trend change, or not.

The Dollar moved to the top of the 91 handle.

Again, let's see which way we go from here.

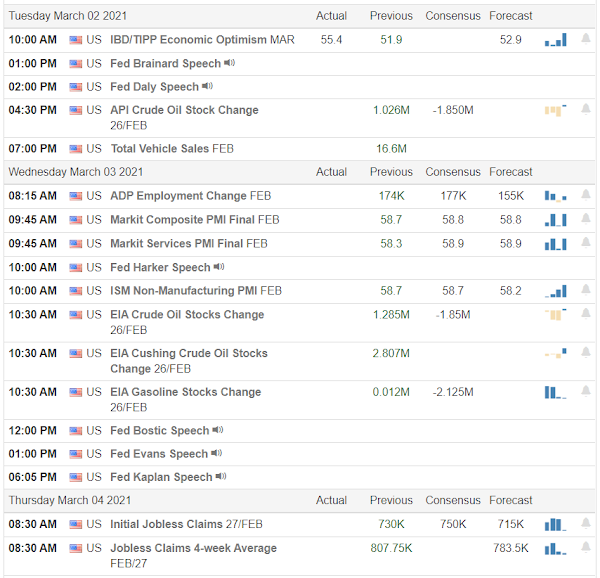

Interest rates may be a key determinant.

For those who are astonished by the antics of the some of the opposition party Senators, both outrageous and shameful, keep in mind that this is nothing new, and not so mysterious.

The same service to the moneyed interests with a reckless disregard for the public was common among the Republican congressmen throughout the Great Depression.

And although it is so often unmentioned, the one percent attempted to foment a coup against the elected government by violent means in Washington DC.

History does rhyme.

People imagine that we all worked together, but this is not at all what happened.

Have a pleasant weekend.