"In my club, I will splash the pot whenever the fuck I please."

Teddy KGB, Rounders

"It hurts doesn't it? Your hopes dashed, your dreams down the toilet. And your fate is sitting right besides you."

Teddy KGB, Rounders

"You're right Teddy, the ace didn't help. [pushes chips towards the center and flops down his cards] I flopped the nut straight."

Mike McDermott, Rounders

Stocks were on another run higher today, as it was risk on de luxe.

Gold and silver continue to climb out of the hole that the bullion banks and hedge funds hammered them down into.

Miners seem to be pacing the way up.

I would not rest too easy in any new long positions.

These jokers love to come back for seconds and thirds. It's a sociopath thing.

Rounders was one of my favorite 'gambling' movies.

We used to go out to Las Vegas three or four times a year in the 70's and 80's.

I liked to stay at the Frontier, so I could hang out in the Stardust Sports Book during the day.

But that was before they ruined the town, and turned the it into a corporate theme park.

It breathed easier when there were big stretches of desert between the clubs.

I got married in Las Vegas, in an actual church that used to be out in the desert all by charming self.

The last time I went out there that little Spanish style desert church was surrounded by condos and new houses.

Let's see how the rest of the week goes.

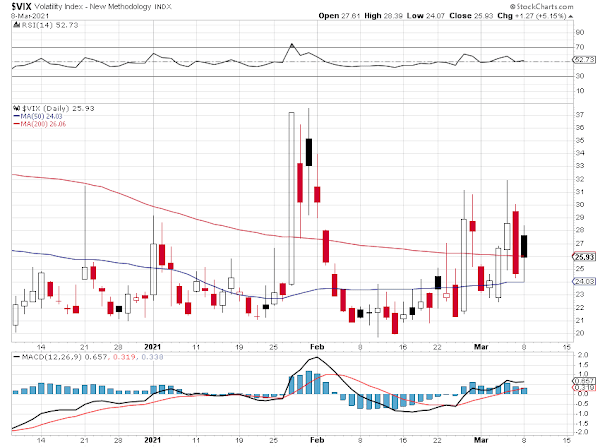

We are heading for a Minsky Moment.

Third time's the charm. Or is it four now?

Timing will be everything.

Just a series of booms and busts.

Who could see the next one coming?

The Fed reserves the right to splash the pot whenever they wish, on behalf of their benefactors.

But in this real life version of the film, Teddy doesn't pay off when he loses. So grab it off the table while you can.

Have a pleasant evening.