“The disposition to admire, and almost to worship, the rich and the powerful, and to despise, or, at least to neglect, persons of poor and mean condition is the great and most universal cause of the corruption of our moral sentiments.”

Adam Smith

"I write to you from a disgraced profession. Economic theory, as widely taught since the 1980s, failed miserably to understand the forces behind the financial crisis. Concepts including 'rational expectations,' 'market discipline,' and the 'efficient markets hypothesis' led economists to argue that speculation would stabilize prices, that sellers would act to protect their reputations, that caveat emptor could be relied on, and that widespread fraud therefore could not occur. Not all economists believed this – but most did.

Thus the study of financial fraud received little attention. Practically no research institutes exist; collaboration between economists and criminologists is rare; in the leading departments there are few specialists and very few students. Economists have soft-pedaled the role of fraud in every crisis they examined, including the Savings & Loan debacle, the Russian transition, the Asian meltdown and the dot.com bubble.

They continue to do so now. At a conference sponsored by the Levy Economics Institute in New York on April 17, the closest a former Under Secretary of the Treasury, Peter Fisher, got to this question was to use the word 'naughtiness.' This was on the day that the SEC charged Goldman Sachs with fraud."

James K. Galbraith, Why the 'Experts' Failed to See How Financial Fraud Collapsed the Economy, May 16, 2010

"There is a kind of chronic complacency that has been rotting American liberalism for years, a hubris that tells Democrats they need do nothing different, they need deliver nothing really to anyone – except their friends on the Google jet and those nice people at Goldman.

The rest of us are treated as though we have nowhere else to go and no role to play except to vote enthusiastically on the grounds that these Democrats are the 'last thing standing' between us and the end of the world. It is a liberalism of the rich, it has failed the middle class, and now it has failed on its own terms of electability. Enough with these comfortable Democrats and their cozy Washington system. Enough with Clintonism and its prideful air of professional-class virtue.

I think what we need in order to restore some kind of sense of fairness is not the final triumph of markets over the body and soul of humanity, but something that confronts markets, and that refuses to think of itself as a brand."

Thomas Frank, 2016

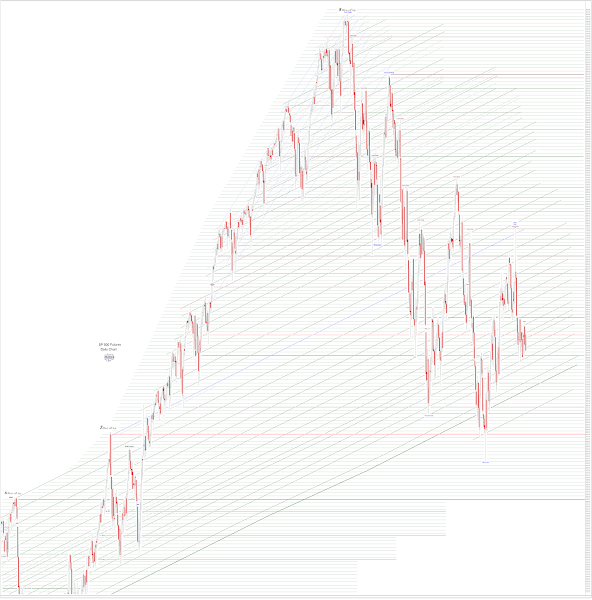

Stocks managed to shake off some early gloom and rallied in the afternoon.

The Dollar chopped sideways, finishing largely unchanged.

Gold and silver rallied sharply.

The VIX fell slightly.

Earnings continue rolling in, for what they are worth.

Did I mention that there will be a stock option expiration on Friday.

Have a pleasant evening.