“Benign remedies are for the innocent. Misdeeds, once exposed, have no refuge but in audacity. And they had accomplices in all those who feared the same fate.”

Tacitus, Annals

"If we are dealing with psychology, then the thermometers one uses to measure it have an effect. I was raising the question on the side with Governor Mullins of what would happen if the Treasury sold a little gold in this market. There's an interesting question here because if the gold price broke [lower] in that context, the thermometer [price of gold] would not be just a measuring tool. It would basically affect the underlying psychology.

Now, we don't have the 'legal' right to sell gold but I'm just frankly curious about what people's views are on situations of this nature because something unusual is involved in policy here. We're not just going through the standard policy where the money supply is expanding, the economy is expanding, and the Fed tightens. This is a wholly different thing."

Alan Greenspan, Federal Reserve Minutes, May 18, 1993

"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Sir Edward 'Steady Eddie' George, Governor Bank of England in conversation with Nicholas J. Morrell, of Lonmin Plc, 1999

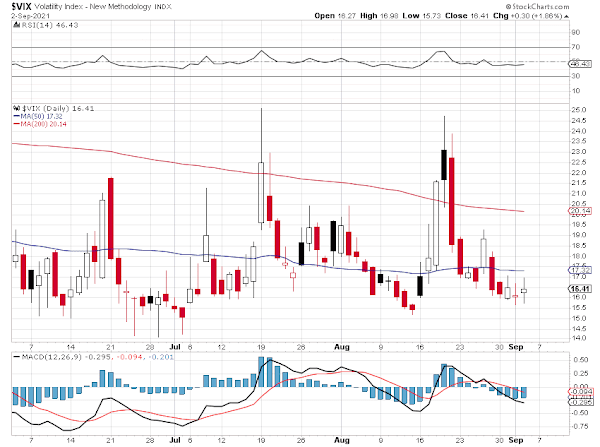

Stocks attempted to rally, but fell into the red in the afternoon, and went out near the lows.

The Dollar dropped to the mid-range of the 92 handle.

Gold and silver rallied back a bit from the recent 'mini-me' smackdown.

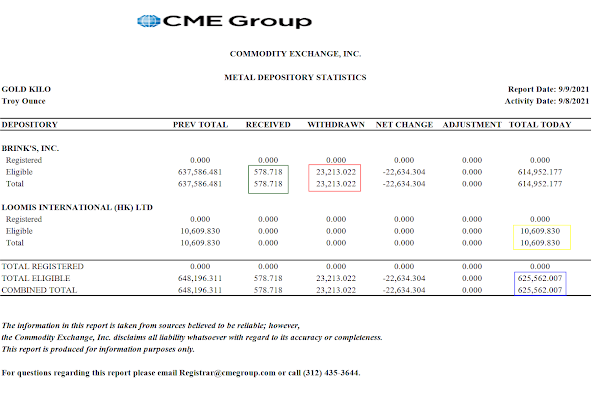

The gold bullion readily available in Hong Kong for Comex delivery is getting a bit sparse again.

Time to milk the ETFs for gold bullion again?

Robbing Peter to pay Ping.

Just keep the music playing as long as the punch and profits are flowing.

They'll never learn. Because their paychecks depend on maintaining a downward spiral of dumbness.

And so gold keeps flowing, from West to East.

Have a pleasant evening