"The wealthiest 1 percent of Americans are the nation’s most egregious tax evaders, failing to pay as much as $163 billion in owed taxes per year, according to a new Treasury Department report released on Wednesday.

The analysis comes as the Biden administration is pushing lawmakers to embrace its ambitious proposal to invest in beefing up the Internal Revenue Service to narrow the 'tax gap,' which it estimates amounts to $7 trillion in unpaid taxes over a decade.

The White House has proposed investing $80 billion in the tax collection agency over the next 10 years to hire more enforcement staff, overhaul its technology and usher in new information-reporting requirements that would give the government greater insight into tax evasion schemes. The proposals have been met with deep skepticism from Republicans and business lobbyists."

DNYUZ, The top 1 percent are evading $163 billion a year in taxes

"Ayn Rand's 'philosophy' is nearly perfect in its immorality, which makes the size of her audience all the more ominous and symptomatic as we enter a curious new phase in our society. Moral values are in flux. The muddy depths are being stirred by new monsters and witches from the deep. Trolls walk the American night. Caesars are stirring in the Forum.

To justify and extol human greed and egotism is to my mind not only immoral, but evil. "

Gore Vidal, Comment, Esquire, July 1961

"But there is a sort of 'Ok guys, you're mad, but how are you going to stop me' mentality at the top."

Robert Johnson, Audacious Oligarchy

Gold and silver were hit again today down to trend resistance, but managed to bounce back a bit into the close.

Not a Dr Evil class market swindle as we saw a week or so ago, but maybe a 'mini-me.'

Stocks were lower, even the storied big cap tech stocks.

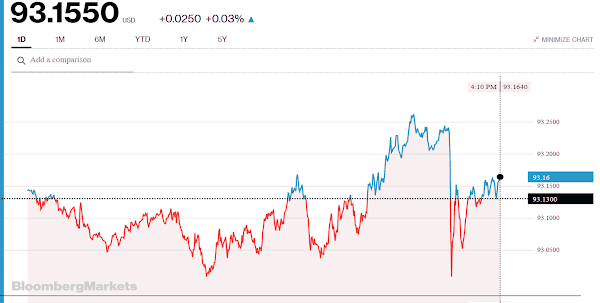

The Dollar moved a little higher.

Again this looks like a very technical trade.

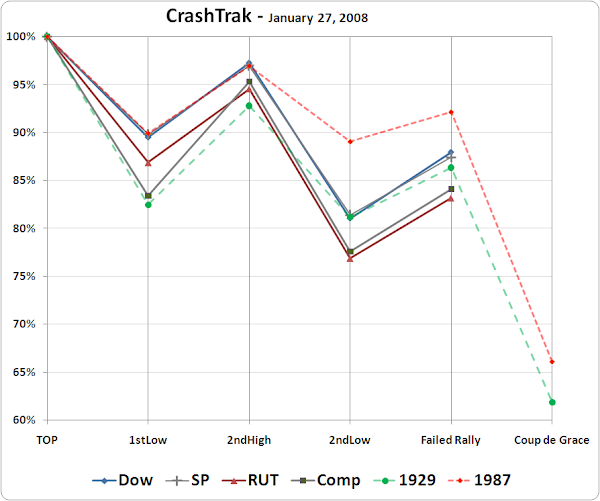

But we are entering what has proven historically to be a volatile season for stock bubbles.

Let's see what the rest of the week brings.

Have a pleasant evening.