"Free market economic 'literature' as economists call it — and their papers frequently are works of fiction — gave succor and intellectual respectability to the decades of deregulation and tax cuts that have bankrupted the country. Congress is compromised, to be sure, but lobbyists and members need economic studies as cover for what they are doing.

The United States is a plutocracy, with an income and wealth distribution that rivals South America’s worst cases, but economists refuse to acknowledge that these outcomes are attributable to ill-advised public policies on taxation, regulation, trade, and education spending over the last several decades.

Economists bleat about 'globalization' as though it were inevitable rather than a set of deliberate policy choices. Markets are political creations, so results produced by them are not inviolable or free from question."

Lee Sheppard, Economists' Malign Influence on Taxes, Forbes, May 3, 2012

“We run heedlessly into the abyss after putting something in front of us to stop us from seeing it.”

Blaise Pascal, Pensées

"Our future could be one in which continued tumult feeds the looting of the financial system, and we talk more and more about exactly how our oligarchs became bandits and how the economy just can’t seem to get into gear. Recovery will fail unless we break the financial oligarchy that is blocking essential reform. We’re running out of time."

Simon Johnson, The Quiet Coup, May 2009

“Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole.”

Robert Heller, Federal Reserve Board, 1989

"Too many of America's elites - among the super-rich, the CEOs, and many of my colleagues in academia - have abandoned a commitment to social responsibility. They chase wealth and power, the rest of society be damned."

Jeffrey Sachs, The Price of Civilization, January 2012

“Political decisions helped to create the super-elite in the first place, and as the economic might of the super-elite class grows, so does its political muscle. Surging income inequality is such a strong violation of our expectations that most of us don’t realize it is happening.”

Chrystia Freeland, Plutocrats

"The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid.”

Neil Barofsky, TARP Inspector General

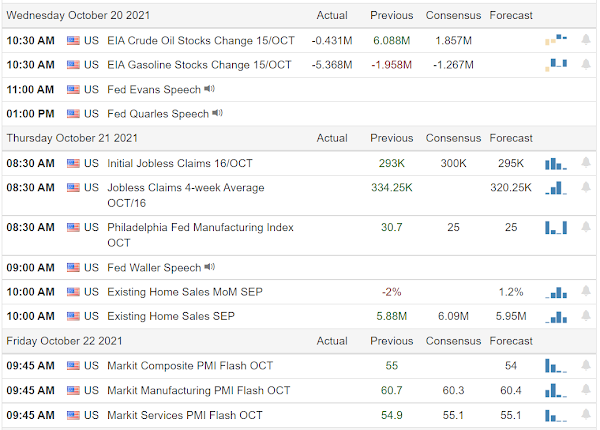

Stocks managed to rally higher and hold their gains for the most part.

The biggest driver was Tesla, which is receiving an order for 100,000 vehicles from Hertz.

After the bell Facebook missed its revenue estimates and gave a soft revenue forecast for the future.

I tend to look at the revenue numbers first, as a good CFO with a flexible accounting structure cane make short term profits do just about anything thy want.

Remember Cisco, which famously beat their earnings number by one penny, quarter after quarter?

Actually this whole market reminds me of 1999-2001.

It is more than a bubble; it is a Ponzi scheme.

Facebook pledged a $50 billion stock buyback program though, so all was quickly forgiven, or at least forgotten.

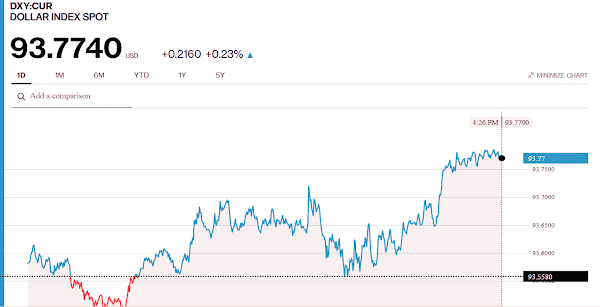

Gold and silver managed to rally today even as the Dollar slightly strengthened.

And the band played on.

Have a pleasant evening.