“Stupidity has a knack of getting its way; as we should see if we were not always so much wrapped up in ourselves. In this respect our townsfolk were like everybody else, wrapped up in themselves; in other words they were human: they did not believe in plagues."

Albert Camus, The Plague

"In the Incarnation the whole human race recovers the dignity of the image of God. Thereafter, any attack, even on the least of men, is an attack on Christ, who took on the form of man, and in his own Person restored the image of God in all. Through our relationship with the Incarnation, we recover our true humanity, and at the same time are delivered from that perverse individualism which is the consequence of sin, and recover our solidarity with all mankind."

Dietrich Bonhoeffe, Letters and Papers from Prison

“Religion used to be the opium of the people. To those suffering humiliation, pain, illness, and serfdom, religion promised the reward of an after life. But now we are witnessing a transformation: a true opium of the people is the belief in nothingness after death, the huge solace, the huge comfort of thinking that for our betrayals, our greed, our cowardice, our murders, that we are not going to be judged.”

Czeslaw Milosz, The Discreet Charm of Nihilism

“A man who lies to himself, and believes his own lies, becomes unable to recognize truth, either in himself or in anyone else, and he ends up losing respect for himself and for others. When he has no respect for anyone, he can no longer love, and in him, he yields to his impulses, indulges in the lowest form of pleasure, and behaves in the end like an animal in satisfying his vices. And it all comes from lying — to others and to yourself.”

Fyodor Dostoevsky, The Brothers Karamazov

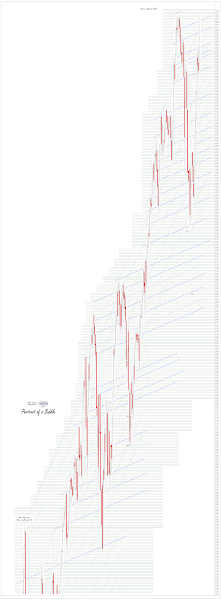

As I noted the other day, rather than call this a 'stock bubble' it would probably more correct and natural to call it a 'ponzi scheme.'

Bubbles tend to masquerade as acts of God, or the madness of crowds.

The only madness of the crowds recently has been to trust in the same old schemes from the usual gang of con men and their mouthpieces.

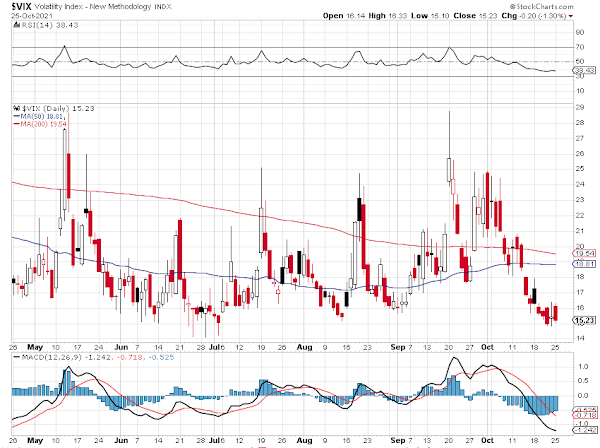

Stocks did a pop and flop.

One of these days that sort of flop is going to translate into a swan dive.

The SP 500 and a couple name stocks are doing all the heavy lifting.

I suspect that insiders are handing off their gains to mom and pop, and their institutions.

Capital is rushing heedlessly into opaque risks, and is readying itself to be consumed.

Gold and silver were hit hard and early, for no particular reason.

They recovered much of their losses into the close.

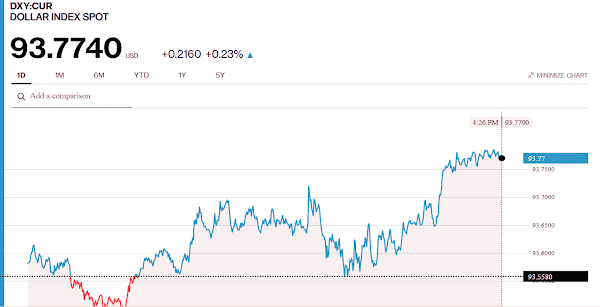

The Dollar chopped sideways.

Keep an eye out for the GDP print for the 3rd quarter on Thursday.

Have a pleasant evening.