"Financial institutions such as JP Morgan love to buy derivatives because they are opaque, create fictional income that leads to real bonuses, and when, not if, they suffer losses so large that they would cause the bank to fail, they will be bailed out."

William K Black

"A synthetic instrument has no real assets. It is simply a bet on the performance of the assets it references. That means the number of synthetic instruments is limitless, and so is the risk they present to the economy. Synthetic structures referencing high-risk mortgages garnered hefty fees for Goldman Sachs and other investment banks. They assumed an ever-larger share of the financial markets, and contributed greatly to the severity of the crisis by magnifying the amount of risk in the system.

Increasingly, synthetics became bets made by people who had no interest in the referenced assets. Synthetics became the chips in a giant casino, one that created no economic growth even when it thrived, and then helped throttle the economy when the casino collapsed."

Carl Levin, US Senator

“Most people are good and occasionally do something they know is bad. Some people are bad and struggle every day to keep it under control. Others are corrupt to the core and don’t give a damn, as long as they don’t get caught. But evil is a completely different creature. Evil is bad that believes it’s good.”

Karen Marie Moning

“Propaganda serves more to justify ourselves than to convince others; and the more reason we have to feel guilty, the more fervent our propaganda.”

Eric Hoffer

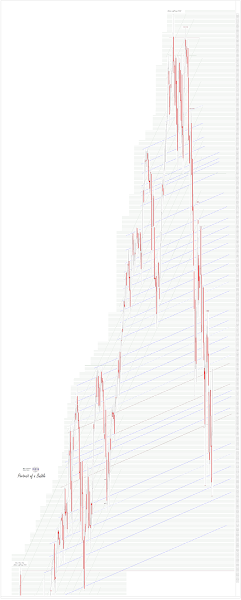

It was risk on again today, as stocks shook off their early losses and managed to rally back into the green, and finally went out near the highs.

The SP and NDX are approaching the level of their latest failed rallies.

This could provide a good test of bully's new resolve to buy.

Gold and silver were higher.

The Dollar and the VIX both fell on the risk appetite for equities.

Quad witching option expiration tomorrow.

Every day we read and hear fresh stories of how the Russian military is experiencing disaster after disaster in the Ukraine.

Their generals are dropping like flies, soldiers are abandoning their equipment and surrendering in tears,

Every day it seems as though Russia is on the verge of admitting defeat and surrendering.

And the Ukraine goes from victory to victory, triumph to triumph.

Just like the economy.

One can only wonder.

Have a pleasant evening.