“Sabbath, in the first instance, is not about worship. It is about withdrawal from the anxiety system of Pharaoh, the refusal to let one’s life be defined by production and consumption and the endless pursuit of private well-being.

In our own contemporary context of the rat race of anxiety, the celebration of Sabbath is an act of both resistance and alternative. It is resistance because it is a visible insistence that our lives are not defined by the production and consumption of commodity goods.

Thus I have come to think that the commandment on sabbath is the most difficult and most urgent of the commandments in our society, because it summons us to intent and conduct that defies the most elemental requirements of a commodity-propelled society that specializes in control and entertainment, bread and circuses, along with anxiety and violence.

The way of mammon (capital, wealth) is the way of commodity that is the way of endless desire, endless productivity, and endless restlessness without any Sabbath."

Walter Brueggemann

"They will be unloving and unforgiving; they will slander others and have no self-control. They will be cruel and hate what is good. They will betray their friends, be reckless, be puffed up with pride, and love pleasure rather than God. They will act religious, but they will refuse the grace that could make them righteous."

2 Timothy 3:3-5

"Then he said to them, 'The Sabbath was made for man, not man for the Sabbath.'"

Mark 2:27

"Beware the leaven of the Pharisees, which is hypocrisy."

Luke 12:1

Hypocrisy is from the Greek and means acting, or playing a part.

Often people become unbalanced in their priorities, taking something which may be good to an extreme that makes it highly counterproductive for others and themselves.

Ideology often makes people into hypocrites, because they lose sight of the why of things and become obsessed with the what and the how.

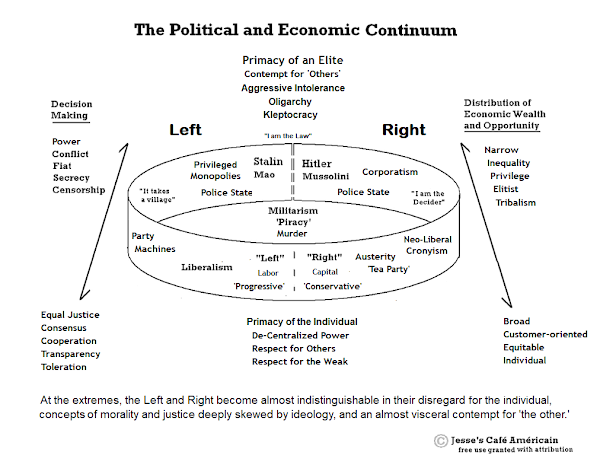

This is why I have shown the chart at the very bottom of this posting that shows a convergence of the far right and the far left, in their disordered sense of priorities.

Bruggerman makes these points about the Sabbath, and to its reason for being, which is our awareness and growth in the love of God above all else.

This is why our Lord himself said, 'The Sabbath is made for man, not man for the Sabbath.' The Sabbath is for our benefit.

If we take a strict adherence to the law, and lose sight for its reason for being, we can fall into the trap of legalism and hypocrisy.

Many of God laws are primarily for our own growth and development, not because God requires it for Himself, or His justice demands it. He does not need our suffering, or our denial of things, or other sacrifices. He does not desire sacrifice for its own sake, but mercy.

The person who becomes obsessed with legalisms loses sight of the reason for these things, and is like the servant who buried their talent in strict observance to what they perceive as a harsh and unreasonable master, and fail to accomplish the purpose of their task, which is to be fruitful in His creation through our actions.

Strict observance without love is an attractive error, because it allows us to believe that we are the best in observing and obeying God, even while we worship something else with our hearts. It is a mask of self-delusion.

And such rigid and harsh thinking is like leaven, it spreads and permeates the whole.

This is why so often we see the harshest and least loving people wearing the mask of perfect ideologist of both the right and the left.

They think 'yes I can hate, because I love God or my political party or economic theory just that much. And so I can negate the other, reduce them to cartoons, and feel very superior to them and their failings.'

And this deadening of self conscience permits even otherwise ordinary people to become part of unspeakable actions and horrors.

The banality of evil is to think that 'I am just a player of a part, an actor, serving a greater power.'

As old as Babylon, and self-deceivingly evil as sin.

Stocks took a dive in the earlier trading, but managed to come back to unchanged in the quiet trading of the afternoon.

Chairman Powell made some hawkish seeming noises today, which helped to take stocks to their lows.

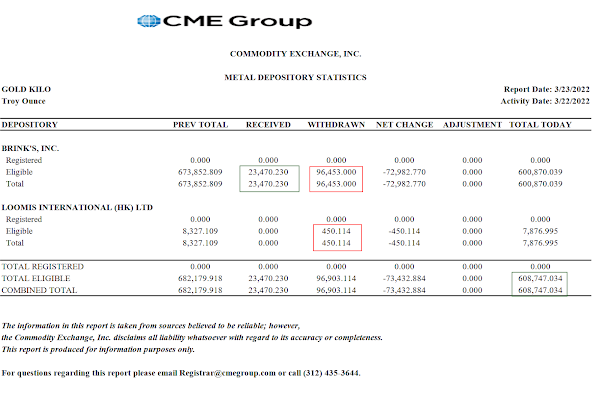

Gold and silver rallied after the quad witching option expiration of last Friday.

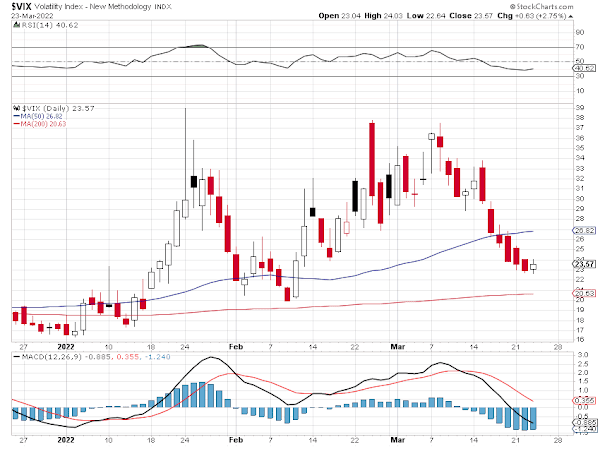

The VIX continued to fall, to a level that seems low in the short term.

Although it fluctuated in a choppy trade, the Dollar managed to go out near the day highs in the mid 98 level.

Geopolitical events will continue to add uncertainty and risk to the market.

As with the economy and money, things may not be what they seem.

Have a pleasant evening.