"Control frauds in the financial markets are by their very nature conspiratorial in that they involve the suborning of regulators, ratings agencies, exchanges, the media, and legislators to ignore and facilitate misrepresentation that enable white collar crime. They are difficult to prosecute because by their nature they involve twisting the legal into the extra-legal on a broad basis to achieve a particular financial effect, while limiting many specific aspects to the letter of the law, or at least the gray areas.

By and large they operate in the shadows, hiding behind secrecy and a general mindset towards short term greed and lapses in ethics. Investigations following the Crash of 1929 and the S&L crisis demonstrated that the existence of such pervasive lapses in stewardship do exist.

Light is a good disinfectant. Fraud cannot bear exposure. While some confidentiality must be maintained in trading, obsessive secrecy regarding significantly large positions and collateral matters is often an indication that something is not right, that it is hidden from the market participants view for a particular reason that is deleterious to market pricing and efficiency."

Jesse, 27 April 2010

"There is not a crime, there is not a dodge, there is not a trick, there is not a swindle, there is not a vice, that does not live by secrecy."

Joseph Pulitzer

"All frauds, like the wall daubed with untempered mortar, with which men think to buttress up an edifice, always tend to the decay of what they are devised to support."

Richard Whately

"Secrecy is completely inadequate for democracy, but totally appropriate for tyranny."

Malcolm Fraser

Stocks slumped today.

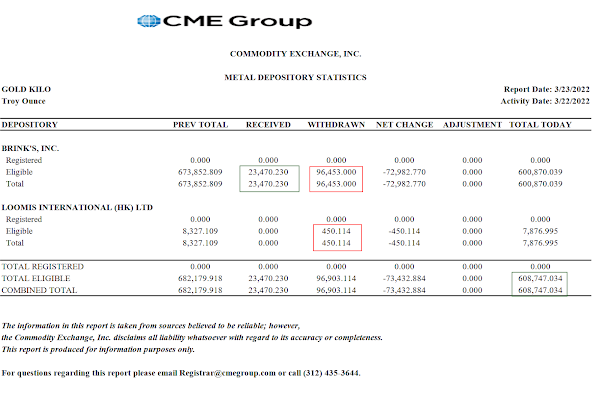

The precious metals rallied.

The Dollar moved up a bit.

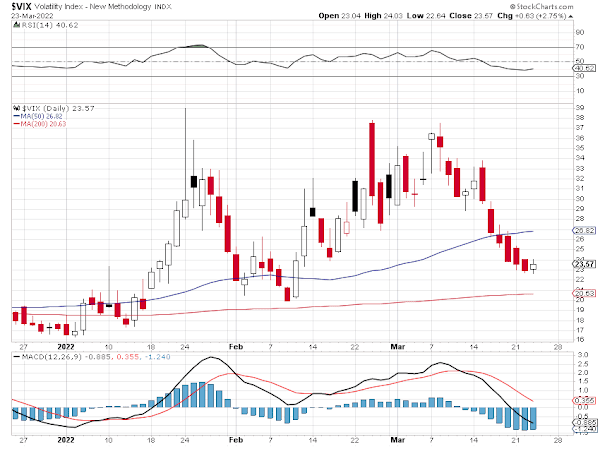

VIX had a little bounce.

Wax on, wax off.

Bonuses on Wall Street this year are up on average by 27%.

In general, the oligarchy is increasingly audacious.

They have exerted their will and influence over corrupt enablers and the easily distracted very well.

Have a pleasant evening.