"God chooses those that the world judges foolish to shame the wise. God chooses those that the world thinks weak to shame the strong. And God chooses the people and things that are insignificant and contemptible to the world, which it regards as worth nothing, to show the uselessness of that which the world esteems."

1 Corinthians 1:27-28

"It is one of the most sublime ironies of God's economy that the greatest weapon in our battle is not the violence and power of the world, but the service and self-effacement of God's love. As Léon Bloy said, 'Love does not make you weak, because it is the source of all strength, but it makes you see the nothingness of the illusory strength on which you depended before you knew it.'

The power of love and forgiveness is unfathomable and bewildering to the principalities and powers of this world, and the spiritual darkness that rules them. And this is to be their failure and their demise."

Jesse, 20 February 2018

"And that is the wonder of all wonders, that God loves the lowly. God marches right in. He chooses people as his instruments and performs his wonders where one would least expect them."

Dietrich Bonhoeffer

"I've seen something wondrous peering through my joy in the beautiful, a sense of its creator. Only people can be truly ugly, because they have free will to separate themselves from this song of praise. It often seems they will drown out this hymn with cannon thunder, curses, and blasphemy. But I have realized they will not succeed. And so I want to throw myself on the side of the victor.”

Sophie Scholl

"Wonderful providence indeed which is so silent, yet so efficacious, so constant, so unerring. This is what baffles the power of Satan. He cannot discern the Hand of God in what goes on; and though he would fain meet it and encounter it, in his mad and blasphemous rebellion against heaven, he cannot find it.

Such is the rule of our warfare. We advance by yielding; we rise by falling; we conquer by suffering; we persuade by silence; we become rich by bountifulness; we inherit the earth through meekness; we gain comfort through mourning; we earn glory by penitence and prayer."

John Henry Newman

It was risk on today, and stocks responded to the call of the wild, moving higher.

The Dollar gave up the 100 handle.

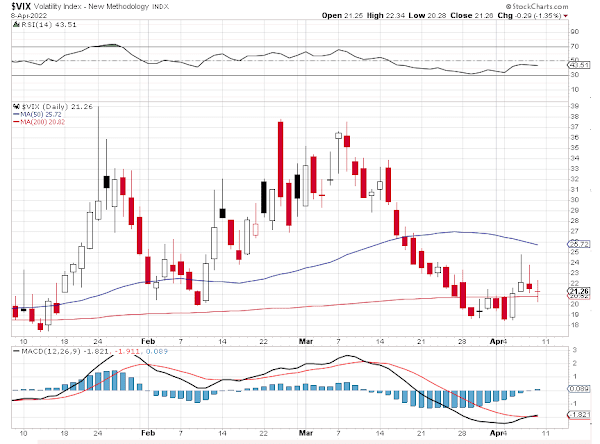

The VIX declined.

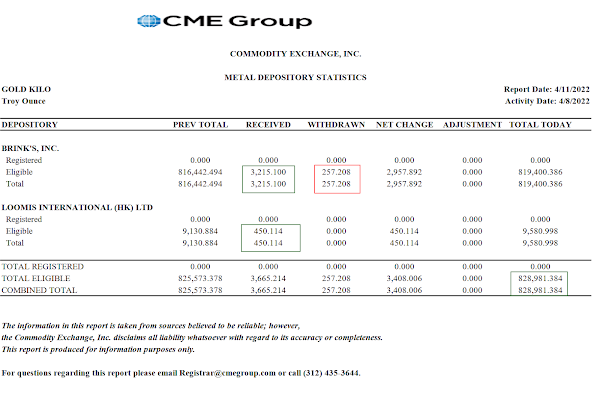

Gold and silver rallied higher in a bit of a countertrend move.

Oh yeah we have an option expiration dead ahead.

Have a pleasant evening.