|

| The Penitence of Peter |

Thomas Merton

"To enter heaven is to become more human than you ever succeeded in being on earth; to enter hell, is to be banished from humanity. What is cast (or casts itself) into hell is not a man: it is 'remains.' To be a complete man means to have the passions obedient to the will and the will offered to God: to have been a man – to be an ex-man or 'damned ghost' – would presumably mean to consist of a will utterly centered in its self and passions utterly uncontrolled by the will.

The real problem is not why some pious, humble, believing people suffer, but why some do not. Everyone has noticed how hard it is to turn to God when everything is going well for us. We 'have all we want' is a terrible saying when 'all' does not include God. We find God an interruption.

You can have no greater sign of confirmed pride than when you think you are humble enough.

Pain insists upon being attended to. God whispers to us in our pleasures, speaks in our conscience, but shouts in our pains: it is his megaphone to rouse a deaf world. No doubt pain as God's megaphone is a terrible instrument; it may lead to final and unrepented rebellion. But it gives the only opportunity the bad man can have for amendment. it removes the veil; it plants the flag of truth within the fortress of the rebel soul.

Mental pain is less dramatic than physical pain, but it is more common and also more hard to bear. The frequent attempt to conceal mental pain increases the burden: it is easier to say 'My tooth is aching' than to say 'My heart is broken'.

Pain provides an opportunity for heroism; the opportunity is seized with surprising frequency. But if suffering is good, ought it not to be pursued rather than avoided? I answer that suffering is not good in itself. What is good in any painful experience is, for the sufferer, his submission to the will of God, and, for the spectators, the compassion aroused and the acts of mercy to which it leads.

I have seen great beauty of spirit in some who were great sufferers. I have seen men, for the most part, grow better not worse with advancing years, and I have seen the last illness produce treasures of fortitude and meekness from most unpromising subjects.”

C.S. Lewis, The Problem of Pain

“Man has places in his heart which do not yet exist— and into them enters suffering, in order that they may have life.”

Léon Bloy

"Suffering is a means by which God saves us, afflicting us so we do not lapse into vain self-sufficiency, a pride and a perverse individualism that gathers us blindly into ourselves, and separates us from His own creation.

To suffer is how we grow in humility, and conform ourselves to do what He commands, rather than as we may will. Prayer is how we sustain ourselves in times of both suffering and joy, with humility in this life, as we resort not only to ourselves or to the world, but to all things with God.

And so we find comfort in His will, and the conversations that we keep with His many tender mercies. The world can not see this, and in not seeing does not understand. To the world we are fools.

His consolations and comforts are hidden, delivered to us in quiet moments, heart to heart. And so He gathers us together to Himself, and keeps us safe, and slowly takes us from this world and the dark powers therein, that search endlessly for souls to make their own, and to devour. "

Jesse, 15 May 2018

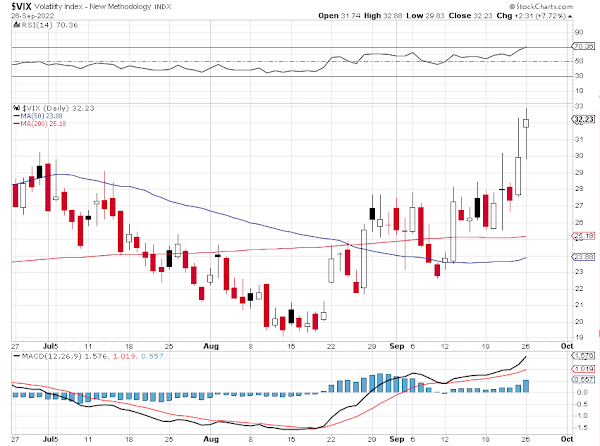

The Bank of England came to the rescue of the gilts market this morning, pledging to buy 'an unlimited amount' of bonds.

While this was obviously just kicking the can down the road as they say, on the premise of easing pressures of dislocation and disorder in their markets, traders nevertheless chose to take it a sign of more general central bank intervention.

And so stocks rallied sharply and held their gains into the close.

Gold and silver were smacked down hard in the overnight, as gut punch to the new holders of futures contracts from the recent option expiration.

But with their expiry manipulation done, gold and silver rocketed higher.

The Dollar fell sharply off the signal to the markets by the BoE and the new appetite for riskier assets.. It was very overbought.

Bully managed to take stocks off the danger of breaking down through the important second low.

Let's see if they can keep it up.

Have a pleasant evening.