"Hot money seeks out the conscious mispricing of risk. Capital, in the form of both money and personal talent, increasingly flows into malinvestment and the gaming of markets.

The productive economy languishes, left wanting for the lack of creative resources and attention. The bubble rises to unsustainable valuations— and fails, and a nation's capital is consumed.

The next five years are not about winning, but surviving."

Jesse, The Men Who Sold the World, 5 August 2019

"When the modern corporation acquires power over markets, power in the community, power over the state and power over belief, it is a political instrument, different in degree but not in kind from the state itself. To hold otherwise — to deny the political character of the modern corporation — is not merely to avoid the reality. It is to disguise the reality."

John Kenneth Galbraith

Philip K. Dick, Flow My Tears, the Policeman Said

"This elite-generated social control maintains the status quo because the status quo benefits and validates those who created and sit atop it. People rise to prominence when they parrot the orthodoxy rather than critically analyze it. Real change in politics or society cannot occur under the orthodoxy because if it did, it would threaten the legitimacy of the professional class and all of the systems that helped them achieve their status."

Kristine Mattis, The Cult of the Professional Class

"The banks engage in fraud for two reasons. First, they profit from swindling the public. Second, they can get away with it via a simple technique. They buy off the regulators with promises of enormously lucrative jobs when they leave government service, and they buy off the politicians with huge direct and indirect campaign contributions."

Laurence Kotlikoff, When Banksters Buy Regulators and Prosecutors, Forbes, October 21, 2014

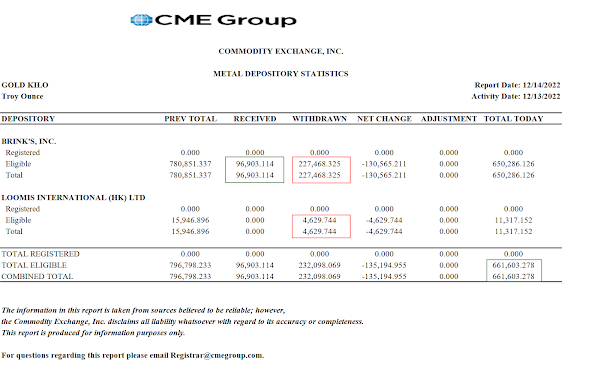

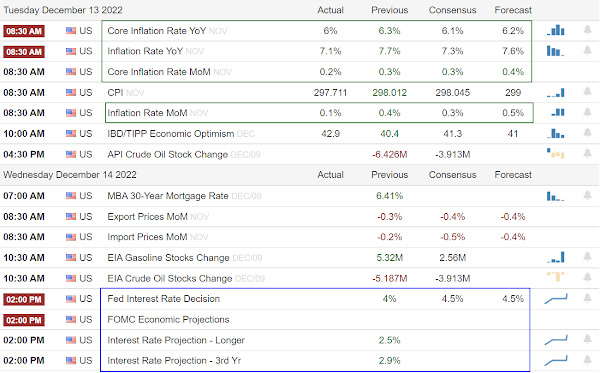

And so the last and one of the biggest quarterly option expirations for 2022 comes to an end.

It was, all in all, a wonderfully obvious and heavy-handed wash and rinse of the nation's capital markets.

Stocks slumped and went out on the lows, totally negating the phony CPI headfake rally from early in the week.

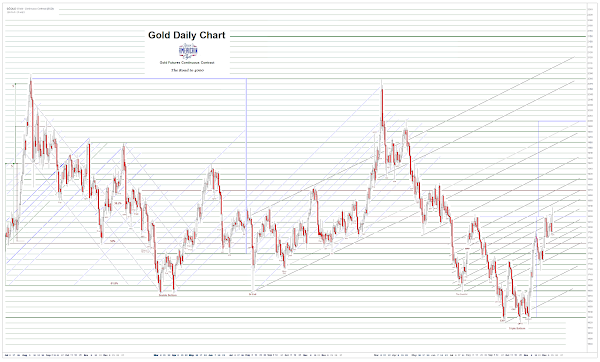

Gold and silver bounced off the drubbing they took yesterday in honor of the expiration.

The Dollar edged a bit higher.

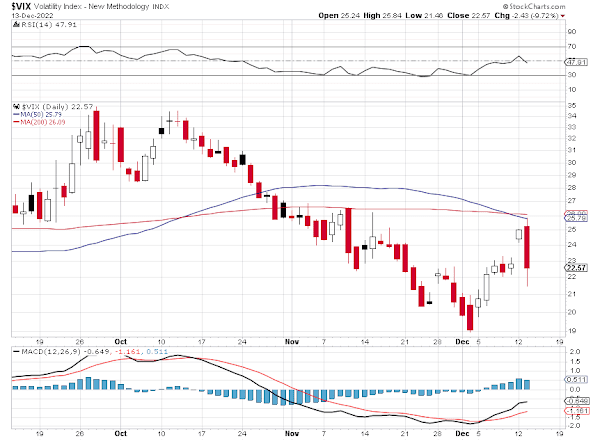

The VIX fell.

And now we slide out to the end of this year on holiday volumes, but with plenty of room for lightly regulated shark tanks to move prices around as they will.

Are you not entertained?

Have a pleasant weekend.