"I thought of this upside down debt pyramid when I was at Citibank in the early ‘60s. I first gave talks on it inside the bank, trying to influence the bank because I saw too much borrowing short term and lending long term. It was just awful! I kept on warning the bank, but was just brushed aside. When Nixon closed the gold window I said, 'This is my chance to get out,' so I took it. It was a great move on my part because I could buy gold and gold mining shares when gold was $50 an ounce or less."

John Exter, 1991

(As late as 2001 gold was trading between $272-$292. The sea change came in 2008 when central banks became net buyers of bullion, although the signs of change were there in 2006.)

"Moral hazard is the probability that a party insulated from risk will behave differently from the way they would behave if fully exposed to the risk. Moral hazard arises because an individual or institution does not bear the full consequences of its actions, and therefore has a tendency to act with increasing recklessness, literally 'without reckoning.' It also encourages the rise to power of the sociopaths in the affected organizations.

It is difficult to explain moral hazard to tenured professors or the pampered princes of bureaucracy, who beat the drum with their silver spoons in support of shifting the risk of loss to the public every time that Wall Street falls into one of its own schemes and blows itself up."

Jesse, Moral Hazard, 22 March 2008

"Over and over we fall into the same trap. Ten years from now we will have forgotten."

Eliot Spitzer, July 14, 2009

“One reason we rush so quickly to the vulgar satisfactions of judgement, and love to revel in our righteous outrage, is that it spares us from the impotent pain of empathy, and the harder, messier work of understanding.”

Tim Kreider

“We are the United States of Amnesia, which is encouraged by a media that has no desire to tell us the truth about anything, serving their corporate masters who have other plans to dominate us. We learn nothing because we remember nothing.”

Gore Vidal

Most of us learn nothing because we are disinclined and even encouraged to forget things, and instead burn with borrowed rage. It is not that we are incapable of thinking, but are generally more inclined towards self-indulgent and complacent behaviour. Our values are shallow and selfish.

Many forget or even dismiss and distort the facts willingly, since it is the easiest way to get along without the effort and risk of thinking independently, choosing instead to mouth slogans and half truths.

And then there are those 'very serious people' from among the self-appointed elite, whose forgetfulness though carefully rationalized is conscious, mandated by their paychecks, positions and pride.

We deal away our sovereign souls for trifles and vanities.

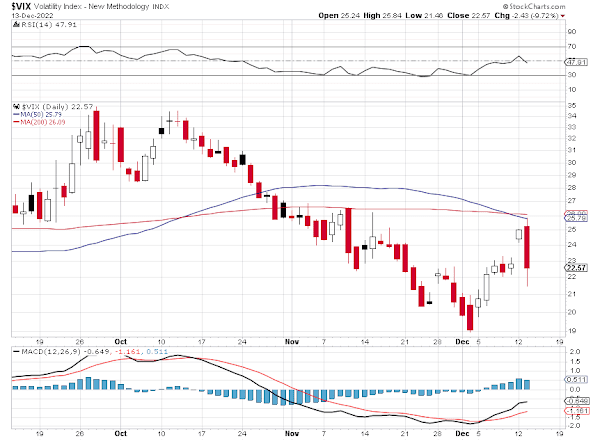

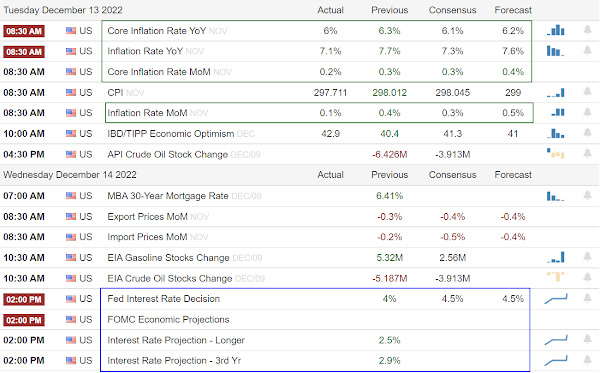

Stocks delivered an express wash and rinse, as a slightly better than expected CPI number triggered a s rocket rally.

This was the shenanigan that I had been expecting, although it happened more quickly than the usual CPI headfake wash and rinse.

I thought the rinse cycle would be coming with the FOMC tomorrow.

But we had a change of pace. The wiseguys have no shame or fear of consequences.

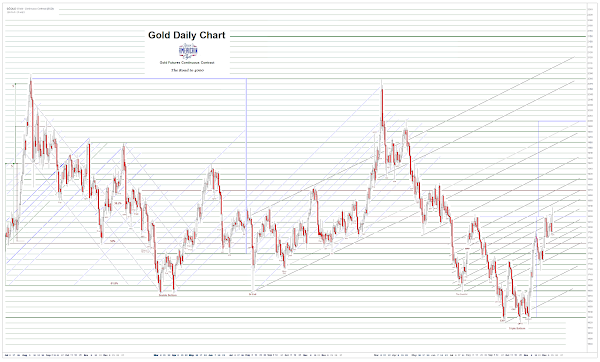

Gold and silver also rocketed higher and both managed to hold on to some of those gains, short of a real breakout.

The Dollar dumped.

More opportunities for hijinks in the rest of the week.

The oligarchy is audacious.

Have a pleasant evening.