"These violent delights have violent ends

And in their triumph die, like fire and powder,

Which, as they kiss, consume."

William Shakespeare, Romeo and Juliet

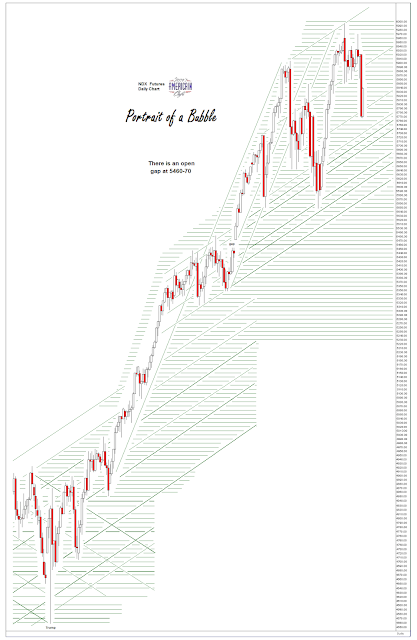

Stocks bounced back a bit on Friday after the big selloff, while the metals continued their upward push into what could be some fairly stiff resistance.

The task for told this week is to take out the psychological 1300 resistance and stick a close above it.

As for silver, the 18 handle looms above.

I have been noticing a bigger than usual divergence between the spot price of gold from Kitco, for example, and the quotes I am receiving live from the Comex.

For example, the Kitco spot price quote right now is 1288, whereas the Comex gold continuous contract and December contract quote is 1294.

Well, it would be more of an issue if I was striking a price for a physical sale.

Stocks need to hang on to the bounce.

With Twitter Man predicting that a trade war with China will commence on Monday, we'll have to see what happens.

Relatives came over from Maryland and Pennsylvania this weekend. I was able to obtain some much appreciated sleep, the time to go to the store and browse a little, and a long, hot shower. And it was nice to have some company in the evening to talk and watch a movie.

Periods of illness of a loved one can become isolating experiences. A visit from a friend, or a kind word and a smile or gesture from a stranger, become very welcome when keeping the long vigil of duty and love.

It is funny how little things can become such welcome luxuries. These are God's tender mercies.

See you tomorrow.