"And afterwards he went there daily, and gained an increasing number of followers. It seemed that from every tear of a martyr new confessors were born, and every groan in the arena found an echo in thousands of hearts.

Caesar was swimming in blood; Rome and the whole pagan world were mad. But those who had had enough of transgression and madness, those who were trampled upon, those whose lives were misery and oppression, all the weighed down, all the sad, all the unfortunate, came to hear the wonderful tidings of God, who out of love for men had given Himself to be crucified and redeem their sins.

When they found a God whom they could love, they had found that which the society of the time could not give any one— happiness and love."

Quo Vadis, by Henryk Sienkiewicz

"And don't let anybody make you think that God chose America as his divine, messianic force to be, a sort of policeman of the whole world. God has a way of standing before the nations with judgment, and it seems that I can hear God saying to America, 'You're too arrogant! And if you don't change your ways, I will rise up and break the backbone of your power, and I'll place it in the hands of a nation that doesn't even know my name. Be still and know that I'm God.'"

Martin Luther King

Stocks moved sideways today in the aftermath of the Facebook miss.

The Street is chomping at the bit, expecting a strong GDP Advance print for 2Q tomorrow morning.

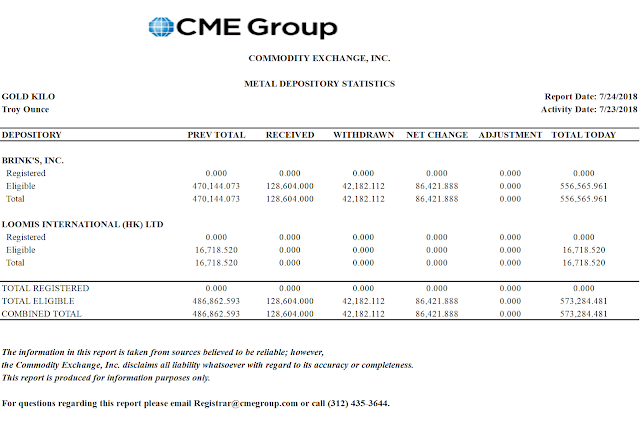

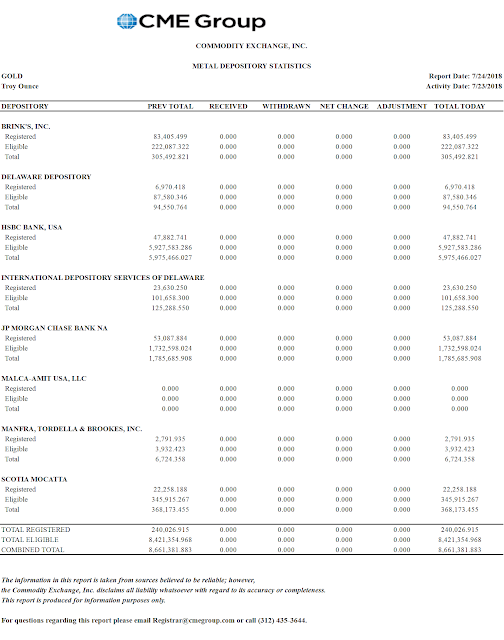

Silver and gold were quiet for expiration with a small loss easily attributable to a rally in the US Dollar.

Thank you Lord, for your presence and faithful providence towards us all.

Spare us, Lord, from your chastisement. Forgive our blindness, our foolish pride and stubborn selfishness, in failing to see your many consolations, gentle corrections, and tender mercies.

Need little, want less, love more. For those who abide in love abide in God, and God in them.

Have a pleasant evening.