To buy, or not to buy? Allocated, unallocated, or exchange-traded, derivative, or nothing? That is the question.

"Simply, antifragility is defined as a convex response to a stressor or source of harm (for some range of variation), leading to a positive sensitivity to increase in volatility (or variability, stress, dispersion of outcomes, or uncertainty, what is grouped under the designation "disorder cluster").

Likewise fragility is defined as a concave sensitivity to stressors, leading a negative sensitivity to increase in volatility. The relation between fragility, convexity, and sensitivity to disorder is mathematical, obtained by theorem, not derived from empirical data mining or some historical narrative. It is a priori".

Nassim Taleb, Mathematical Definition, Mapping, and Detection of (Anti)Fragility

Yes, there is a certain fiendish humour as Taleb introduces this quotation with 'simply' and then goes on to use enough jargon to make the layperson's eye glaze over.

But what Taleb is describing here is a fundamental that many have forgotten. It is the corollary to his more famous observation about 'black swans' and 'tail risks.'

What Taleb is basically saying is that a system or investment that is designed to accommodate infrequent but outsized and somewhat unpredictable risks performs one way he calls anti-fragile. And other systems and investments are designed so that they perform well under 'normal conditions' but tend to underperform, and often badly, during the unexpected.

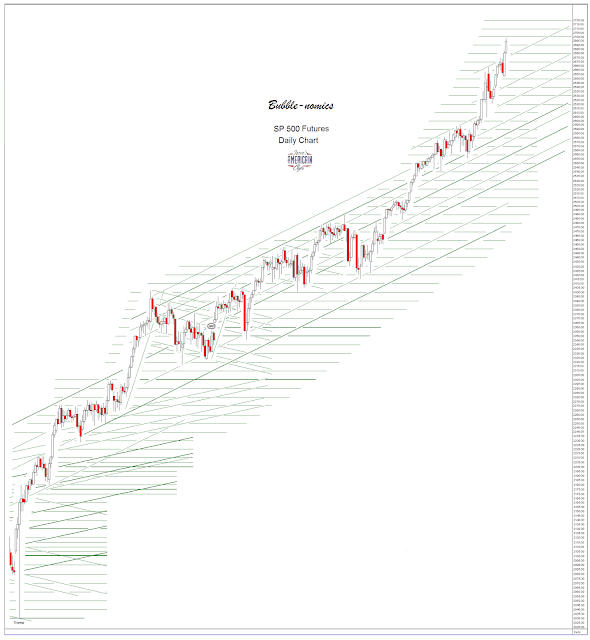

Here is my own picture of Taleb's concept of how investments react. It might not be exactly what Taleb himself has in mind, but it something that fits certain other types of information systems in a prior occupation, and how I remember it for my own purposes:

If you want to grossly oversimplify this principle, and remember it as a saying,

pick the right tool for the right job, and remember that nothing comes for free. I used this in describing tradeoffs in very complex products and networks, and while it may sound tritely obvious, it worked with a lot of upper level executives.

But what is the job itself? Well, the application defines it of course. But one must also take performance criteria into account, and with performance there are environmental conditions and variabilities. Would you like to have a network that can function for your casual use in your home, or a high performance network that can survive arctic cold and desert heat?

Don't laugh. we used to drop networks into some of the more out of the way and volatile places around the world, put electronic equipment in explosive environments, and met application criteria that had many other product groups running out of the room screaming for momma. It was our particular competitive edge. It only comes with experience, confidence, and a fanatical understanding of the odds and how they can mount against you.

But you don't want to waste money and over engineer something either. That is a good way to go broke. One needs to understand expected performance, and the risk profiles for just about anything that is not merely incidental.

And if there is anything that I wish you to remember from this blog, after all these years, it is the deadly trap of undisclosed risks and the tendency of some to understate those risks for their own short term advantages. And how other people will go along with them for the sake of position, power, and prestige. In a nutshell, this is the story of our recent financial crises.

It is far too complicated to get into this afternoon, but lets just say that a number of mathematicians and industry analysts, among them Taleb, Mandelbrot, Tavakoli, William Black, Yves Smith et al., saw that there was significant undisclosed risk in the system because models (Black-Scholes for example) greatly simplified the risks, and assumed distributions of variability that were not real world realistic.And even worse, in many cases the risks were actively hidden, and even more despicable in the worst of them, purposeful.

There was a movement in finance to force normal distributions onto data that did not really justify it. In order to achieve this, the risk models made certain assumptions, and thereby 'flattened' reality in order to fit the model. What one ended up with was a mis-estimation of the risk probabilities. And so we saw 'once in a hundred year events' happening with alarming frequency, despite the best efforts of the financial planners to smooth them over with piles of bailout money.

Here is a picture of what such a discrepancy might look like:

So the financial system designer likes the normal distribution and makes their operational plans based on that. But why is this? Are they diabolical fiends? Do they enjoy screwing up?

No, they are ordinary people for the most part, but following orders. And the orders are sometimes to take the

faux normal approach because it costs less to implement, allows for greater leverage, and

fattens profits, at least in the short term. Watering the cattle, cutting a corner, putting lipstick on a pig.

Careerism's second law is if you are wrong with everyone else, no one can blame you. And so many financial myths have thereby obtained extended lives, because they provided a fig leaf for someone's self serving ends and moral trembling. This is in some ways the story behind the failure of our regulatory systems, often staffed by good people but who are underpaid, overworked, and subject to extraordinary political pressure to turn a blind eye to which otherwise might provoke their action. Especially where there is a lack of complete certainty, which is all too often the case in real life. The rationalizations are venerable, with their roots in the Garden of Eden.

So what is the punch line? If you are buying an investment as a safe haven, something that will perform well in a difficult and somewhat unpredictable circumstance, you may wish to take your money into something that is highly transparent, robust made to endure the unexpected, given to few assumptions, and perhaps even strongly guaranteed.

And if you are not, if you wish to invest in something with a decent return, but in your own estimation performs adequately for your time horizons and expectations, then pick the product in which you have confidence, provided it meets your needs and possesses some advantages in features and price.

These principles can be applied to the pros and cons of certain types of gold and silver investments. And those pros and cons are ALWAYS going to be affected by how you perceive the risks, and how that investment fits into your plans. This is a given. And this is why I would never give anyone specific advice, because I am not a financial advisor and do not have the knowledge of their own particular situation, their goals and time horizons.

I will use myself as an example. I tend to gravitate a portion of my portfolio into very transparent and 'safe' gold and silver investments, where I have a very high confidence in them based on audits, ownerships, and so forth. There is not much about them I do not know and have to assume. Yes there are the high improbable outliers like a meteor hitting the earth and bringing on Mad Max and cyclist cannibals, and so one might drop a dime or two on arms and infrastructure just for grins, but by and large I think we can ignore them for now.

But for the most part a failure in the financial system that could be adverse to one's wealth seems a little more likely. And so a part of my portfolio is in reasonably secure investments that will benefit somewhat from disorder and provide a small premium on return or at least weather the situation well.

And other parts of my portfolio are in investments that are more

fragile as Taleb would say. But they provide a nicer short term return with less expense. And there is nothing wrong with this. Not at all.

By the way, and I hate to even bring it up, but gold and silver themselves suit slightly different purposes. Silver is less 'anti-fragile' than gold in dire circumstances, generally. But it offers some juicy upside in certain circumstances in compensation. And there are always special situations to consider, and for this one might read Richard Russell or Ted Butler among others, who track imbalances and trends that could provide opportunities or risks.

I do not consider gold better than silver; they are

different. And I own both, and invest speculatively in both, at varying intensities depending on the changing context of the markets. What is better, a hammer or a screwdriver? It depends on what you wish to do with them.

I would certainly buy some other financial instrument or stock I consider less robust for a quick flip or outsized return. The miners would fall into this sort of category. I am sure some of my bank accounts would as well, depending on how high the risks, And physical property is notoriously non-portable if you decide to take up roots and go to another place.

So, as far as unallocated gold goes, there is nothing inherently wrong with it. It is a very nice way to own gold with a reduction in expenses. I am sure not all providers of such a service are equally reliable, and their representatives would do well to discuss their own advantages, guarantees and superior performance as would any provider of products when faced with less reliable competitors.

I will say that deriding critics as loons and charlatans, and referring to a portion of your prospective clients and client influencer base in a generally derogatory manner with a pejorative nickname promulgated by economists who hate precious metals on principle, is probably not a high profile technique in the salesperson's handbook for success. Answer with facts. Once you descend to name calling you have lost. Just a word to the wise, and enough said about that.

Know why you are buying what you are buying, and how it fits into your overall scheme, and what assumptions you are using. And do not be afraid to have contingency plans and change them if new data comes your way.

I know it is hard, especially in times of currency wars, because the first victim in all war is the truth. But don't go off the deep end either, and waste your money on over complex plans or put all your eggs in an improbable basket. It's your call, and perhaps you need a professional to help sort out exactly what your priorities are.

I keep a spreadsheet, and on it there is a summary of all my assets, and it fits them into a simple risk portfolio so I can see how they are distributed by risk and by total value. Since the prices of things change, you have to be aware of how that affects your overall portfolio. I have to say that physical bullion has taken a much larger place in my overall profile since 2000. But that is fine, I just need to be aware of not letting it become a risk, and to balance it as required.

Would I personally buy GLD as 'insurance' against a systemic failure? Hell no. Maybe as a flip investment on a technical trade. Would I buy some physical trust with strong outside auditing and redemption features that were practically available? Probably, because it covers a bit of both insurance and investment. But it lacks the leverage of a small cap miner just for example. But it does not nearly have the risk.

Yes it is 'that simple.' Which is to say, it can be simple to understand but hard to implement. But you have to start somewhere, and if you start all wrong, it gets worse as you go. Some parts of my portfolio are for insurance, and other parts are for investment. They serve different purposes. I had the damnedest time trying to convince a broker at a white shoe firm who was managing my stock options portfolio of this. He thought I was schizoid. He only thought in terms of good stocks and great stocks. So I got rid of him, as he was too focused on his own goals, even when he feigned altruistic concern for my money.

And sad to say, for most people, their major task is just getting by day to day. And so the pros and cons of various investment techniques is so much

hoohah because their most ambitious aspiration is to stay out of debt, especially usurious and fee laden debts, while putting a little bit aside. And this is why I spend quite a bit of time writing about these abuses, because I am not only a caterer to the elite, but to our little community which has a range of wonderful souls in it.

As always, the devil is in the details, but it helps if you know the lay of the land, and where you think you are heading, and why. And of course, you adjust for changing circumstances as they occur.