You have probably heard by now that the popular US news magazine style program

60 Minutes carried a segment interviewing Michael Lewis about his new book last night. In it Lewis says that the 'US Stock Market is rigged,' referring to the front running of basic price data taking place with the cooperation of 'the exchanges, the banks, and the traders' in order to regularly cheat large institutional and fund investors on their stock transactions.

You may rightly say that this is nothing new. You have heard about this new type of organized and systemically arranged 'front running' here and other places on the web many times over the past five years. And there were people who had been interviewed, occasionally but not so much of late, on some of the financial news networks complaining about it.

This morning NY AG Eric Schneiderman was interviewed about the investigation he is conducting on Bloomberg TV. Schneiderman was quite politic, praising HFT itself as 'providing liquidity' and pointing to some of the trading firms grasping for milliseconds of advantage as some sort of misguided bad apples.

The lady anchor on the show who questioned him was quite adamant that is it the fault of the regulators for allowing it to happen. She likened these Wall Street traders to her children, who are constantly looking for ways to circumvent her rules, and the shame is on her when they succeed.

I don't think the anchor really understood what she was saying in that awful comparison. These are not children, in the morally formative stage of relative innocence. They are adults, with tremendous advantages and often in positions of power, who have often taken oaths and fiduciary responsibilities. And they too often violate them, and twist the laws to escape responsibility, shamelessly.

This is the unspoken entitlement of the privileged class, the price of their naturally beneficial role in society, that is, the entitlement of being above the law, because they are so special, and so legally advantaged and well connected. This is the twisted reincarnation of class and racial arrogance,

the one percent's burden of bringing order and direction to its social and genetic inferiors

.

Well, that is the moral hazard of excusing Wall Street's criminal thefts, of giving a slap on the wrist when they are caught lying, cheating and stealing, of believing canards like the exchanges are responsible and self-regulating, and ignoring the key role that they and the Banks play in enabling widespread fraud and financial plunder.

Why do people ever listen to those apologists for financial fraud, who dismiss all accusations of market manipulation as mere conspiracy talk? Yes they are skillful in creating doubt, and since all fraud is founded on the hiding and control of information, there is always room for doubt.

Perhaps the worst of this is that 60 Minutes and other are willfully ignoring the power of money in silencing regulators, cutting their budgets, and using political influence to kill their attempts at enforcing the law by corrupting the political process.

Complicating matter, the Federal Reserve has taken the policy of shoving manufactured liquidity into the system through these very Wall Street banks and their exchanges, who are taxing the stimulus like warlords who take Red Cross aid for themselves, allowing a trickle of them to go to the intended recipients. This 'trickle down' approach by the entitled is a sick joke, because it continues robbing the public to pamper the privileged few.

And anytime a whistleblower steps forward, they are smeared and charged with crimes. What a world we are giving to our children, who we apparently teach by our words and example that breaking the rules is a fine art, and that justice is a poorly defined and highly debatable abstract concept. And the truth is merely what we say it is, if we say it well enough, and have enough powerful people and credentialed experts to back us up. Whatever 'is' might mean.

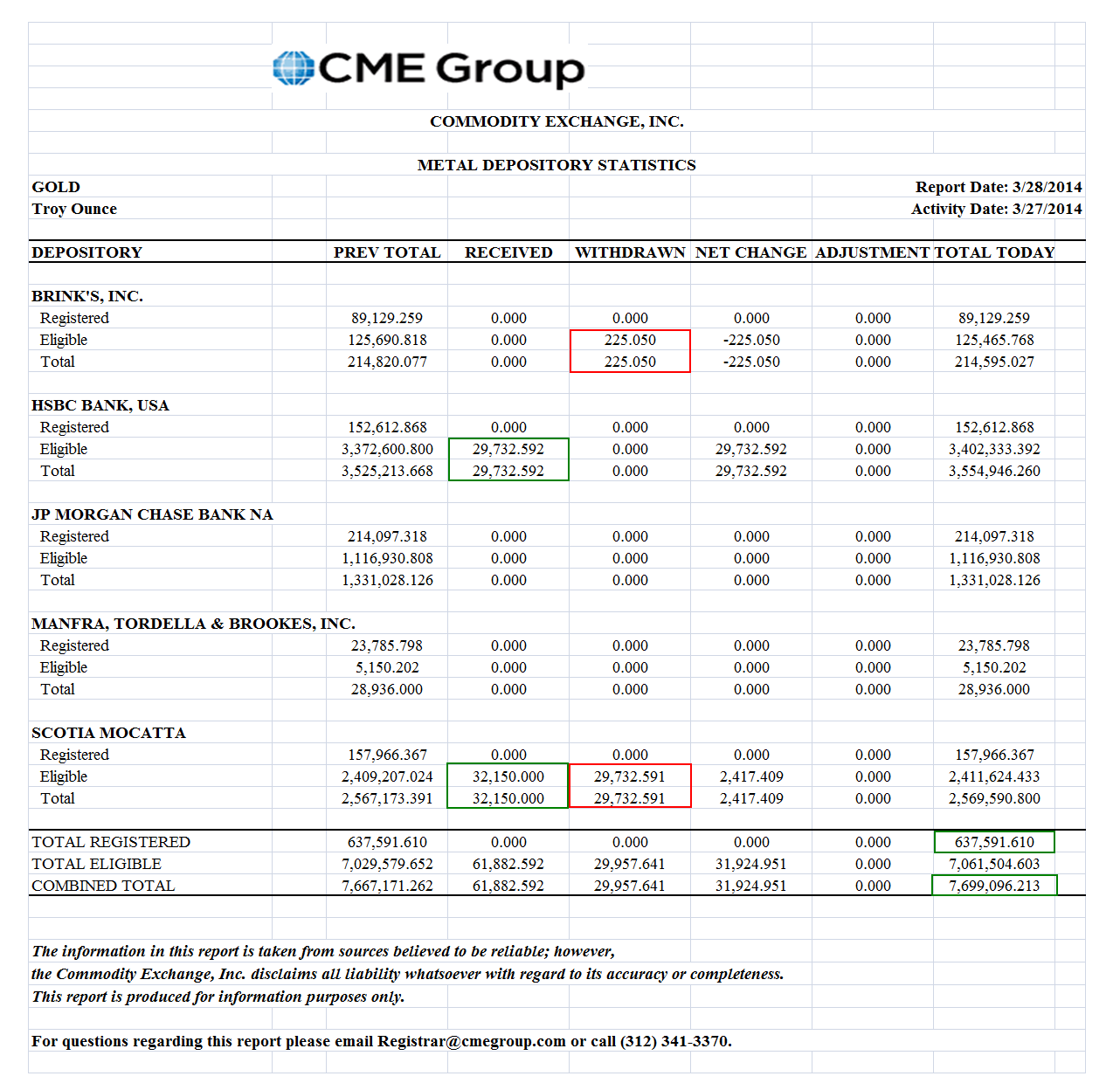

And there are other frauds still going on, like the blatant manipulation of the futures markets with large scale buying and dumping of positions in quiet markets to shove the price around, with regulators turning a blind eye to it. As long as the exchanges, the biggest traders, and the politicians are getting their piece of the action, nothing will be done about it. But such actions have real world consequences.

Old story, always with a bad ending.