"Defenseless under the night

Our world in stupor lies;

Yet, dotted everywhere,

Ironic points of light

Flash out wherever the Just

Exchange their messages:

May I, composed like them

Of Eros and of dust,

Beleaguered by the same

Negation and despair,

Show an affirming flame.”

W.H. Auden, September 1, 1939

"You should thank God for bank bailouts. Now, if you talk about bailouts for everybody else, there comes a place where if you just start bailing out all the individuals instead of telling them to adapt, the culture dies...

There's danger in just shoveling out money to people who say, 'My life is a little harder than it used to be.' At a certain place you've got to say to the people, 'Suck it in and cope, buddy. Suck it in and cope.'"

Charlie Munger

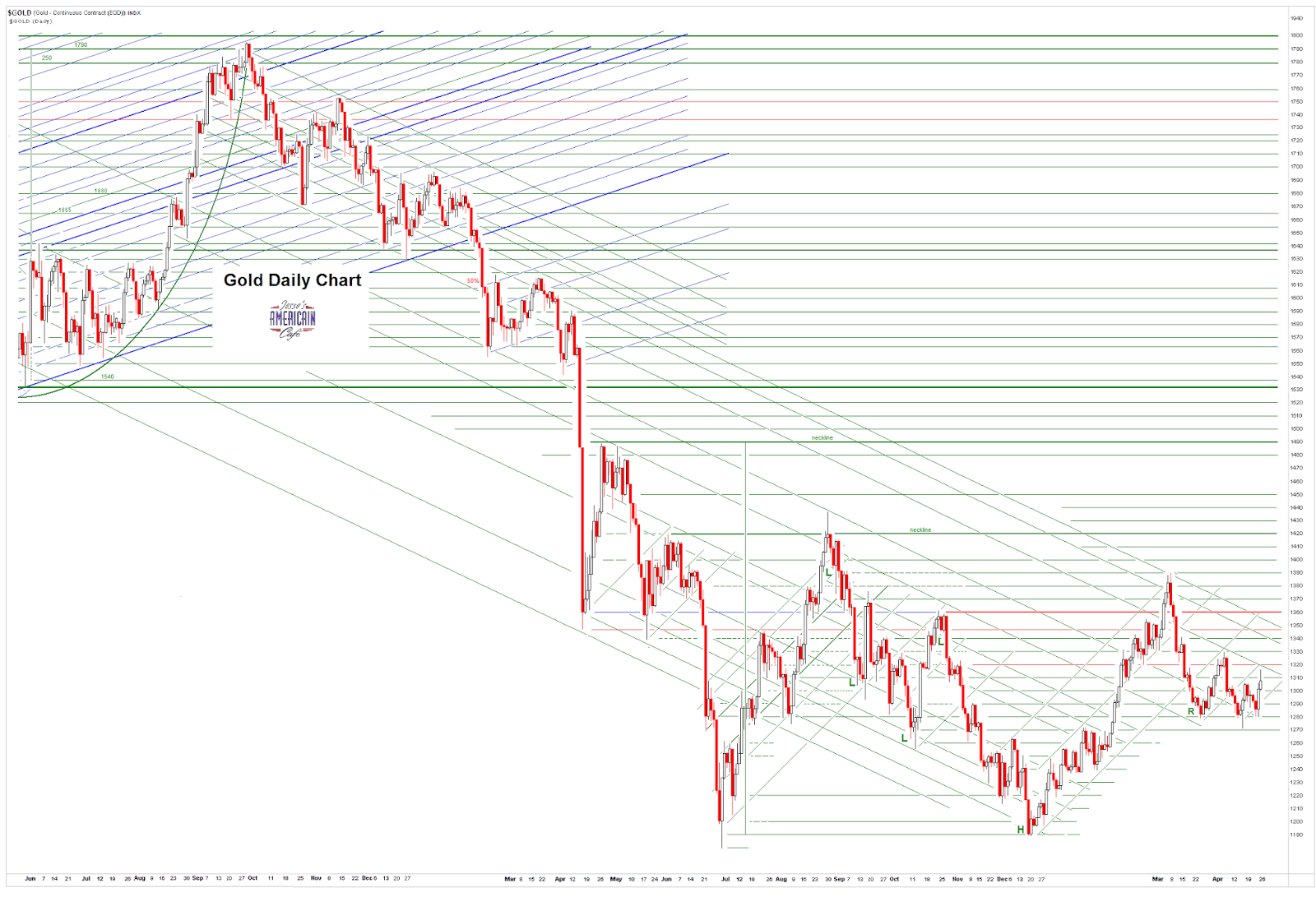

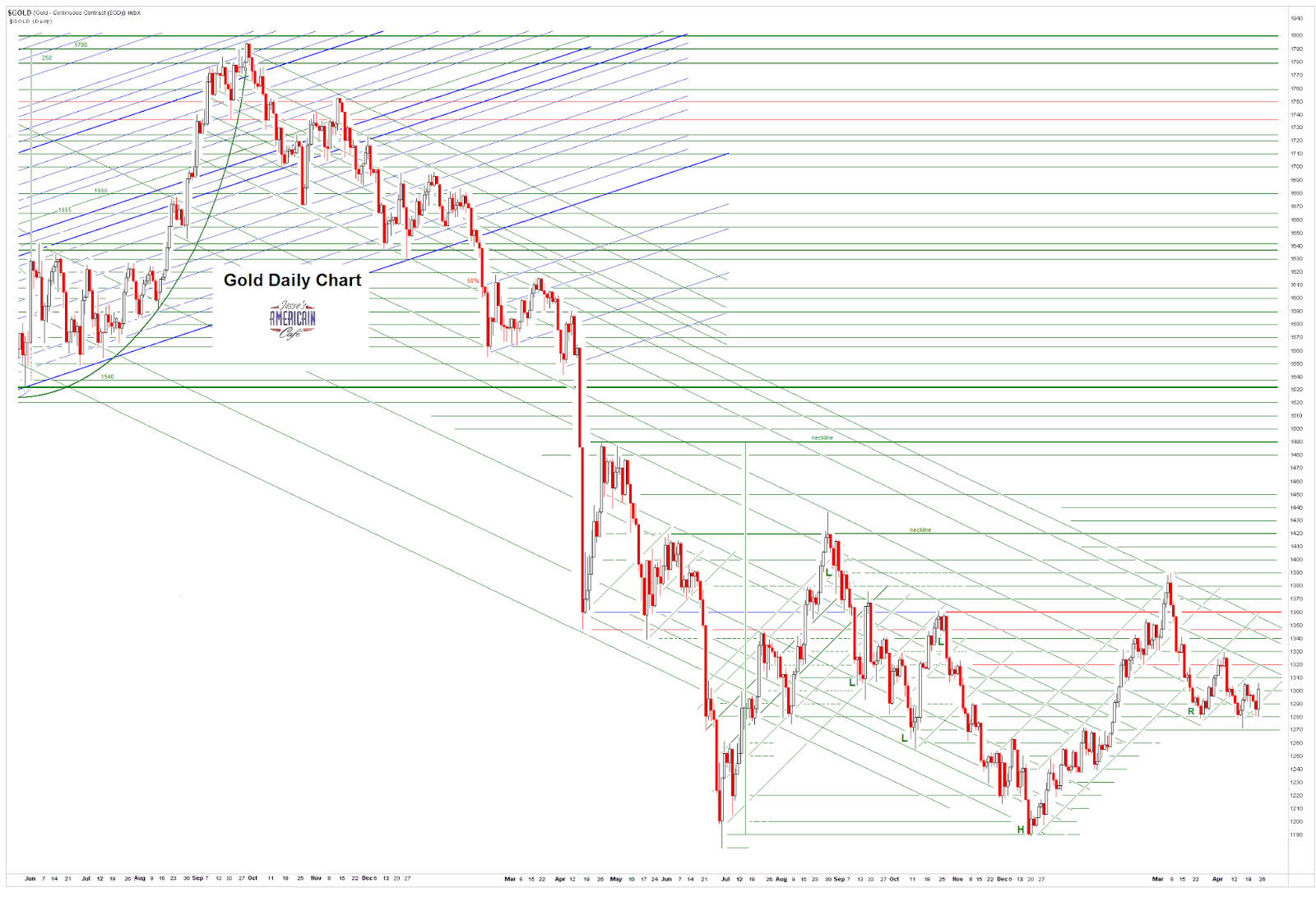

As you may recall it was reported last week that Morgan Stanley was predicting that gold would never see $1300 again, having failed to take out that level so many times and then fallen back to 1280. That is the headline that Mining.com was carrying at least, although that is not exactly what they said according to the quotes, which were still rather bearish to say the least.

I am waiting for a breakout and confirmation from what is an obviously tight range around the 100 and 200 DMAs. Since I believe that gold and silver are very manipulated markets these days, with semi-official sanction at the least, I am not willing to place any faith yet in the technicals that seem to indicate a bottom has been made.

Silver is struggling in particular, and gold gets batted around on the Comex in the off hours with almost reckless abandon, or audacious arrogance if you prefer.

The divergence and manipulation between the paper markets and the physical markets is real, obvious to anyone who has eyes to see, and more widespread than the media will seemingly admit. from energy to interest rates, from currencies to precious metals.

And that will end, badly. It will hasten the demise of the existing financial order. And there is both risk and opportunity in this change.

Have a pleasant evening.