When a problem comes alongYou must whip itWhen something's goin' wrongYou must whip itDevo - Whip It

The metals continue coiling as gold is held around the 1200 level and silver between 16 and 17.

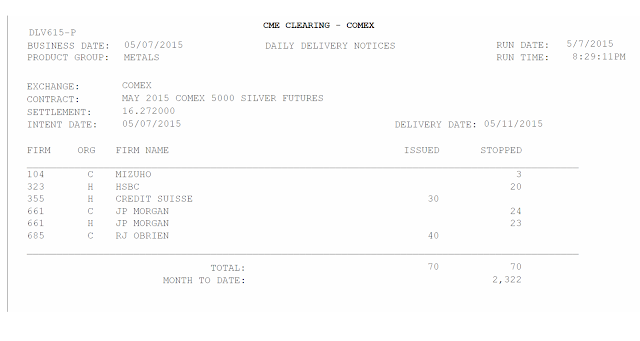

The 'delivery action' is in silver this month, and the relative scarcity of deliverable warehouse metal at this price is in gold.

I wonder how long the Fed and their cronies can hold the metals down, while they desperately whip the flagging economy into recovery.

The urban cowboys are the Wall St Bankers, and the red hatted weirdos are the Fed.

Whip it good.

Have a pleasant evening.