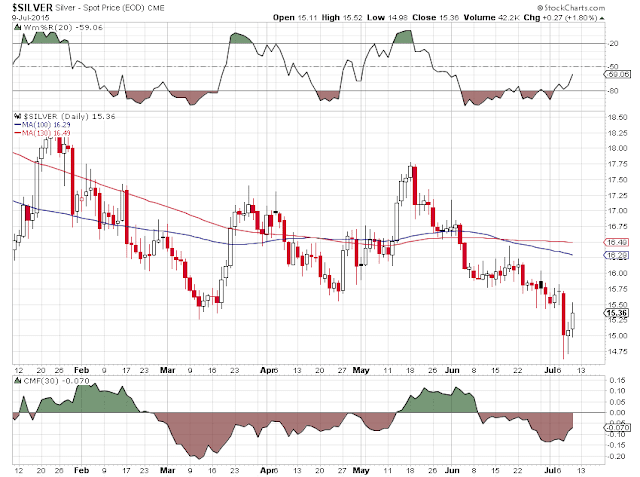

Gold and silver were in the usual capping mode today, although silver managed to finish the week on a slight gain.

I am liking silver more and more here, and am not adverse to some small buys at regular intervals with a longer term time horizon. Nibbles, if you will.

Today was all China and Greece. China rallied so everyone had a good day. I think this is just the end of Act I, and direct your attention to the comparison of the Shanghai Composite and the Nasdaq in the dot.com bubble.

As for Greece, we had florid headlines about 'Tsipras is destroying Greece' today.

Greece is playing a rough hand, and more than anything else, playing for time. What else does one think they would have gotten out of the Berlin blockheads, a fair deal, a workable solution? Hah!

Why should that happen now, when the crony capitalists have been pushing so hard for deprivation first, and then privatization and a general looting of productive assets next? This is a well-established pattern.

Why should that happen now, when the crony capitalists have been pushing so hard for deprivation first, and then privatization and a general looting of productive assets next? This is a well-established pattern.

I think this was laid out in a pretty straightforward manner a couple of weeks ago. But the sturm und drang is certainly diverting, especially the German hubris and the Greek negotiation tactics. You cannot adequately follow the game unless you understand the objectives.

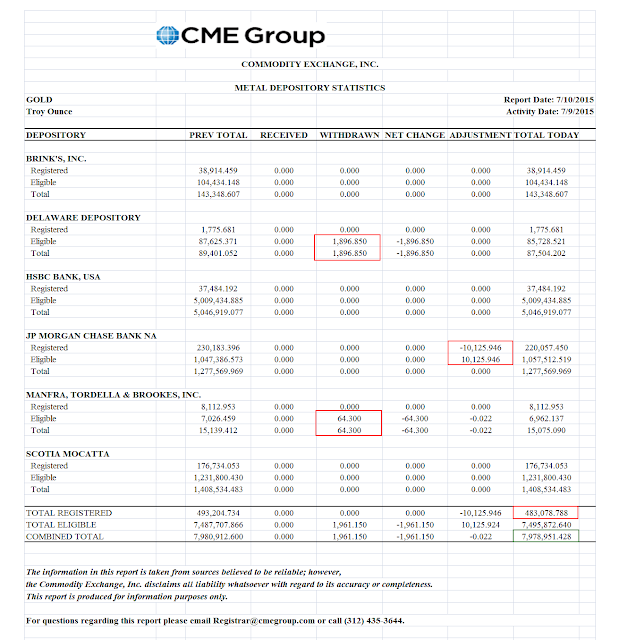

The drama in gold and silver is now laid bare for all to see. Anyone who doubts the rigging in the precious metals is not to be taken seriously anymore.

I really wish I could understand the intended endgame a bit better, at least as it stands in the minds of the gold pool and the silver market riggers. Where do they think they are going with this?

I think I know what the other side expects to do. They know the price manipulation will eventually run out of steam. All such operations invariably do so. And in that aftermath market forces that have built up with take the pricing higher by multiples. I am not saying that there will be any sort of an overthrow. Like Greece, the rest of the world asks for reasonable, livable terms.

I think I know what the other side expects to do. They know the price manipulation will eventually run out of steam. All such operations invariably do so. And in that aftermath market forces that have built up with take the pricing higher by multiples. I am not saying that there will be any sort of an overthrow. Like Greece, the rest of the world asks for reasonable, livable terms.

Yellen's speech today was held at the City Club of Cleveland, which is one of my old haunts. I used to have lunch there almost every Friday, some years ago, and attended some notable speakers who said exciting things. Yellen was certainly not among them.

The Fed wants to raise rates for their own policy purposes and will do quite a bit to get a fig leaf to cover what is at bottom a self-serving act from a generally insular and self-serving crew of technocrats in the service of kleptocrats, the Banks and their political praetorians.

The real solutions are fairly simple, but will not happen because there are such powerful interests allied against them. And they have managed to delude a vocal portion of the populace by feeding them a steady diet of slogans, sociological phantoms for children, and economic hoo-haw.

Financial reform and wage growth, with more certainty in the big variables of healthcare costs and retirement plans is key to a sustainable and organic recovery.

The way things are arranged now, hiring even a single person is a 'step function' because you are not only signing them up for a wage, but for benefits that can vary all over the place and represent a burden for a new or small business.

Gee, I wonder what a developed country would do. Oh yes, the US started on the path for a sane solution in this matter in the 1930s and the New Deal, but alas, were hijacked along the way.

Single payer healthcare and a robust social security system, taking the matter out of the hands of individual businesses who look for ways to cheat and cut corners would be more cost effective and much more workable.

And much easier then to get business to pay a living wage to a national workforce in which essential items like healthcare were not wild cards and the feeding grounds of healthcare and insurance monopolies that add roughly 50 percent overhead to the costs.

And finally there is the matter of tax loopholes and multinational tax cheating to consider.

And for the love of God: break up the Banks.

But the sine qua non is campaign finance reform. The current system of soft bribery for the political class makes a progressive democracy ineffective in the face of big money and crony capitalism.

But the sine qua non is campaign finance reform. The current system of soft bribery for the political class makes a progressive democracy ineffective in the face of big money and crony capitalism.

Oh well, interesting times. It is a good phrase for the day.

Have a pleasant weekend.