And so we close the door on the leap year-lengthened month of February, which was a particularly good month for gold.

And as always with the end of one month and the beginning of another, there will be a Non-Farm Payrolls report at the end of this week.

Gold is clearly in a symmetrical triangle, trying to decide which way to break, up or down, from this potential 'cup and handle' formation. And remember right now it is all potential, not having set a firm handle and broken up and out from that retest.

I included some material from a few years ago that shows the formation when it works in both a textbook and a 'real life' example. You may read about it here.

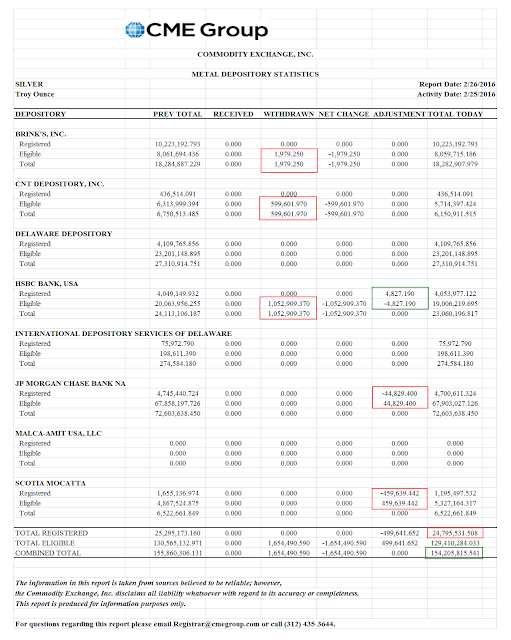

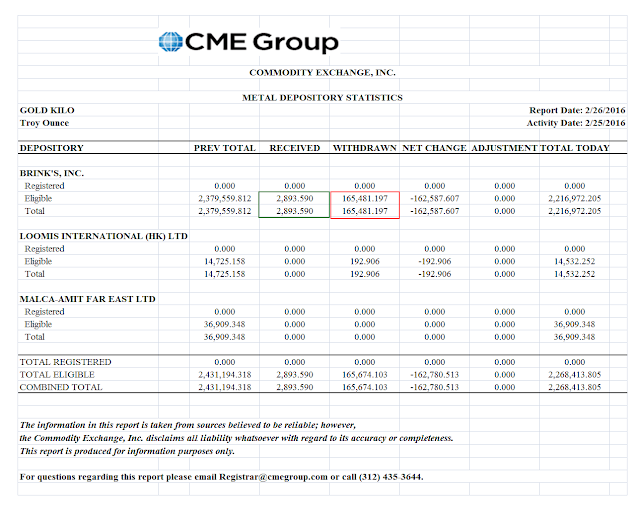

I have included the box scores from The Bucket Shop, both for the end of February and the piddling deliveries seen so far on the March contracts.

If you are looking for the web site Confounded Interest and are puzzled why it is missing in action, be advised that dissenting from the Federal Reserve and the established economics hierarchy of thought is not tolerated well amongst the very serious people, and those who do not pay their respects to the established orthodoxy can find themselves dispossessed of platforms.

Especially if they say things that draw the ire of those for whom free speech and thought is merely a theoretical concept, for themselves mostly. No, we are in the age of political and economic power, the rawer the better. And we could get quite an object lesson in this from either the Donald or the Hillary. Could there be two better symbols for what is going wrong with us?

No wonder they 'never see it coming.' They have their eyes closed, or just firmly on themselves and their possessions. And they would like you to close yours too.

If you are looking for the web site Confounded Interest and are puzzled why it is missing in action, be advised that dissenting from the Federal Reserve and the established economics hierarchy of thought is not tolerated well amongst the very serious people, and those who do not pay their respects to the established orthodoxy can find themselves dispossessed of platforms.

Especially if they say things that draw the ire of those for whom free speech and thought is merely a theoretical concept, for themselves mostly. No, we are in the age of political and economic power, the rawer the better. And we could get quite an object lesson in this from either the Donald or the Hillary. Could there be two better symbols for what is going wrong with us?

No wonder they 'never see it coming.' They have their eyes closed, or just firmly on themselves and their possessions. And they would like you to close yours too.

Have a pleasant evening.