After the bell there was a magnitude 6.9 earthquake off the cost of Fukushima prefecture, about 160 miles from Tokyo . A tsunami warning has been issued.

I hope that all of you in the affected areas will be listening to instructions carefully. I will be remembering you all in my prayers, as I do for all readers of Le Cafe each week, without fail, in addition to all the special intentions of my correspondents and their families.

We had the first snowfall of the season this weekend past. It was quite the surprise to see an inch of snow on the ground in the early morning after heavy rains the night before. I am glad I am keeping up with the yardwork. Some places north of here in the higher elevations had six inches of snow.

Winter is coming.

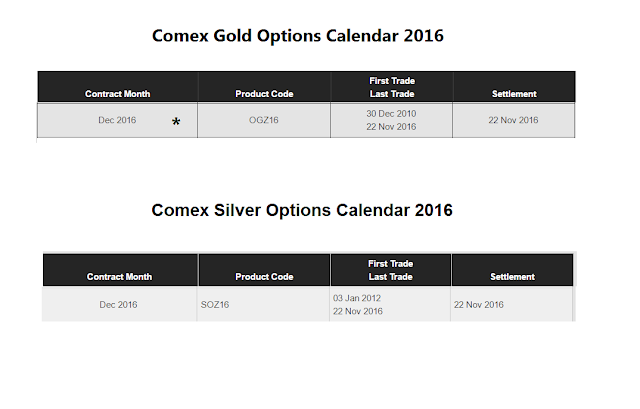

Gold and silver were largely marking time today ahead of the Comex precious metals option expiration tomorrow in this holiday-shortened week.

The dollar was not quite as exuberant today as it has recently been. This is understandable because it has come very far in a short period of time off the US election results.

The dollar was not quite as exuberant today as it has recently been. This is understandable because it has come very far in a short period of time off the US election results.We picked up a new car on Saturday, and so far it seems quite nice. We chose a Subaru Forester. We took a little drive in it today to the doctor's office, and took a swing back through the nearby 'horse country' to drive past the mighty Trump National Golf Course in Bedminster which I had never seen before.

My father-in-law was an avid golfer, and when he visited us I sometimes took him to see the USGA golf headquarters and museum in the next town over in Far Hills, NJ. There are collections and memorabilia on display which are substantial and significant.

There is also the official testing facility for balls and clubs which is fascinating. I don't know if the test lab is still open to the public. I am not a golfer but I liked to take the visiting relatives to see it.

The association is housed in what had been the private residence of Averell Harriman, of Brown Brothers Harriman. Some of the mansions around the Somerset Hills are fairly impressive, both old and new. The higher elevations provided cooler weather in Summer, with easy access by train to NYC.

When we first moved here the train line to NYC was still running the DC electric trains that Edison had created, with old time wicker seats and big wooden ceiling fans. The Gladstone line was the last leg of NJ Transit to get upgraded to AC current service and modern cars. But that was long ago.

Speaking of which, turkeys are certainly in vogue this week. We picked ours up for .99 per pound for a fresh Butterball turkey at Costco. I am sure it will do the job for our family dinner this Thursday.

Let's see how gold and silver do into the long holiday weekend, with the option expiration under their belts after tomorrow.

The delivery report for gold showed another big customer disgorgement, but otherwise all was quiet.

Have a pleasant evening.