"In the past 5 years the amount of UST's the US needs to roll over every year has risen by nearly 15% CAGR, the while US nominal GDP is just over 2%. A 1200bp gap isn't sustainable for very long, yet the overwhelming consensus [assumption] is that it's sustainable for decades."-

Luke Gromen

"The first panacea for a mismanaged nation is inflation, the second is war. Both bring

temporary prosperity; both bring permanent ruin. But both are the refuge of political and

economic opportunists.”

Ernest Hemingway

"People who know nothing of God and whose lives are centered on themselves, imagine that they can only find themselves by asserting their own desires and ambitions and appetites in a struggle with the rest of the world.

They try to become real by imposing themselves on other people, by appropriating for themselves some share of the limited supply of created goods and thus emphasizing the difference between themselves and the other men who have less than they, or nothing at all."

Thomas Merton

"This is the way the world ends.

Not with a bang, but a whimper."

T. S. Eliot

"And what rough beast, its hour come 'round at last,

Slouches towards Bethlehem to be born."

W. B. Yeats

Along with love, darker spirits are moving among us. To whom shall we turn? This is the critical question for each of us.

And when the unsustainable does not sustain any longer, we might see a bipartisan effort by the moneyed interests to come after what remains of the working class, in an attempt to finally roll back the last traces of the 'New Deal' and make of the public's misery a burnt offering.

If the last Gilded Age is any indication, and if history repeats, they will not stop in their mad quest for everything until blood is flowing and cities are burning, How easily we forget the past.

These darker gods serve none but themselves. Their worship is the way of madness, unleashed upon mankind again.

Will the rest of the world stand idly by? Perhaps not. Europe, Japan, Russia, China Line Up Against the US

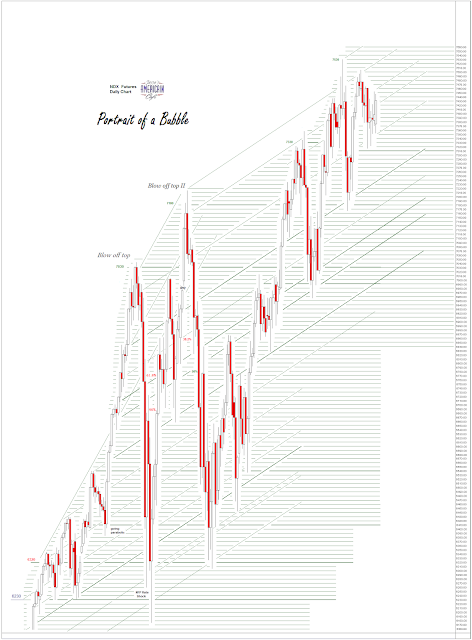

Stocks managed to overcome their earlier losses on impeachment and trade jitters.

Gold and silver gave some of their recent gains back on a stronger US Dollar.

Have a pleasant evening.