"There is no clean way to make a hundred million bucks. Somewhere along the line guys got pushed to the wall, nice little businesses got the ground cut out from under them. Decent people lost their jobs. Big money is big power, and big power gets used wrong. It's the system."

Raymond Chandler, The Long Goodbye

"I’ve seen it for years. I’ve seen a media, which has basically ignored the declining middle class, that doesn’t talk about poverty at all, and has no sense of what is going on in the minds of millions of ordinary Americans. They live in a bubble, talk about their world, worry about who’s going to be running 18 years from now for office. Meanwhile, people can’t feed their kids."

Bernie Sanders

"There is no trap so deadly as the trap you set for yourself.”

Raymond Chandler, The Long Goodbye

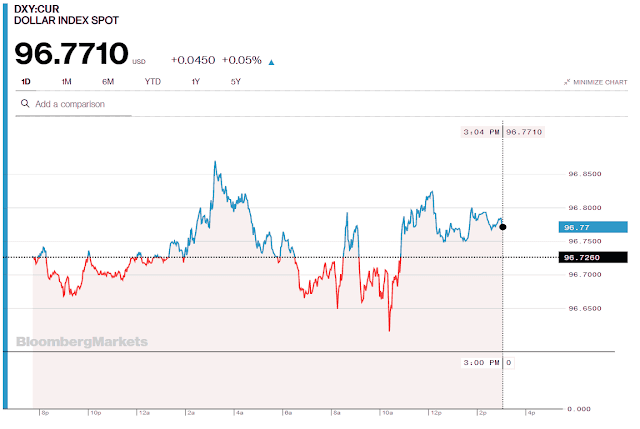

Most of the adults are on a long holiday weekend, so the trading was light, and fairly predictable.

And the weather here is just steamy!

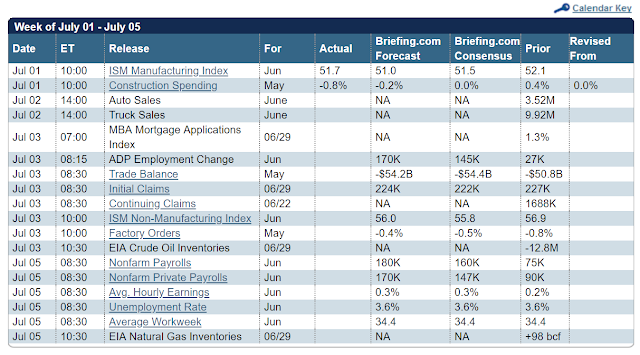

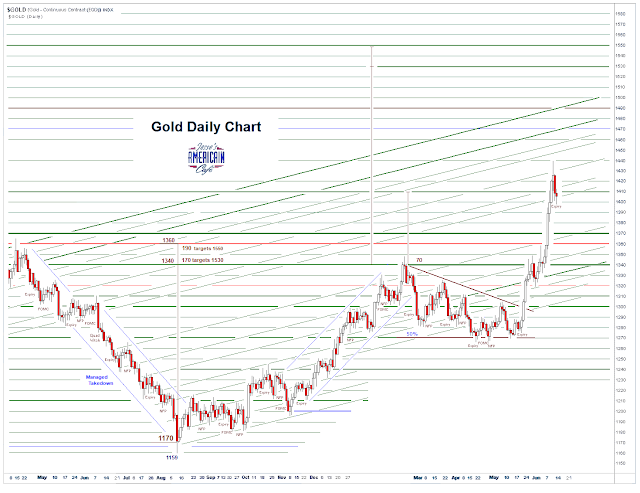

Gold and silver and stocks were all smacked down hard by a stronger than anticipated Non-Farm Payrolls Report.

All recovered somewhat into the close.

All in all it proved to be a decent opportunity to replensih the short term gold positions that I sold into that last try at 1440. Not all. Now is not the time to have no longs in gold. Or too many longs in equities.

The charts seem somewhat straightforward.

I am concerned a bit about the future, and the failure to achieve a sustain recovery and meaningful reform.

I am concerned a bit about the future, and the failure to achieve a sustain recovery and meaningful reform.The elite continue to pursue their unjust privileges, and deny their felonies and insults to justice and office with a comfortable pride and smug, habitual deception.

Although this is nothing new, we have not seen the magnitude of this sort of reckless greed in over a hundred years.

"The US labor force has actually contracted by more than 600,000 workers this year via Bloomberg opinion. Household Survey jobs down this year by almost 200,000, while twice as many who were earlier unemployed have given up looking for jobs. Every time the Fed has embarked upon a rate cutting campaign on average you get about 23 and a half basis points of cuts per month…which suggests the markets pricing in 3 to 4 rate cuts in the next 12 mos might not be aggressive enough. Another piece of the puzzle...multiple job holders...why doesn’t MSM at the very least try to give people a real sense of where this economy is...these jobs numbers are so misleading."I am watching The Big Sleep, the later version with Robert Mitchum and Joan Collins. I am going to watch the classic with Bogart and Bacall later on this evening.

Danielle DiMartino Booth

Need little, want less, love more.

Have a pleasant weekend.