Nov. 27 Comex December gold options expiry

Nov. 27 Comex December silver options expiry

Nov. 27 Comex December copper options expiry

Nov. 28 Comex December miNY gold futures last trading day

Nov. 28 Comex November copper futures last trading day

Nov. 28 Comex December E-mini copper futures last trading day

Nov. 28 Comex December miNY silver futures last trading day

Nov. 30 Comex December gold futures first notice day

Nov. 30 Comex December silver futures first notice day

Nov. 30 Comex December copper futures first notice day

Nov. 30 Nymex December palladium futures first notice day

Dec. 21 Nymex January 2013 platinum options expiry

Dec. 26 Comex January 2013 copper options expiry

Dec. 27 Comex December gold futures last trading day

Dec. 27 Comex December silver futures last trading day

Dec. 27 Comex December copper futures last trading day

Dec. 27 Comex December E-micro gold futures last trading day

Dec. 27 Comex January 2013 E-mini copper futures last trading day

Dec. 28 Nymex December palladium futures last trading day

Dec. 30 Nymex January 2013 platinum futures first notice day

Dec. 31 Comex January 2013 silver futures first notice day

Dec. 31 Comex January 2013 copper futures first notice day

20 November 2012

Comex Options Calendar For the Remainder of 2012

Category:

Comex,

Gold Options,

Silver Options

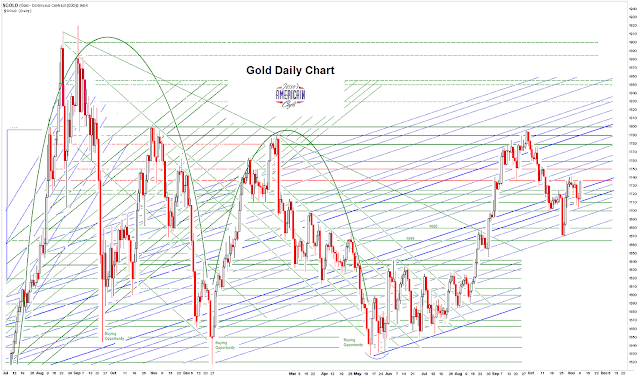

Gold Daily and Silver Weekly Charts

Just another day in the snoratorium as the precious metals and miners took a little hit when the Bernank turned his crank, jawbone-wise, in a very light holiday week trade.

The premiums on the bullion funds are impressively low as pointed out in intraday commentary.

They *could* hit the metals in the thin trade, and we can buy the dip for a later date. Life goes on.

The adults will be leaving for the Thanksgiving holiday sometime after noon tomorrow, unless they do not bother coming in at all.

SP 500 and NDX Futures Daily Charts

Bernanke spoke today.

I came, I saw, I printed.

And he is willing to print some more, but would rather not tip his hand.

Otherwise it was an uneventful, boring market.

Net Asset Value Premiums of Certain Precious Metal Trusts and Funds

Premiums are certainly not exuberant especially on the Sprott funds where they are downright thin by historical measures.

The metals were hit about the time that Bernanke started speaking. The short selling trading desks like to key off certain events in order to try and generate a little downside panic and some quick profits from a wash and rinse.

A strong and honestly efficient market with specialists who manage such irregularities would minimize the effectiveness of such efforts, and failing that, which always happens under any system of self-governance, official regulation would prohibit it. Unfortunately the US has neither, and no prospects of any near term change for the better.

This is how it is when markets are left to the machinations of insiders by the abrogation of justice. I think the paper veneer is covering a harder core of bullion held by stronger and stronger hands. Shortfalls develop and leverage increases, and at some point that tired old strategy fails badly, and then we have fireworks to the upside.

This lack of small investor enthusiasm may be bullish for more gains in bullion, after some short term shenanigans by the price fixers and market manipulators, who act largely unaffected by the regulators.

Category:

NAV of precious metal funds

Warren E. Pollock

For those who have inquired, Warren Pollock is as well as can be expected for someone who is caught up in the devastation that Hurricane Sandy has wreaked on his area of the south shore of New York City and Long Island, not to mention the Jersey shore and wide areas inland.

Being without power, and gasoline, and reliable sources of heat in the raw cold of a late northeastern autumn is no fun. And far too many people are still homeless and living a somewhat nomadic existence, as they have described it to me.

He has taken down his blog, Inflection Points, his videos and his twitter feed, voluntarily.

Apparently the negative comments and skepticism, heckling might also be fair to say, and the apathy of the crowd, which he received in reponse to his last few videos was a bit too much for him to bear under the circumstances of his personal situation. Tragedies bring out both the heroic, and the ugly. Anyone who has lived a full life knows this.

There are minority of people who have chosen to believe in an alternative reality, and cannot bear to hear anything that conflicts with their view of the world. You are free to believe whatever it is they wish to tell you to believe. And if you do not, they react with anger and even hysteria. One has to accept that this is just a facet of the human condition, cherish the good who are many, and ignore the rest.

I have been generally impressed with the way in which the governors of NJ and NY have responded to this, and Obama's support for them as well. As usually happens, the well-connected and well to do receive the quickest and most attention. And there have been some serious blunders. At one point in my corporate career I had a large scope of responsibility that included dealing with disasters, and have some understanding of it.

A sound management will learn from mistakes, and continue to improve their processes. A good manager also knows where to apply correction amongst their organization, and at select times a size 11 shoe. And where they do not, it is the duty of their constituents to remind them in the appropriate ways. Under stress, people can forget to be human.

And as always, there have been many heroic acts of selflessness and courage, amongst those government workers who act as first responders.

It is relatively easy for an area to act privately when only a small portion of the people are affected. But when the problem is wider spread, it takes a more united force of government to respond.

And the scope of the damage in this case is vast. This is the largest storm ever to hit one of the most populated sections of the US, and the damage is widespread and deep, particularly in the areas closest to the shore. There are some hour long documentaries about Sandy generally including the word Megastorm in the title, and they are well worth watching. Thank God the low lying areas were spared the heavy rains that were expected.

Warren may choose to begin publishing again at some point in the future, and I wish he would, because I often enjoy hearing what he has to say. I was also keenly interested in hearing about the less fortunate areas of New York City, which seem to be in the news, and then are so often forgotten. Why waste one's beautiful mind on the suffering of others.

19 November 2012

A Short Video Primer on the US Debt and Deficit, Hubris, and the Credibility Trap

As I have said on many occasions, the problem is not so much this overblown 'fiscal cliff' and 'debt crisis.' These are spurs to desired action from the status quo.

This is almost an exact replay of the Crash of 1929 and the Great Depression, excepting of course that the US now has a manager rather than a leader.

The problem is the lack of reform of a system that is still given over to malfeasance, and remains badly out of balance.

Shifting the damage that has resulted from financial corruption on to the backs of the weak and the public in order to continue to pamper the predatory class is not the answer. It will only make things worse and at some point most likely tear open the social fabric.

Source

A credibility trap occurs when the regulatory, political and informational functions of a society have been compromised by corruption and fraud, so that the leadership cannot effectively reform or even honestly address the situation without impairing and implicating, at least incidentally, a broad swath of the power structure, including themselves.

The status quo tolerates the corruption and the fraud because they have profited at least indirectly from it, and would like to continue to do so. Even relatively honest reformers within the power structure become susceptible to various forms of soft blackmail and coercion.

And so a failed policy and its support system become almost self-sustaining, long after it is seen by the people to have failed, and in failing becomes a counterproductive force on a sustainable recovery. Admitting failure is not an option for those who receive their power from that system.

The continuity of the structural hierarchy must therefore be maintained at all costs, even to the point of becoming a painfully obvious hypocrisy.

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustained recovery.

Category:

credibility trap,

Crony Capitalism,

deep capture,

financial reform,

hubris,

kleptocracy

Gold Daily and Silver Weekly Charts - Cup and Handle Develops - SEC Rocked By Sex and Corruption Scandal

"The filing of this lawsuit now by Weber officially begins the raging clusterfuck portion of the story, as he and his lawyers are releasing lurid details not only about Kotz and Maloney, but about a host of other SEC and SEC IG officials.

It's very strong stuff: the only things missing from this lawsuit are tales of SEC officials running white-slavery rings and snorting brown-brown off the corpses of strippers with West African rebels...

It's hard to say how all of this will shake out. Certainly, from a P.R. standpoint, it'll be ugly for the SEC. One other storyline to follow: If the Weber retaliation claims are true, they fall within an ongoing and increasingly disturbing pattern of federal whistleblowers who have come forward and experienced reprisals themselves instead of having their claims investigated properly."

Matt Taibbi, SEC Rocked By Sex and Corruption Scandal

Hell hath no fury like a whistleblower fired, ridiculed, and scorned in the national press. As you may recall, earlier this year Mr. Weber was labeled a dangerous crank for allegedly wanting to bring a gun to work. He was subsequently cleared in an investigation but was fired nonetheless.

I do not recall hearing about this unfolding scandal at the SEC on the mainstream medias. But I tend to get most of my serious financial news and commentary from Rolling Stone magainze and the Comedy Central network these days anyway.

The story about this lawsuit came out quietly last week in the wire services with non-descript headlines like: Ex-SEC Investigator Sues Agency, Seeks Damages of $20 Million. There was a more in-depth story from Thomson Reuters that portrayed Weber's allegations as 'hard to swallow in their entirety' here.

The Taibbi piece is an interesting read. Matt has an outré phraseology that puts a sharp point on his stories. If there is a Congressional investigation about this I would imagine that C-Span would receive a significant boost in the number of viewers for some of the live testimony. Americans do not care much about financial corruption, or even gross abuses of justice and individual rights including torture, unless it involves sex.

As you may recall there was a minor scandal a couple of years ago when it was revealed that there was a propensity amongst some at the SEC to spend most of the quiet intervals between trips through the revolving door between Washington and Wall Street by surfing the web with a bias towards porn sites.

Apparently not all regulators were so sedentary in their pursuit of kicks, bangs, and thrills of the belly button and below. You can read the details from Taibbi here.

The continuing development of a potential 'cup and handle formation' was discussed intraday here.

As I pointed out last week, the markets were being taken much too far to the sell side, and it appeared to be tax-selling as the VIX failed to show any real fear that was driving the market. It was more of a financial calculation.

So what next. This is a holiday market in the States, and is going to be thinly traded. There are the 'fiscal cliff' which is artificial, and the continuing conflict in Gaza, which is a destabilizing influence on the region and a human tragedy for all concerned. And thirdly there is the economic instability in Europe and the adoption of the bank bailouts "Japanese model" which is crippling the real economy.

All three of these present a situational risk to markets should they take an unfortunate turn for the worse. There could be an associated divergence between stocks and bullion as they may not present as liquidity events but as a risk trade.

Let's see how the market makes its way into December.

Have a pleasant evening.

Subscribe to:

Comments (Atom)