13 June 2013

Comex Registered Gold Continues to Fall To All Time Lows

"I have no spur

To prick the sides of my intent, but only

Vaulting ambition, which overleaps itself,

And falls on the other. . . ."

Macbeth Act 1, scene 7. 25–28

Every time the Comex registered gold has moved to these extreme lows, it has marked a bottom and a major trend change.

The value of global currencies, Comex gold, JPM's vault bullion, and the confidence of the people in the markets.

All in all, it seems like a race to the bottom.

This has many people just shaking their heads. And one can hardly blame them.

How low can they go?

Category:

comex warehouse

Max Keiser and Mark O'Byrne Discuss the Gold and Silver Markets

"The tyranny of a prince in an oligarchy is not so dangerous to the public welfare as the apathy of the citizens in a democracy."

Montesquieu

I do not see the NSA involvement which Max mentions. It does not seem to be necessary if you have big market principals and insiders involved, able to operate in secret with the acquiescence of the regulatory bodies and exchanges. And if there is a need to obtain more specific information, the industry dominant Bloomberg terminal offer a wealth of information about how and when it is being used.

I do think there is serious fraud and abusive market rigging going on, as we have seen in LIBOR, energy, ISDA spreads, advance selling and leaking of key economic data, insider trading, Bernie Madoff, MF Global, the London Whale, and now currency markets.

There is a general disregard for the rule of law when it is overruled by 'expediency.' And the threshold for overruling it has gotten lower and lower, to whenever it is of benefit to one's friends and associates, rather than isolated to key issues of national interest. That is a corrosive condition. It is crony capitalism, and it is destructive of real economic productivity and of markets.

It is ironic that the freest exchanges of information on some of these market abuses are occurring in Asia, and in governments that have made much less pretense to transparency and freedom of information than the US and UK. They see what is coming and are making it easier for their people to protect themselves. This is because they are not beholden to the Anglo-American banking cartel.

I am sure that the Congressional hearings that would follow the 'failure to deliver' of a major bullion bank or exchange will be very impressive, full of faux anger and histrionics from outraged politicians. But like the MF Global hearings, I would expect much noise and heat, little light, and no effective redress for those who have been harmed, 'bailed-in' if you will.

I expect the whole thing, all the leverage, deception, and fraud to be swept under the rug, and the event attributed to the course of human events. The madness of crowds, practically an act of God, like the rewriting of the CDO/Housing financial crisis. It is the most likely outcome in a credibility trap. And apathy just encourages greater and bolder excesses and abuses. Greed and fraud are usually not self-limiting, but self-reinforcing. If it worked once it will work again, so keep expanding. Nothing is sacred.

Here is a reminder of the fundamentals.

Category:

credibility trap,

GATA,

gold manipulation,

silver manipulation

12 June 2013

Gold Daily and Silver Weekly Charts - Hunger Games

The FOMC meets next week. Tomorrow will bring more economic news.

QE is not over by a long shot. They may call it something else. They may wrap it in a different package. And the government may finally get busy and do some decent economic planning for growth rather than this interminable infighting and divvying of loot.

People may wish to protect some of their wealth from expropriation. There are a number of things one may do if you have not done so already.

One of the things you may wish to do is to watch The Hunger Games if you have not had time to read the books. I think that the dystopia it portrays is as possible as 1984 or a Brave New World. Or perhaps even something by Charles Dickens.

The price manipulation in the markets is fairly obvious for anyone who wishes to look and see it. I mean, really.

SP 500 and NDX Futures Daily Charts - Front Running For a Fee

Stocks gave it up today on mostly international jitters, with the political situation in Turkey and the economic situation in Japan.

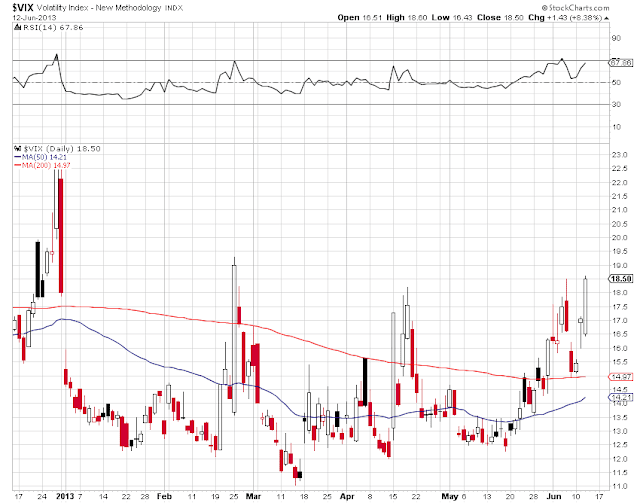

VIX has now reach the levels that have signaled the recent high water marks.

Tomorrow we get US unemployment claims, Ex-Im Prices, and Retail Sales.

Any further weakness risks stocks slipping out of their short term trend channels and providing a more interesting test of support.

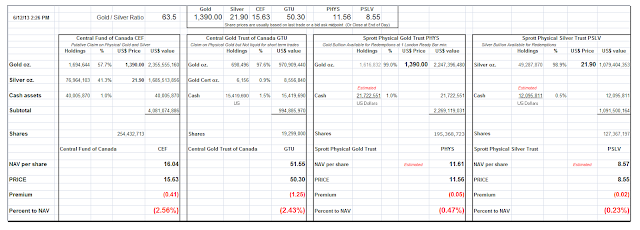

NAV Premiums of Certain Precious Metal Trusts and Funds

Subdued pricing even with today's little rally.

The specs are licking their chops to sell into an anticipated Friday decline, based on their recent experience. It is merely a herd behavior, similar to 'rally Tuesday' in stocks. That decline is generally for the period after the world markets close for the weekend.

Category:

NAV of precious metal funds

Subscribe to:

Posts (Atom)