30 November 2014

29 November 2014

Switzerland Leads In Gold Sales Among Central Banks Since 1993

Although they are still among the top ten in total gold holdings, Switzerland has been one of the largest sellers of gold among official entities since 1993.

It is no surprise then that some of the people of Switzerland have taken to a referendum to provide their opinions on this to the Swiss National Bank.

With regard to the second chart, personally I do not believe that the World Gold Council estimates are correct for China at all, and probably Russia.

28 November 2014

Fed Earmarked Gold Holdings Continued to Decline In October

Nemo debet esse judex in propria causa.

Earmarked gold at the Federal Reserve dropped 42 tonnes for the month of October as foreign countries repatriate their gold.

Despite these declines the Fed's earmarked holdings are quite substantial to say the least.

One has to wonder why the German people are not able to get back their gold for seven years.

Why would the US raise such a fuss about returning it, if they still have over 6,000 tonnes of other people's gold in their accounts?

Are they 'managing' this gold held in custody? Are they receiving and sharing returns from it? Or is it just idly sitting their in storage?

Is it all still physically there, and unemcumbered by multiple claims?

Something does not quite add up. Let's check the latest audit. The Fed does not allow itself to be subject to independent audits. They demand our trust.

"Justice must not only be done, but must be seen to be done."

They are independent of the law, and beyond good and evil.

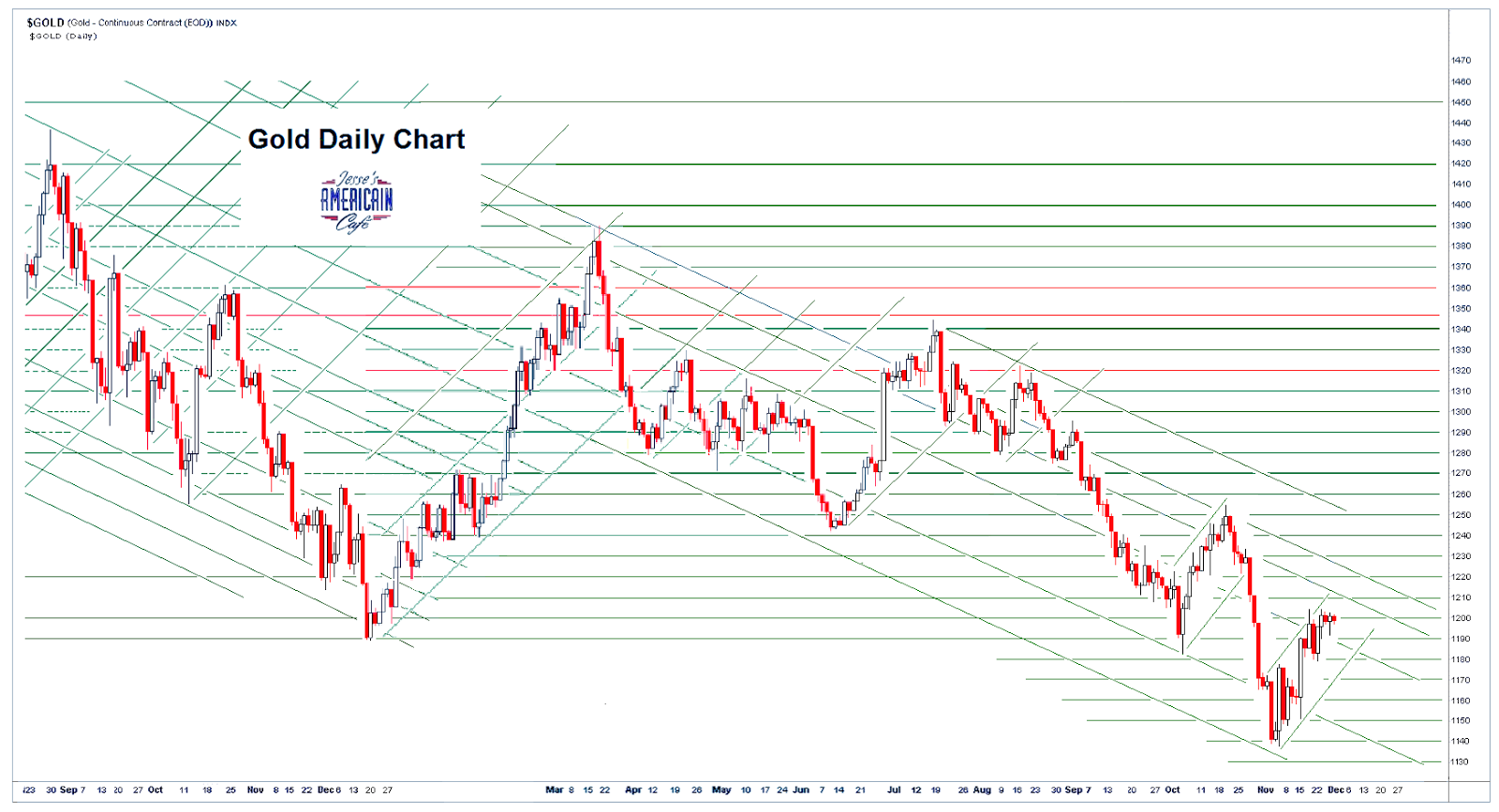

Gold Daily and Silver Weekly Charts - 1812 Overture

"He is the Napoleon of crime, Watson. He is the organizer of half that is evil and nearly all that is undetected in this great city.Arthur Conan Doyle, The Final Problem"Du sublime au ridicule, il n'y a qu'un pas."“From the sublime to the ridiculous, there is only one step."Napoleon Bonaparte, On his retreat from Russia to Paris in 1812

Gold and silver got mugged in very quiet trading for the end of the month, with most traders off on holiday.

If anyone was short gold or silver, their end of month results looked quite a bit better after today. So like the retailers they had their 'Black Friday.'

Paper covers rock. Who's got the scissors?

The Swiss will be voting on their referenda on Sunday. Among these are the gold referendum.

Next week is the Non-Farm payrolls for November.

Have a pleasant evening.

26 November 2014

Gold Daily and Silver Weekly Charts - Now Thank We All Our God

"A proud man is seldom a grateful man, for he never thinks he gets as much as he deserves."Henry Ward Beecher

The joyfulness of simplicity is a folly to the world, but the charism of a loving God to His people.

Gold and silver were both flat in lackluster trade today, as the US markets were simply going through the motions in holiday trade and ahead of a few real world events.

OPEC will be meeting this weekend to consider the dropping price of oil. It is clear that the Saudis are producing at a higher than usual manner, and as you may recall I have speculated that this is part of a ploy with the US to hamper Russia, but to also send a price gut check to the shale oil producing crowd.

The Swiss will be having their gold referendum on Sunday, 30 November and it will be interesting to see how that turns out.

And finally we are now switching to the December contract, and what may prove to be a more active month in the paper markets.

Have a pleasant weekend. See you Sunday evening.

Subscribe to:

Comments (Atom)