20 February 2015

19 February 2015

China Offtakes 59.12 Tonnes of Gold For Week Ending 13th February

China withdrew 59.12 tonnes of gold bullion from the Shanghai Gold Exchange for the week ending 13 February.

This makes 374 tonnes year to date.

China has withdrawn a total of 8,288 tonnes of gold from the SGE.

Category:

Shanghai Gold Exchange

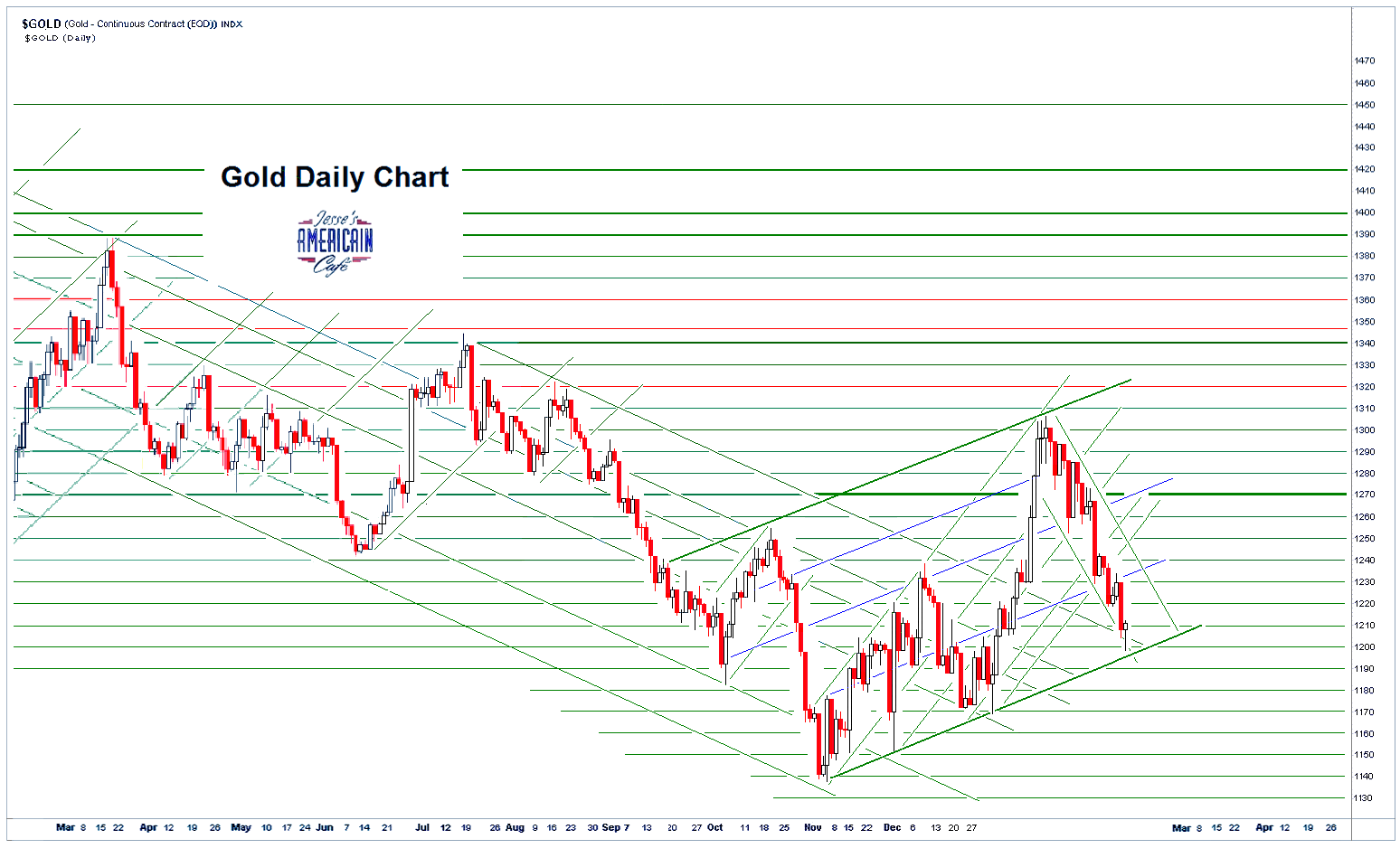

Gold Daily and Silver Weekly Charts - Ounce by Ounce - Farewell to Empire

The Capitol stuffs its ears when it hears you; the world reviles you. I can blush for you no longer, and I have no wish to do so.The howls of Cerberus, the dog of the underworld, though resembling your speeches, will be less offensive to me, for I have never been associated with Cerberus, and I need not be ashamed of his howling.Farewell, but make no music; commit murder, but write no verses; poison people, but do not dance; be an incendiary, but play no harp. This is the wish and the last friendly advice sent to you by me.Petronius, Arbiter Elegantiae, Farewell to His Emperor

The Western gold market is a bucket shop. Its manipulations are slowly depleting their prospects and their reserves.

Their vaults are being drained of gold, ounce by ounce, day by day, year by year.

They have taken flight from the moral high ground, and have found their true place, in wallowing with pigs.

It is a long walk down a dark hallway to the waiting crowd, and the inevitable day of reckoning, when you too are fallen. You can and do extend your time by hiding and running, masquerading and lying, but you will never rest, in this world or the next.

Besides the incremental output from mining, the basis for the great Ponzi scheme keeps getting smaller, and smaller.

Time is on our side. And this is the nature of our warfare; we rise by falling.

For we wrestle not against flesh and blood, but against principalities and powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Have a pleasant evening.

Category:

imperial Presidency

SP 500 and NDX Futures Daily Charts - Complicity of the Advantaged in the Nakedness of Kings

"Folly is a more dangerous enemy to the good than evil. One can protest against evil; it can be unmasked and, if need be, prevented by force. Evil always carries the seeds of its own destruction, as it makes people, at the least, uncomfortable. Against folly we have no defence. Neither protests nor force can touch it; reasoning is no use; facts that contradict personal prejudices can simply be disbelieved — indeed, the fool can counter by criticizing them, and if they are undeniable, they can be just pushed aside as trivial exceptions.So the fool, as distinct from the scoundrel, is completely self-satisfied; in fact, he can easily become dangerous, as it does not take much to make him aggressive. A fool must therefore be treated more cautiously than a scoundrel; we shall never again try to convince a fool by reason, for it is both useless and dangerous."Dietrich Bonhoeffer

"You have repeatedly confessed to-night, by direct avowal or ignorant statement, that you do not know the working class. But you are not to be blamed for this. How can you know anything about the working class? You do not live in the same locality with the working class. You herd with the capitalist class in another locality. And why not? It is the capitalist class that pays you, that feeds you, that puts the very clothes on your backs that you are wearing to-night. And in return you preach to your employers the brands of metaphysics that are especially acceptable to them; and the especially acceptable brands are acceptable because they do not menace the established order of society.Be true to your salt and your hire; guard, with your preaching, the interests of your employers; but do not come down to the working class and serve as false leaders. You cannot honestly be in the two camps at once. The working class has done without you. Believe me, the working class will continue to do without you. And, furthermore, the working class can do better without you than with you."Jack London, The Iron Heel

No warning will suffice to powerful fools who, driven mad by hubris and lust for power, weave the hangman's ropes of their own destruction. They preach the necessity of hardness, and practice the circumvention of the law for themselves and their associates in injustice.

But when the reckoning comes for them, as it eventually does, they always seem astonished, but unfortunately never to the point of speechlessness. They will harangue fortune, and all those imaginary enemies who conspired to their downfall, to the bitter end.

The Western elite are in a denial, and a bubble of delusion, so profound that I am concerned that when reality intrudes their reaction will be mishandled, provocative, and likely to hasten a generational change that is already occurring and being fiercely resisted, slowly.

Have a pleasant evening.

18 February 2015

Gold Daily and Silver Weekly Charts - Bucket Shop

Gold was hit fairly hard for no apparent reason this morning, but recovered shortly afterwards.

See the Dr. Evil strategy favored by some of the large trading firms, and running afoul of the regulators from time to time when they step on the wrong toes, or skin the wrong cats.

Here is an account of Barclays being specifically fined for stepping on a big customer using gold manipulation.

This is the liar's poker market on the Hudson.

The Comex is now the kind of market where speculators and trading companies wager with many thousands of paper positions representing various real world items, with no intent to actually take or give delivery of them with any connection to the real world of commerce.

They wager with almost wholly synthetic positions. As such, the Comex has become a virtual bucket shop that is by tradition and custom still setting many critical prices for the world markets.

As defined by those august solons on the US Supreme Court in Gatewood v. North Carolina, 27 S.Ct 167, 168 1906 a bucket shop is:

"an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in."

These sorts of long term price manipulations have very corrosive effects on real world supply factors, and are often the source of market dislocations as they collapse, not to mention large fortunes for a few, and human misery for many.

There was intraday commentary here, Pictures of a Currency War, With Narrative.

They say that no non-purely defensive war can occur unless the moneyed interests see it as a profitable opportunity. And I say, that goes double for 'financial wars' such as we are seeing now.

A little gold and silver were shoved around the plate today in the 'Delivery Report' and the warehouses.

Have a pleasant evening.

Category:

Dr. Evil

SP 500 and NDX Futures Daily Charts - No Reform, No Recovery

The economic data was a bit gloomy this morning.

The real economy does not seem to count for much in this blizzard of paper.

We are papering over quite a few things.

There are some 'green shoots' by way of low paid jobs, often part time. But the lack of vitality in this economy is palpable to any but the most resolutely deluded.

On the next downturn, we may see a proper panic in pigtown.

Unless we have reform, financial and political, we will see no recovery, and no peace.

Have a pleasant evening.

Taibbi: A Whistleblower's Horror Story

"Crush humanity out of shape once more, under similar hammers, and it will twist itself into the same tortured forms. Sow the same seed of rapacious license and oppression over again, and it will surely yield the same fruit according to its kind."Charles Dickens, A Tale of Two Cities"Flagrant evils cure themselves by being flagrant."John Henry Newman

If a whistleblower reveals benign 'secrets' of government actions to a domestic reporter in the time honored tradition, they may be prosecuted as 'enemies of the state' under the abusive misuse of the Espionage Act.

It was Winston's contention that six week's after refusing to lie in his report to Moody's, Angelo Mozilo personally contacted Winston's supervisor and demanded his termination based on a personal website Winston maintained for his work as a motivational speaker and expert in leadership.

What I find particularly odious in the judgement is that not only will Winston NOT be able to obtain the reward from the jury verdict, which is a legal matter which I understand can be contended. Although it seems that the appeals court took a fairly aggressive stance in this appeal, to the point of nullifying the jury not on the legal process but on their judgment about the evidence itself. A copy of that first appeal is downloadable here.

The subsequent judgement against plaintiff to pay the costs filed by Bank of America seems excessive if not vindictive to say the least, given that the case itself was a 'close call' at worst. And then there is the matter of his speaking to Frontline, and engaging in behavior in describing the ongoing frauds at Countrywide that were very embarrassing to Bank of America, and the DOJ itself. It smells of vindictiveness.

I don't think it is this case alone that is so infuriating, but the context of Wall Street friendly judicial policy in the Obama Administration, and the hypocritical and harsh treatment of whistleblowers in general. And Taibbi does a fairly good job of bringing these things forwards in his article linked below which I suggest that you read.

I don't think it is this case alone that is so infuriating, but the context of Wall Street friendly judicial policy in the Obama Administration, and the hypocritical and harsh treatment of whistleblowers in general. And Taibbi does a fairly good job of bringing these things forwards in his article linked below which I suggest that you read.

Deceit and theft by the privileged is excused and protected, while honesty and innocence are severely punished. And the great mass of official journalists are silent, so we hear the news about this in a rock 'n roll magazine.

Rolling StoneA Whistleblower's Horror StoryBy Matt Taibbi18 February 2015Two years ago this month, Winston was being celebrated in the news as a hero. He'd blown the whistle on Countrywide Financial, the bent mortgage lender that one could plausibly argue nearly blew up the global economy in the last decade with its reckless subprime lending practices.He described Countrywide's crazy plan to give anyone who could breathe a mortgage in a memorable January, 2013 episode of Frontline called "The Untouchables," a show that caught the eyes of several influential politicians in Washington. The documentary inspired Senate hearings and even the crafting of new legislation to combat too-big-to-jail corruption in the financial world.Winston was later featured in the New York Times as the man who "conquered Countrywide." David Dayen of Salon described Winston as "Wall Street's greatest enemy."But today, Winston is tasting the sometimes-extreme downside of being a whistleblower in modern America.He says he's spent over a million dollars fighting Countrywide (and the firm that acquired it, Bank of America) in court. At first, that fight proved a good gamble, as a jury granted him a multi-million-dollar award for retaliation and wrongful termination.But after Winston won that case, an appellate judge not only wiped out that jury verdict, but allowed Bank of America to counterattack him with a vengeance.Last summer, the bank vindictively put a lien on Winston's house (one he'd bought, ironically, with a Countrywide mortgage). The bank eventually beat him for nearly $98,000 in court costs.That single transaction means a good guy in the crisis drama, Winston, had by the end of 2014 paid a larger individual penalty than virtually every wrongdoer connected with the financial collapse of 2008.When Winston protested his preposterous punishment on the grounds that a trillion-dollar company recouping legal fees from an unemployed whistleblower was unreasonable and unnecessary, a California Superior Court judge denied his argument — get this — on the grounds that Winston failed to prove a disparity in resources between himself and Bank of America!This is from the court's ruling:Plaintiff argues that the disparity in the resources between the individual plaintiff and the defendant Bank of America make it unfair to place the cost of the premium on plaintiff. Plaintiff offered no evidence in support of this argument; it is rejected...Read the entire story in Rolling Stone here.

Subscribe to:

Comments (Atom)