The Fed is increasing its monetary base aggressively again.

15 February 2013

Gold Intraday

Hard to miss the deliberate price smackdown.

As I said yesterday, "I will not be surprised to see a final big move to run the stops to the downside in the precious metals, and take additional shares and units of paper claims before the markets break free."

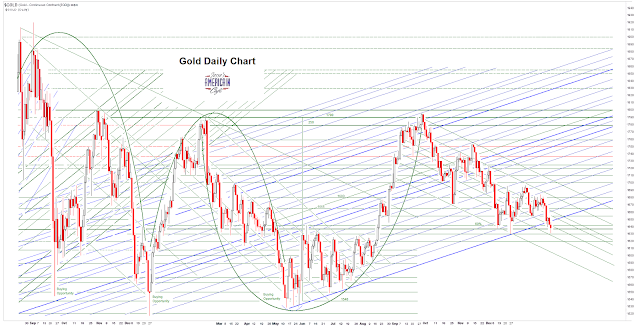

So is this 'the final big move?' Of course I do not know, no one does. But gold is now deeply oversold, and we are nearing the rinse phase of the wash-rinse cycle, at least according to the technical indicators.

Things like this are a pity, because they make a sham of the markets. But what else is new.

Three day weekend ahead. And the currency war is on.

Category:

Gold Price manipulation

14 February 2013

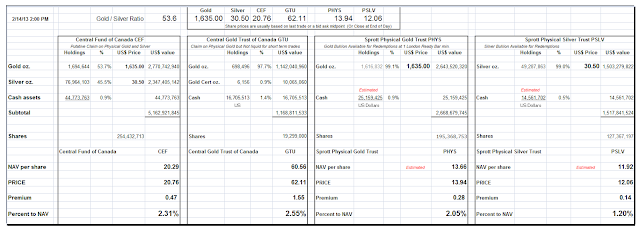

Gold Daily and Silver Weekly Charts - The Art of Currency War

“Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.”

Carroll Quigley, Tragedy and Hope, p. 278

"Of course, convergence of finance and monopoly capitalism with monopoly communism was always the long-range goal of the Money Power, as William Gladstone called them...

The conflict between the East and West was designed to scare the people of the world into accepting a convergence of these two monopoly systems of authoritarian power. The end result was to be a new Imperial Order and a New World Empire run by an elite self-perpetuating oligarchies from the leading nations of the earth."

Carroll Quigley, Tragedy and Hope, p. 860

Crazy, huh? Quigley was a professor of history at Georgetown University, and was a mentor to Bill Clinton, having recommended him for his Rhodes scholarship.

It seems a bit less crazy today than it did when I first read this in the 1990's.

Speaking of quotes, this particular quote came to mind today as I thought about the metals markets.

“Appear weak when you are strong, and strong when you are weak.”Why the big show of control over the markets? It is fairly obvious if you watch the daily action on the tape.

Sun Tzu, The Art of War

I *think* that the financial system is quietly unraveling behind the scenes again, and that at some point this great complacency is going to break, and hard. But the gaming will continue until something provokes a change in the short term equilibrium, which I believe is false.

I will not be surprised to see a final big move to run the stops to the downside in the precious metals, and take additional shares and units of paper claims before the markets break free.

SP 500 and NDX Futures Daily Charts - Option Expiration

"Another cause of today’s instability is that we now have a society in America, Europe and much of the world which is totally dominated by the two elements of sovereignty that are not included in the state structure: control of credit and banking, and the corporation.

These are free of political controls and social responsibility and have largely monopolized power in Western Civilization and in American society. They are ruthlessly going forward to eliminate land, labor, entrepreneurial-managerial skills, and everything else the economists once told us were the chief elements of production.

The only element of production they are concerned with is the one they can control: capital."

Carroll Quigley, Oscar Iden Lecture Series 3, 1976

The equity markets are awash in liquidity, but it remains somewhat narrow, its success due to the 'lack of selling' moreso than a breadth of participation. In other words, well-heeled banks and hedge funds are gaming the system higher, using levered instruments like the SP 500 futures for example.

Conversely, the metals markets are being used like their personal ATM.

Let's see how long they can keep this up, before we see another 'wash and rinse' cycle.

As a reminder, Monday 18 February is a national holiday in the US.

13 February 2013

Echoes of the Past In The Economist - The Return of the Übermenschen

"There is not a more perilous or immoral habit of mind than the sanctifying of success."

Lord Acton

Just when you think the oligarchy could not become any more audacious.

'Slow mobility' as used in this essay from this recent issue of The Economist implies a natural class structure amongst people.

It suggest that a child would only slowly, and not usually, rise above the station of their parents and grandparents, presumably in terms of wealth, education, and opportunity. If you are born to poor parents, you are likely of an inferior genetic quality, poor stock, your success unlikely, and your servile station or poverty pre-destined.

The reason for this is because the children of 'the elite' will have 'inherited the talent, energy, drive, and resilience to overcome the many obstacles they will face in life.'

These inherited gifts are supplemented, of course, by the easy opportunities, valuable connections, and access to power. And a virtual freedom from prosecution does not hurt either, in case they have inherited a penchant for sociopathy, or something worse, along with their many gifts.

And by inference, the children of the poor will not do well, because they are genetically inferior. These are the pesky 47% who deserve to be cheated and robbed by the elite, because of the inherent superiority of the one percent. There is no fraud in the system, only good and bad breeding, natural predator and prey.

This line of thinking rests on the assumption that society today is a naturally efficient meritocracy, despite the enormous advantages of the children of 'the elite,' because they would have succeeded anyway.

I succeed, therefore I am. And if you do not, well, we shall have to do something about that drag on the efficiency of the economy and the maximization of profits. Ah, the burdens of the aristocracy, and their far flung sahibs.

This essay concerns me greatly, because such thoughts echo throughout the Anglo-American culture of late. They are whispered in the evolving mythos of those favored few who enjoy certain völkisch advantages, presumably justified by the nature of their blood.

We have seen this kind of sociology before, as the justification for the widespread looting of wealth, the ransacking of nations, and the neglect, ghetto-ization, and murder of marginalized people.

Never again. Until we allow it, because we think it serves our purposes. But the madness serves none but itself.

"Many commentators automatically assume that low intergenerational mobility rates represent a social tragedy. I do not understand this reflexive wailing and beating of breasts in response to the finding of slow mobility rates.

The fact that the social competence of children is highly predictable once we know the status of their parents, grandparents and great-grandparents is not a threat to the American Way of Life and the ideals of the open society.

The children of earlier elites will not succeed because they are born with a silver spoon in their mouth, and an automatic ticket to the Ivy League.

They will succeed because they have inherited the talent, energy, drive, and resilience to overcome the many obstacles they will face in life. Life is still a struggle for all who hope to have economic and social success. It is just that we can predict who will be likely to possess the necessary characteristics from their ancestry."

Greg Clark, The Economist, 13 Feb. 2013

Mr. Clark is now a professor of economics and department chair until 2013 at the University of California, Davis. His areas of research are long term economic growth, the wealth of nations, and the economic history of England and India.

"During this time, a growing professional class believed that scientific progress could be used to cure all social ills, and many educated people accepted that humans, like all animals, were subject to natural selection. Darwinian evolution viewed humans as a flawed species that required pruning to maintain its health. Therefore negative eugenics seemed to offer a rational solution to certain age-old social problems."

David Micklos, Elof Carlson, Engineering American Society: The Lesson of Eugenics

“With savages, the weak in body or mind are soon eliminated; and those that survive commonly exhibit a vigorous state of health. We civilised men, on the other hand, do our utmost to check the process of elimination; we build asylums for the imbecile, the maimed, and the sick; we institute poor-laws; and our medical men exert their utmost skill to save the life of every one to the last moment.

There is reason to believe that vaccination has preserved thousands, who from a weak constitution would formerly have succumbed to small-pox. Thus the weak members of civilised societies propagate their kind. No one who has attended to the breeding of domestic animals will doubt that this must be highly injurious to the race of man.

It is surprising how soon a want of care, or care wrongly directed, leads to the degeneration of a domestic race; but excepting in the case of man himself, hardly any one is so ignorant as to allow his worst animals to breed.

The aid which we feel impelled to give to the helpless is mainly an incidental result of the instinct of sympathy, which was originally acquired as part of the social instincts, but subsequently rendered, in the manner previously indicated, more tender and more widely diffused. Nor could we check our sympathy, if so urged by hard reason, without deterioration in the noblest part of our nature. The surgeon may harden himself whilst performing an operation, for he knows that he is acting for the good of his patient; but if we were intentionally to neglect the weak and helpless, it could only be for a contingent benefit, with a certain and great present evil.

Hence we must bear without complaining the undoubtedly bad effects of the weak surviving and propagating their kind; but there appears to be at least one check in steady action, namely the weaker and inferior members of society not marrying so freely as the sound; and this check might be indefinitely increased, though this is more to be hoped for than expected, by the weak in body or mind refraining from marriage.”

Charles Darwin, The Descent of Man

Category:

Aktion T4,

audacious oligarchy,

banality of evil,

Eugenics,

one percent,

Power Elite

Subscribe to:

Comments (Atom)