28 July 2010

SP 500 September Futures; Gold Daily; Gold Weekly

SP 500 Sept Futures

It will be interesting to see if they can keep taking this higher. The McClellan Osciallator is at a extreme reading. But volumes remain light, and while heavy selling is absent, prices on the margins can be lifted higher, in a manner similar to a ponzi scheme. But if selling appears again, particularly if it is driven by exogenous events, prices can therefore fall rather quickly, because of the lack of fundamental underpinnings for the price supported by investors with conviction, rather than the cheap tricks of convicted trading companies.

Gold Daily Chart

It's never easy. This will likely not be over until 'roll week' is finished on Thursday. This is a blatant fraud in my opinion, similar to the roll week frauds perpetrated on holders of ETF's. It is done with at least the passive approval of many traders, exchanges, the media, and investment companies, similar to the manner in which they enabled the mortgage backed securities frauds. The attitude is that investors are not human beings but 'dumb money' deserving of no consideration or protection, even if it is one's job to protect them from control frauds.

Gold Weekly

Important for maintaining perspective. Please notice the periodic severe corrections to trend. In eash case sentiment becomes rather pessimistic, and people tend to say silly, illogical and blatantly incorrect things. When the market turns up again they slink away, waiting for the next opportunity to crawl out of their deep wells of subjectivity. If the trend is decisively broken then we will adjust our trading to accommodate that change.

"Gottes Mühlen mahlen langsam, mahlen aber trefflich klein,

Ob aus Langmut er sich säumet, bringt mit Schärf' er alles ein."

Friedrich von Logau

27 July 2010

Goldman's Derivatives Clearing Service: The Better To Cheat You With My Dear

Say, aren't Goldman the fellows that just pled to fraudulent dealing in financial instruments like MBS, and paid a fairly hefty 500+ million dollar fine? The company is starting a centralized clearing facility for derivatives, which may be among those mandated for use by market participants, in the US government mandated efforts to reform.

Say, aren't Goldman the fellows that just pled to fraudulent dealing in financial instruments like MBS, and paid a fairly hefty 500+ million dollar fine? The company is starting a centralized clearing facility for derivatives, which may be among those mandated for use by market participants, in the US government mandated efforts to reform.

When one considers the information available to a central clearing facility, somewhat like an exchange, it does give one pause to have the owner of that facility as a somewhat notorious and aggressive market participant with a known penchant for exploiting information for its own ends.

Financial reform and change you can believe in. It pays to have friends in high places.

Economic Policy Journal

If Regulators Say Trade Through a Central Exchange...

By Robert Wenzel

...Goldman Sachs starts a central exchange.

Is it me, or does it just seem that whatever the rules or regulations, Goldman comes out on top and pretty much ends up running the show?

Regulators are preparing rules that will require the majority of privately traded derivatives be cleared through central counterparties.

Goldman Sachs announced today the launch of its Derivatives Clearing Services (DCS) business. The DCS will provide clients with a comprehensive global OTC clearing service for interest rates, credit, foreign exchange, equities and commodities, says Goldman.

“In partnership with our clients, regulators and multiple clearing venues, we are committed to improving market structure for derivatives,” said Michael Dawley, Managing Director and Co-Head of Futures and DCS, Goldman Sachs. “The DCS offering provides our clients with a host of value-added services and multi-product expertise to successfully navigate this dynamically changing environment.”

According to a press release,Goldman Sachs said it recognizes that clients will be faced with new reporting, connectivity, and regulatory requirements. The firm is committed to investing in innovative solutions to help clients address these changes.

“The move to central clearing for OTC derivatives is a significant turning point in the marketplace," said Jack McCabe, Managing Director and Co-Head of Futures and DCS at Goldman Sachs. “Our strong trading franchise, coupled with our market leading futures and prime brokerage services, enables us to provide our clients with the foundation they need to adapt to these important industry developments."

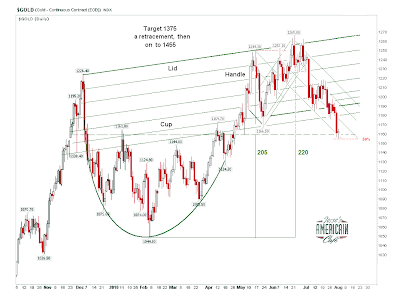

Gold Daily Chart; Shock and Awe for Comex Option Expiration

Today is yet another Comex option expiry, and the metals, which have been subject to bear raids for the past week, were hit hard and heavy from the New York crowd. This is also the "roll" week, as anyone not intending or funded to take delivery of August gold has to be out of their long positions by the end of the day Thursday.

Why anyone would bother to invest in Comex options is beyond me, or Comex futures for that matter, given the position abuses it tolerates. While we welcome Bart Chilton's stirring message of reform, we'll have to wait and see what the actions taken by the CFTC in position limits and disruptive manipulation are. I think the traders on the NY commodities exchanges have given Bart their answer to his proposed changes, and put him in his place.

Besides the usual market manipulation generally seen around key events like the end of quarter or an option expiration, what reason is there for this incessant capping and smackdowns of the precious metals? Is it a simple question of confidence in the dollar? Surely it is not because of the $30 billion being made available for subsidized small business lending. Or are their preparations being made for another large round of Quantitative Easing II, or even the pre-emptive bombing of Iran? It is hard to say, since the fraud option has been on the table as an instrument of US policy since the 1990's at least.

Obama has proven to be a good talker for reform but a very poor performer when it comes to curbing the excesses of his supporters and contributors at the large corporations particularly in the financial sector. This taints his entire administration.

At 11:00 AM

Here is an intraday update on the Gold Daily Chart. 1166.50 is an important level because it marks a prior low. We have reached it intraday today, so we would look for some support and a potential double bottom.

The formation as a 'cup and handle' is still valid, with the retracement less than 50% off the final high (1154 would be 50%) but there are other formations worth considering. We'll keep an open mind on that depending on how this week finishes.

Unfortunately for Larry Summers, Ben Bernanke, and their friends at the BIS, they have not yet figured out how to print physical gold, silver, and the world is reaching the point where it might start simply ignoring the New York markets with respect to essential commodities such as basic materials, oil, foodstuffs, metals, and the like, as they become increasingly irrelevant, fraudulent, and Orwellian. And then where will the financial engineers be, except with no more excuses and no place to hide?

26 July 2010

As the US Dissolves: Mad Max Monday

Lots of gloom to be found as witnessed in the two stories below, counter-balanced by the shameless cheerleading on the financial news networks that are celebrating the rally in US equities and the economic recovery.

Both points of view are a bit extreme and probably unrealistic for my palate, although I am in a sufficiently grumpy mood having spent the weekend cleaning, waterproofing, painting, and reshelving our storeroom, workroom, and pantry. Herself and the children return this evening from holiday, and so the repairs must be completed before the horde is once again underfoot. Oh head is spinning from fumes, and oh my aching back. lol.

I have to wonder if the mass of the people will ever do something and react to the abuses of government in cooperation with the corporations, or if they will seek to lose themselves in the day to day of their lives, allowing a minority to set their course. The next twelve months should prove interesting, especially around the mid-term US elections. Although eyes are on the US, the UK and Europe will likely lead the way.

When Globalism Runs Its Course...

The Year America Dissolved

By Paul Craig Roberts

It was 2017. Clans were governing America.

The first clans organized around local police forces. The conservatives’ war on crime during the late 20th century and the Bush/Obama war on terror during the first decade of the 21st century had resulted in the police becoming militarized and unaccountable.

As society broke down, the police became warlords. The state police broke apart, and the officers were subsumed into the local forces of their communities. The newly formed tribes expanded to encompass the relatives and friends of the police.

The dollar had collapsed as world reserve currency in 2012 when the worsening economic depression made it clear to Washington’s creditors that the federal budget deficit was too large to be financed except by the printing of money....

Read the rest here

Emergency Care Drugs In Short Supply

Warren E. Pollock

24 July 2010

CFTC's Bart Chilton On Financial Reform, Position Limits, and Curbing 'Disruptive Practices'

Actions will speak much louder than words, especially given the many disappointments in the past from the SEC and CFTC. Position limits are a good idea. Let's see how long banks like JPM and HSBC have to implement them if they are covered at all. And as for 'disruptive practices' in the market, I will be impressed if Goldman Sachs and Citigroup are ever called out for their abusive market practices in the US as they have been in Europe and Asia.

I like Bart Chilton, quite a bit actually. If he delivers on these promises, I would work for him to be elected or appointed to higher office. But after the great disappointment of Obama, it will take actions first to gain people's enthusiasm for a reformer.

We are all for you Bart, but now you must deliver.

Here is an introduction to this presentation by Bart Chilton from another good guy, GATA's Chris Powell:

"The member of the U.S. Commodity Futures Trading Commission who has been advocating imposing position limits on traders in the precious metals markets, Bart Chilton, has made a video explaining why he thinks the financial regulation law just enacted by Congress and President Obama promises great progress, particularly in making the commodity markets freer and more transparent. The law, Chilton explains, requires the CFTC to establish position limits and authorizes the commission to prosecute "disruptive trading practices." Chilton says he is especially pleased with that, because the commission's market manipulation standards have failed almost completely for many years.

Chilton has been amazingly conscientious on the precious metals manipulation issue and has been amazingly responsive to gold and silver investors who have complained to the CFTC about market manipulation. He'll need their support as the CFTC writes the position limits regulations required by the new law. The big commercial shorts are sure to be heard as the commission continues to take public comment, so gold and silver investors can't let up yet."

The Health Care Bill Change in 1099 Reporting Requirements Does NOT Target Gold and Silver

I had originally included this in my weekly gold and silver market wrap up. But I have received so many emails from alarmed readers about the topic that I thought it would be useful to give it a separate blog entry that is linkable, so it would be easier to answer those who express concern.

Those who originally raised this issue of a change in the law stated it rightly, but since then it has been fanned into a falsehood and a bogeyman, far beyond the proportions of its original scope and intent.

It is true that transactions in gold and silver and more particularly rare coins were exempt from 1099 reporting under the previous 1099 MISC rules. But they were always reportable and taxable on one's tax returns. Goods were exempts, but services were not exempt from 1099 MISC reporting and the thresh hold for them was $600. This law primarily applied to the self-employed and small businesses.

The change in the law removed the exemption for all goods, and not just for gold and silver and rare coins and collectibles, which are a small if not minuscule percentage of all commercial business transactions in goods and services.

It is well and good to remain vigilant to encroachments of the government on the rights of individuals and of private property. But one must also be on guard against becoming an unthinking member of a mob, reacting to those who would play on their emotions for their own ends.

Insidious men will use any issue, any crisis, any emotion, and turn it to their devious intentions. The central bankers and politicians began selling and leasing gold and property that did not belong to them but to their people, on the principle that controlling the price and the markets was a necessary instrument, a tenet, in their financial engineering, according to the counsel of their well-credentialed advisors. This was turned to the profit of the few, the financiers, and took on a life of its own, and became a looting of public wealth, and an abuse of property. Before it ends these abuses may become more egregious and widespread. It is no vain effort then to be on guard against them.

And as for us in times of official deceit and the abuses of the few, we must therefore hold even more firmly to the truth, and make every effort to find it, or risk being swept away in the swell of retribution and the restoration of justice that may turn to madness unbidden.

The Change in 1099 Reporting Requirements in Section 9066 of the Health Care Bill Does NOT Target Gold and Silver

On another matter, there is some misinformation creating concern, bordering almost on mild hysteria at times, about a change that was made in the Health care Bill Section 9066 regarding the reporting of sales of over $600.

There are those who say that the purpose of this law is to track the sale of gold and silver.

A decent discussion of the change is the law is available here and here.

The change in the law does NOT 'target the sale of gold and silver.'

I don't like the provision and think it was written badly, generating senseless paperwork for small businesses in a desire to make more business to business transactions subject to 1099 MISC for purposes of income reporting. I suspect and would hope that the interpretation of this law and its requirements will clarify the issues. If this change in the requirements includes what are essentially retail transactions then it is very badly written indeed.

But the point I wish to make here, and I want to be very clear on this, is that this change in the law is NOT specifically targeting gold and silver sales. It is targeting unreported income from transactions of any sort, the vast majority of which are no more sinister than common supplies, computers, and routine business goods. And coin sales in particular may be affected, along with quite a few other things.

Some might correctly say that this provision targets 'cash businesses' where income is easily hidden and unreported. So if one has been cheating on their taxes and hiding income, this change in the rules will most likely be an inconvenience. There are other more substantial issues with the burden placed on small businesses and the need to generate 1099's.

But this does not specifically target the sale of gold and silver, the income from which has always been taxable, and reportable.

The reporting requirement seems to have an unusually low thresh hold. This is has it has always been, it is primarily the exclusion for goods that has been eliminated.

I do not imagine that the IRS wishes to be inundated with useless mountains of 1099's. I do not believe they even have the capability of processing them effectively.

And I have to wonder why the Democrats slipped this change into the health care bill essentially chasing small loopholes for what is really small change, 20 billions over ten years, when there are so many large loopholes yawning wide open for the use of their corporate benefactors and the super wealthy.

Yes, that was a rhetorical question. The wealthy, who sit contentedly, fat on the spoils of their deceptions, and their bought politicians and judges, still greedy for more to be squeezed from the many, should well bear in mind the consquences of their perversion of the law in these wise words from the American revolution:"When the rich plunder the poor of his rights, it becomes an example for the poor to plunder the rich of his property, for the rights of the one are as much property to him as wealth is property to the other, and the little all is as dear as the much.

It is only by setting out on just principles that men are trained to be just to each other; and it will always be found, that when the rich protect the rights of the poor, the poor will protect the property of the rich. But the guarantee, to be effectual, must be parliamentarily reciprocal."

Thomas Paine

SP 500 September Futures - Goal of 1100 Reached Inspiring Euro Confidence, Or Not

The Merry Marketeers were able to coax the SP futures to the 1100 level, in a show of support for the results of the Euopean Bank Stress Tests. Huzzah!

The results were rather anemic, even given the somewhat unrealistic nature of the tests.

I can understand that they did not include a sovereign default by the likes of Greece, but that they included only the banks' trading portfolios, and not their commercial loan portfolios, seemed almost astonishing.

Reggie Middleton does a good job discussing the European Stress Tests here and here

But in the meanwhile, the increasing trivialization of the capital markets by the financial engineers in the service of their nonsensical schemes seems more alarming than anything else I could imagine.

Can they do what they did in 2005, and break the market out to the upside and inflate yet another financial asset bubble? They may very well do this. And it will once again end badly, much worse than the last. But why should they care, or stop, while they continue to become rich?