These are strong, almost startling words from Bart Chilton, part of Obama's incoming administration, currently on the CFTC.

The message is good and to the point. The illustration of the performance of the regulators over the past ten (not eight) years is remarkable, an indictment of the existing Federal regulatory system as a whole.

Actions will speak louder than words. We will all look forward to seeing what happens in Washington over the next few months, and in particular, what is done by the CFTC and the SEC in reforming US financial markets.

Washington

Time to restore mission of regulators

By Bart Chilton

January 1, 2009

In the building that currently houses the president-elect's transition team, there used to be an imposing bronze plaque with the visage of the Securities and Exchange Commission's redoubtable third chairman, William O. Douglas. It was emblazoned with the inspiring legend, "We are the Investor's Advocate."

For many decades, the SEC enjoyed the reputation of living up to the noble standard of public service. The plaque no longer graces the entryway of the SEC's new quarters, and with the recent revelations of failure to detect and prosecute incidents of egregious securities fraud and abuse, both internally and externally, the agency's reputation has been severely tarnished.

These types of disclosures make us as public servants ask some fundamental questions: Why are we here? The Founding Fathers had the answer: We are employed to protect the common wealth and serve the public good. We are not here to serve amorphous philosophical, economic or ideological concepts such as "financial markets" or "economies."

Our task is to serve the public -- those people in the hinterlands, many of whom have recently lost 30 percent or more of their retirement funds and/or home values and who now face losing their jobs. Our "client," our "constituent," is the American consumer and worker, the businessman or woman who generates and uses the products and services that comprise our "markets" and our "economy." If we fail to protect, first and foremost, these individual Americans, we cannot succeed in assuring the strength of our economy, nor in protecting the integrity of our financial market system.

Do we need to have statutes and regulations in place to ensure reliability of the marketplace? Of course we do, but over the past decade "the marketplace" has been exalted to a position perceived as virtually omnipotent and omniscient, while consumer protections have been generally neglected. The consequence lies scattered around us.

By veering too sharply to the right and letting go of the regulatory reins, we provided neither the market nor the consumer a great service. Rather we harmed both, and have a long hike to escape the resulting global economic meltdown. We must be careful not to over-correct -- not to go so far in the other direction that we stifle innovation and market growth. But it is clearly time for federal financial regulators to re-evaluate our current statutes and regulations, and to put "common sense rules of the road," as the president-elect has suggested, in place to protect consumers and bring our economy back into balance.

The SEC isn't the only federal financial regulator to have failed in serving the public. The Treasury Department appears to have lost its way as well, when a $700 billion bailout package, purportedly written to ensure against unconscionable executive compensation was, within weeks after passage, found to have a loophole allowing such compensation.

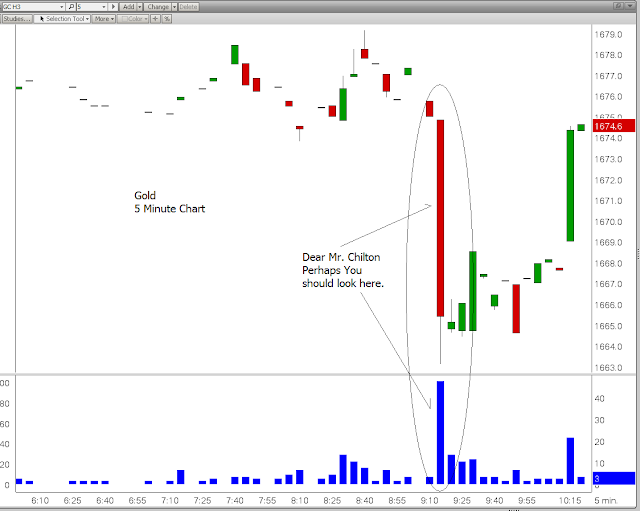

Federal banking regulators seem to be off course, permitting casino-like buying and selling of trillions of dollars worth of virtually worthless transactions. When gasoline topped $4 a gallon, the Commodity Futures Trading Commission dropped the ball, unable to oversee speculation's uneconomic role in the U.S. commodities markets.

In decades past, the CFTC has been charged with being too tied to the industry, too closely aligned with the regulated, and overly concerned with protecting "markets" rather than consumers. We've made good progress, and there are very fine people in all of these agencies and departments, but we too can and must do much better.

I have advocated a comprehensive legislative reform of the laws governing over-the-counter trading, and requested that authority over these critically important markets be vested in the Commodity Futures Trading Commission. The CFTC, a small agency in comparison to the SEC, has exclusive jurisdiction over risk-management markets in the United States, and has in recent years carved several significant notches in its enforcement belt.

At any one time, this small agency, with one-tenth the enforcement staff of the SEC, is investigating or prosecuting anywhere between 750 and 1,000 individuals or entities for violations of the Commodity Exchange Act. The agency has, just in the past year, tagged bad actors with more than $630 million in fines and settlements, in actions involving fraud, manipulation and other misconduct. Not a bad record for a small agency operating on a shoestring budget -- and we'd be able to do even more if given the authority.

With the collapse of the economy, the transition of government already under way with the new Obama administration, and the appointment of an excellent new federal financial regulatory team, it will soon be time to implement this new legislation, and similar consumer protection initiatives.

Also, we need to restore the clarity of our own mission in government: that we are here to assure financial opportunity and market fairness to the public. We need to regain the public trust.

With a shared vision of our mission and much needed reforms, our duties and responsibilities will flow clearly. Chief among these duties is a strong and aggressive enforcement arm. Markets must be free from fraud and manipulation for them to operate as they should -- for all Americans. This baseline approach to enforcement protects consumers and allows for open and free markets that are able to grow and innovate.

Investor's Advocate: A good legend, apparently forgotten. All federal financial regulators should use a new door sign: Consumers First. Everything else will follow.

Bart Chilton is a commissioner on the Commodity Futures Trading Commission, a Democrat, and a member of the Obama transition team.