A reader, David B, has suggested that I remind you all of the big cup and handle of 2010, with its subsequent breakout run higher in 2011. The bottom of the first big retracement was on the August 2010 gold option expiration on the Comex.

I admit that being preoccupied with other things, and not wanting to get ahead of ourselves, I have merely been plugging in prices for you, and not discussing the progress of the cup and handle. Since I have had several emails about this, I thought a brief discussion now might be worthwhile.

First as a reminder, here is the cup and handle of today. The target on a breakout is 1490. I have included that notation, admittedly in the 'small print' for many months.

I will fill more things in, such as initial targets and retracements, once the formation is activated and confirms its viability with a breakout. The fundamental driver could be a break in the free gold float in London and a short squeeze in search of physical supply, and a deleveraging of 'paper gold.'

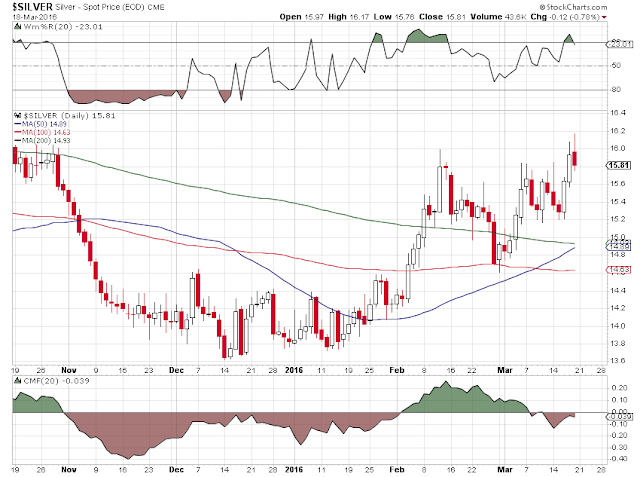

In the very last chart I show how silver broke through 19 and ran to break above 40 in the same time period. If we get a breakout in the weekly cup and handle in silver that is working itself out on the charts I think a new all time high is in the cards.

Let us not get ahead of ourselves. The price must breakout over the topmost slanted trendline in green in order to be activated. Thinking about what may or may not happen next sets us up for a disappointment and does not lend itself to 'get right and sit tight.'

So far I have not been particularly surprised by anything that has happened. If you refresh your memory about the prior cup and handle you will see why.

Patience is our ally, and time is on our side. Change is coming, slowly but surely, and at the end, all in a rush.

And we'll always have rock n' roll, moondogs.

Below is a chart of that prior cup and handle from the year 2010 which initially targeted 1375 and then 1455.

And below that is a picture of its fulfillment early in the year 2011.

But we'll always have rock n' roll.

Speaking of being preoccupied with other things, I will be spending most of the afternoon at hospital with herself, getting her sorted out and prepared for the next steps, so there may be no updates tonight.